Monday, May 30, 2016

How Do College Endowments Work

How do endoewments work

Myths About Endowments

http://iWhy Colleges Don't Use Endowments to Pay Student

Understanding Endowments

10 Universities With the Largest Endowments

10 Universities With the Largest Endowments

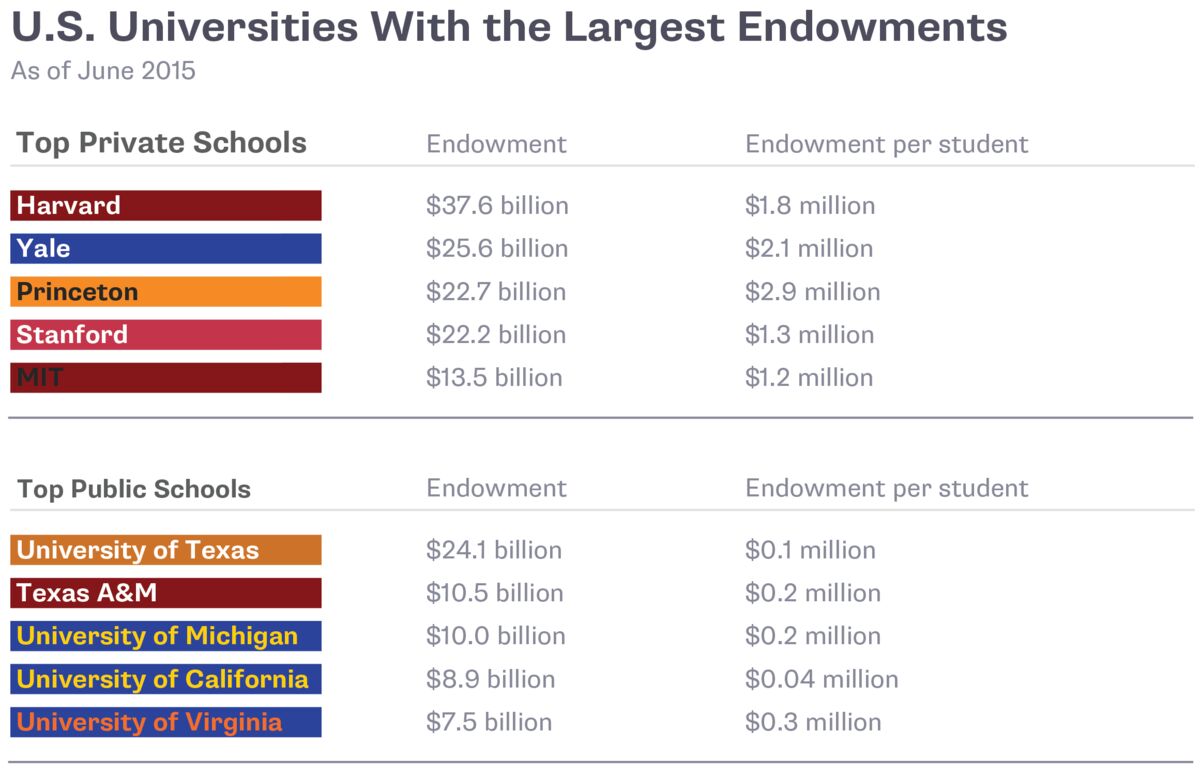

The endowment at each of these schools topped $8 billion.

At the end of fiscal year 2014, Harvard University's endowment was about $36 billion – more than any other ranked school that reported data to U.S. News.

The U.S. News Short List, separate from our overall rankings, is a regular series that magnifies individual data points in hopes of providing students and parents a way to find which undergraduate or graduate programs excel or have room to grow in specific areas. Be sure to explore The Short List: College, The Short List: Grad School and The Short List: Online Programs to find data that matter to you in your college or graduate school search.

When a school has a large endowment – a fund of donated money that the institution invests – it can generate more cash for everyone on campus.

When a school has a large endowment – a fund of donated money that the institution invests – it can generate more cash for everyone on campus.

Professors may get higher salaries, and students – in some cases – may get lower tuition and fees. Endowment spending can also go toward classroom technology, research, maintaining campus buildings and other perks that help a college or university give students a quality education.

As the country bounces back from a recession, school endowments are growing. Among 832 institutions, endowments returned an average of 15.5 percent for the 2014 fiscal year after subtracting fees, compared with 11.7 percent for the 2013 fiscal year, according to the NACUBO-Commonfund Study of Endowments.

Some universities are in a league of their own when it comes to the size of their endowments. Harvard University's endowment was $36,429,256,000 at the end of fiscal year 2014. It had the largest endowment among 1,140 ranked institutions that submitted data to U.S. News in an annual survey.

