Over the Christmas weekend AT&T Inc. (T) officially started their hybrid movie program with Wonder Woman 1984 being released both in movie theaters as well as direct to viewers' homes through HBO Max.

Summary

- AT&T's successful blockbuster release over the holiday weekend confirms that their hybrid model is a winning formula.

- In the evolving streaming wars, quality of each platform's media library is becoming increasingly important.

- Despite the company's recent successes, the stock continues to trade at its lowest valuation in a decade.

Valuation

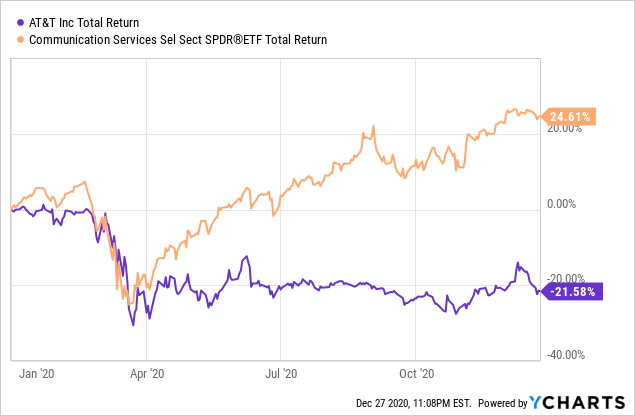

Despite all the success AT&T has had this year in growing their business and repositioning their debt, the company's stock has declined more than 20% while the broader Communications Services Sector, as measured by State Street's Communications Services Sector ETF (XLC) is up nearly 25%. If AT&T's stock kept pace with peers for 2020, the stock would be trading in the mid-$40s.

Year to Date Total Return for AT&T and State Street's Communications Services Sector ETF

Data by YCharts

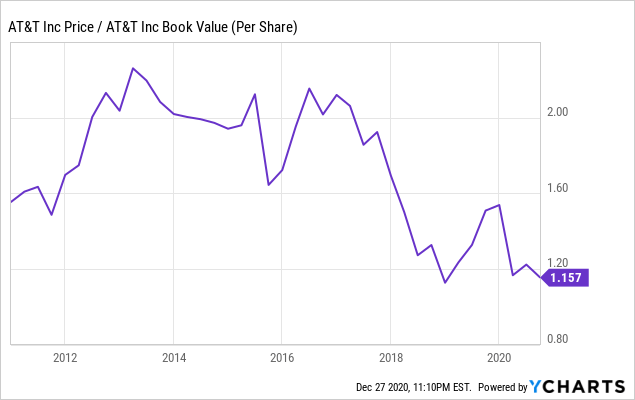

Data by YChartsTurning from peers to AT&T's historical valuations, the company's stock is also exceptionally cheap. One of our favorite metrics to use in valuing an asset-heavy company is their book value per share. Historically, AT&T has traded around 2x book value over the past decade. Not surprisingly, as AT&T's debt level hit all-time highs in 2018, this multiple dropped precipitously. While management worked to improve the balance sheet and integrate the acquisition of Time Warner, this multiple rapidly moved towards its historical level.

With the COVID Pandemic, investors shunned the company's stock and saw this multiple drop back to the lowest levels seen over the past 10 years. With the company better positioned for growth, a highly attractive dividend yield of 7%, and a sustainable dividend that should continue to grow as the payout ratio is now roughly 50%, the company should quickly move back to their historical valuation. This should drive the stock price for AT&T to $50 per share.

AT&T's Historical Price to Book Value - Past 10 Years

Data by YCharts

Data by YChartsRisks

Investors in AT&T should also closely evaluate the potential risks that can materially change the way the company delivers on their growth goals.

- Warner Media - The COVID Pandemic has changed the way we consume movies. While AT&T has positioned the company to deliver blockbuster movies direct to consumers, the revenue per movie might be significantly lower. This could have a largely negative impact as it is very expensive to bring a large scale movie to market. Ultimately, this could translate into lowered success per movie in the future.

- HBO Max - Currently, most hardware providers are allowing HBO Max to be available on their devices. If this were to change, the subscriber base and future subscriber growth could be negatively impacted.

- Wireless Network - AT&T continues to invest heavily to create a robust 5G network and beyond. In the wireless space, it is a constant scrum amongst the major carriers to deliver the largest, fastest, and most reliable networks for their customers. This entails a large amount of capital to be spent each year to maintain market position. If AT&T were to make a misstep in this area, the decisions could be costly and could impact their ability to add customers.

Conclusion

The results of AT&T's hybrid release of Wonder Woman 1984 continue to build on our view that AT&T is well-positioned for 2021. In addition to the good steps the management team has taken to grow the business in 2020 and reduce the company's debt load, the ability to successfully pivot on a Pandemic-constrained world should give investors comfort. Additionally, AT&T has proven that it is uniquely positioned to deliver premium content to their customers through HBO Max. With AT&T still trading at their lowest valuation level in the past ten years, AT&T's stock is a great addition to one's portfolio.

One final note: I hope you enjoyed this article and my analysis of the company above. One favor that I ask is that you click the "Follow" button so that you can receive real-time e-mails for the articles that I publish and so I can grow my Seeking Alpha community. I value this as a personal Thank You for this article and a vote of support as I share my experience and views in the markets to the broader Seeking Alpha Community.

No comments:

Post a Comment