The amount is almost $4 billion more than Harvard's endowment at the end of fiscal year 2013, when it also topped the list of 10 schools with the largest endowments.

Princeton University increased its endowment by roughly $2 billion, but it fell to No. 4 on the list. It had the third-largest endowment at the end of fiscal year 2013.

Among the 10 schools with the largest endowments for 2014, the average endowment was $16.2 billion.

The University of Nebraska—Kearney had the smallest endowment among all schools: $65,712. UNK is a Regional University in the Midwest; the 10 schools with the largest endowments are National Universities.

National Universities offer a range of degree programs at the undergraduate, master's and doctoral levels and are committed to doing groundbreaking research.

Below is a list of the 10 universities with the most money in their endowments at the end of fiscal year 2014. Endowments were examined by campus, not across public university systems. Unranked schools, which did not meet certain criteria required by U.S. News to be numerically ranked, were not considered for this report.

| School name (state) | End of fiscal year 2014 endowment | U.S. News rank and category |

|---|---|---|

| Harvard University (MA) | $36,429,256,000 | 2, National Universities |

| Yale University (CT) | $23,858,561,000 | 3, National Universities |

| Stanford University (CA) | $21,466,006,000 | 4 (tie), National Universities |

| Princeton University (NJ) | $20,576,361,000 | 1, National Universities |

| Massachusetts Institute of Technology | $12,425,131,000 | 7, National Universities |

| Texas A&M University—College Station | $10,521,034,492 | 70 (tie), National Universities |

| University of Michigan—Ann Arbor | $9,603,919,000 | 29, National Universities |

| University of Pennsylvania | $9,582,335,000 | 9, National Universities |

| Columbia University (NY) | $9,223,047,000 | 4 (tie), National Universities |

| University of Notre Dame (IN) | $8,189,096,000 | 18 (tie), National Universities |

Don't see your school in the top 10? Access the U.S. News College Compass to find endowment data, complete rankings and much more. School officials can access historical data and rankings, including of peer institutions, via U.S. News Academic Insights.

U.S. News surveyed nearly 1,800 colleges and universities for our 2015 survey of undergraduate programs. Schools self-reported myriad data regarding their academic programs and the makeup of their student body, among other areas, making U.S. News' data the most accurate and detailed collection of college facts and figures of its kind. While U.S. News uses much of this survey data to rank schools for our annual Best Colleges rankings, the data can also be useful when examined on a smaller scale. U.S. News will now produce lists of data, separate from the overall rankings, meant to provide students and parents a means to find which schools excel, or have room to grow, in specific areas that are important to them. While the data come from the schools themselves, these lists are not related to, and have no influence over, U.S. News' rankings of Best Colleges, Best Graduate Schoolsor Best Online Programs. The endowment data above are correct as of Oct. 6, 2015.

___________________________________________________________________________________

_

__________________________________________________________________________________

Endowments

Question:

How large are the endowments of colleges and universities in the United States?

How large are the endowments of colleges and universities in the United States?

Response:

At the end of fiscal year 2012, the market value of the endowment funds of colleges and universities was $425 billion, reflecting an increase of 1 percent compared to the beginning of the fiscal year, when the total was $421 billion. At the end of fiscal year 2012, the 120 colleges with the largest endowments accounted for $316 billion, or about three-fourths of the national total. The five colleges with the largest endowments in 2012 were Harvard University ($31 billion), Yale University ($19 billion), Princeton University ($17 billion), the University of Texas System ($17 billion), and Stanford University ($17 billion).

SOURCE: U.S. Department of Education, National Center for Education Statistics. (2015). Digest of Education Statistics, 2013 (NCES 2015-011), Chapter 3.

| Endowment funds of the 20 colleges and universities with the largest endowments, by rank order: Fiscal year (FY) 2012 | |||

| Institution | Rank order1 | Market value of endowment, as of June 30 (in thousands of dollars) | |

| Beginning of FY | End of FY | ||

| United States, all institutions | $420,785,545 | $424,587,666 | |

| Harvard University (MA) | 1 | 32,012,729 | 30,745,534 |

| Yale University (CT) | 2 | 19,174,387 | 19,264,289 |

| Princeton University (NJ) | 3 | 17,162,603 | 17,404,002 |

| University of Texas System Office | 4 | 14,635,240 | 17,070,515 |

| Stanford University (CA) | 5 | 16,502,606 | 17,035,804 |

| Massachusetts Institute of Technology | 6 | 9,712,628 | 10,149,564 |

| Columbia University in the City of New York | 7 | 7,789,578 | 7,654,152 |

| University of Michigan, Ann Arbor | 8 | 7,725,307 | 7,586,547 |

| Texas A & M University, College Station | 9 | 6,362,369 | 7,032,204 |

| University of Pennsylvania | 10 | 6,582,030 | 6,754,658 |

| University of Notre Dame (IN) | 11 | 6,383,344 | 6,444,599 |

| University of California System Admin. Central Office | 12 | 5,441,225 | 6,342,217 |

| Emory University (GA) | 13 | 5,443,397 | 5,774,500 |

| University of Chicago (IL) | 14 | 5,691,013 | 5,701,419 |

| Northwestern University (IL) | 15 | 5,474,935 | 5,574,319 |

| Duke University (NC) | 16 | 5,747,377 | 5,555,196 |

| Washington University in Saint Louis (MO) | 17 | 5,348,871 | 5,303,196 |

| University of Virginia, Main Campus | 18 | 4,707,593 | 4,734,895 |

| Rice University (TX) | 19 | 4,498,951 | 4,448,069 |

| Cornell University (NY) | 20 | 3,960,057 | 3,850,426 |

1 Institutions ranked by size of endowment in 2012.

NOTE: Degree-granting institutions grant associate's or higher degrees and participate in Title IV federal financial aid programs.

SOURCE: U.S. Department of Education, National Center for Education Statistics. (2015). Digest of Education Statistics, 2013 (NCES 2015-011), Table 333.90..

Other Resources: (Listed by Release Date)

Sunday, May 29, 2016

Donald Trump tells Californians there is no drought,

WELL, THERE’S AN ENGINEERED DROUGHT: “Donald Trump tells Californians there is no drought,” USA Todaymisleadingly claims in their headline:

Most people just call him Jerry, but to each his own, I guess. More from USA Today:

California suffered one of its driest years in 2015. And last year the state hit its driest four-year period on record.Analysis: True. Or as Victor Davis Hanson noted at City Journal last year in a piece titled “An Engineered Drought:”

But Donald Trump isn’t sold. The presumptive GOP nominee told supporters in Fresno, Calif., on Friday night that no such dry spell exists.

Trump said state officials were simply denying water to Central Valley farmers to prioritize the Delta smelt, a native California fish nearing extinction — or as Trump called it, “a certain kind of three-inch fish.”

“We’re going to solve your water problem. You have a water problem that is so insane. It is so ridiculous where they’re taking the water and shoving it out to sea,” Trump told thousands of supporters at the campaign event.

[Jerry] Brown and other Democratic leaders will never concede that their own opposition in the 1970s (when California had about half its present population) to the completion of state and federal water projects, along with their more recent allowance of massive water diversions for fish and river enhancement, left no margin for error in a state now home to 40 million people. Second, the mandated restrictions will bring home another truth as lawns die, pools empty, and boutique gardens shrivel in the coastal corridor from La Jolla to Berkeley: the very idea of a 20-million-person corridor along the narrow, scenic Pacific Ocean and adjoining foothills is just as unnatural as “big” agriculture’s Westside farming. The weather, climate, lifestyle, views, and culture of coastal living may all be spectacular, but the arid Los Angeles and San Francisco Bay-area megalopolises must rely on massive water transfers from the Sierra Nevada, Northern California, or out-of-state sources to support their unnatural ecosystems.And note this in the USA Today piece:

Most people just call him Jerry, but to each his own, I guess. More from USA Today:

Meanwhile, the powerful farm lobby is trying to secure federal and state approval for billions of dollars to create new water tunnels, dams and other projects.Note how USA Today’s 20-something Steph Solis makes that sound like it’s a bad thing in her mind.

At least we know where Trump stands on the issue: “If I win, believe me, we’re going to start opening up the water so that you can have your farmers survive.”

46Posted at

Thursday, May 26, 2016

Let Endwments pay Tuition Costs

University Endowments

By

Janet Lorin

| Updated May 25, 2016 5:48 PM UTC

A not-so-old joke has it that Harvard is best thought of as a hedge fund with a university attached. The money in question is its endowment, a $37.6 billion pool made up largely of donations and retained earnings from investments. Big college endowments are a mostly American phenomenon, the product of a culture of philanthropy, rising inequality and aggressive investment techniques. Endowments also benefit from tax breaks for donors and a tax exemption on a fund’s earnings. Critics, including some members of Congress, are asking whether endowments are doing enough to help students at a time of soaring educational debt — or if the support by taxpayers is just helping the richest schools get richer.

The Situation

Harvard isn’t the only school with lots of money. As of June 2015, the endowments of the 812 U.S. universities that responded to an industry survey amounted to $529 billion. Some 75 percent of that was held by the wealthiest 94 universities in the survey, which each had endowments of $1 billion or more. The average return on investment in the year ending June 2015 was 2.4 percent, compared with a 4.6 percent gain for the S&P 500 Index. Larger endowments showed the benefit of diversification, even with the unsteady financial markets: The one-year return for endowments under $25 million was 2.3 percent, while endowments over $1 billion returned 4.3 percent. In early 2016, the two most important tax-writing committees in Congress asked the richest 56 private schools to provide details about how their investment returns are spent and how much endowment fund managers are paid. One Congressional proposal would require schools with endowments over $1 billion to devote a quarter of their investment income to tuition relief for middle- and low-income students. In the U.K,Cambridge reported an endowment of 2.2 billion pounds ($3.2 billion), andOxford one of 2 billion pounds. Other schools with big endowments include the King Abdullah University of Science and Technology in Saudi Arabia and the National University of Singapore.

SOURCE: BLOOMBERG

The Background

Endowments have long played a central role in the rise of some colleges. A $17 million bequest in 1932 from George Eastman, the inventor and founder of Eastman Kodak, helped make the University of Rochester one of the nation’s richest for several decades. Donations of $100 million or more have come in a flurry in recent years, with about a dozen received by universities in 2014 and 2015. Endowments have also grown by adopting aggressive investment techniques. In 1985, 65 percent of Yale’s fund sat in U.S. equities; its asset allocation target for domestic stocks in fiscal 2016 is 4 percent. Its pioneering chief investment officer, David Swensen, described an endowment’s long time horizon as “well suited to exploit illiquid, less efficient markets.” Other universities followed suit, and returns rose. Then came the 2008 downturn, when the lack of liquidity contributed to some big losses. Harvard’s fund declined 27 percent. Today, some schools with big endowments and smaller student bodies, such as Princeton, Amherst and Grinnell, derive about half their operating budgets from endowment income.

SOURCE: YALE

The Argument

A Congressional Research Service report estimated that taxing endowments’ investment income at a 35 percent rate would have produced $16.2 billion in fiscal 2014, and that the cost of tax deductions claimed by individual and corporate donors to universities amounted to $6.3 billion per year. Both benefits flow largely to elite schools. One advocacy groupestimated that the $6 billion a year needed to fund President Barack Obama’s plan to make community college free could be raised by a sliding-scale excise tax of between 0.5 percent and 2 percent on endowments that exceed $500 million. Colleges counter that they can’t spend their funds like money in a bank account. Endowments are comprised of thousands of individual funds derived from gifts, and schools must by law follow the intention of the donors. The latest Congressional inquiry isn’t the first — the Senate Finance Committee raised similar questions before the financial crisis. Around the same time, about 30 of the nation’s richest schools replaced loans with grants in financial aid packages.

The Reference Shelf

- The yearly survey of endowments and investment returns by the National Association of College and University Business Officers.

- A Congressional Research Service report on endowments and tax options.

- Annual reports from the Harvard and Yale endowment managers.

- An American Institutes for Research study suggests taxing large endowments to support low-income students at public and community colleges.

To receive a free monthly QuickTake newsletter, sign up atbloombergbriefs.com/quicktake

FIRST PUBLISHED FEB. 10, 2016

Monday, May 23, 2016

Hillary Bought and Paid For

Here’s how much Hillary Clinton was paid for her 2013-2015 speeches:

- 4/18/2013, Morgan Stanley Washington, DC: $225,000

- 4/24/2013, Deutsche Bank Washington, DC: $225,000

- 4/24/2013, National Multi Housing Council Dallas, TX: $225,000

- 4/30/2013, Fidelity Investments Naples, FL: $225,000

- 5/8/2013, Gap, Inc. San Francisco, CA: $225,000

- 5/14/2013, Apollo Management Holdings, LP New York, NY: $225,000

- 5/16/2013, Itau BBA USA Securities New York, NY: $225,000

- 5/21/2013, Vexizon Communications, Inc. Washington, DC: $225,000

- 5/29/2013, Sanford C. Bernstein and Co., LLC New York, NY: $225,000

- 6/4/2013, The Goldman Sachs Group Palmetto Bluffs, SC: $225,000

- 6/6/2013, Spencer Stuart New York, NY: $225,000

- 6/16/2013, Society for Human Resource Management Chicago, IL: $285,000

- 6/17/2013, Economic Club of Grand Rapids Grand Rapids, MI: $225,000

- 6/20/2013, Boston Consulting Group, Inc. Boston, MA: $225,000

- 6/20/2013, Let’s Talk Entertainment, Inc. Toronto, Canada: $250,000

- 6/24/2013, American Jewish University Universal City, CA: $225,000

- 6/24/2013, Kohlberg Kravis Roberts and Company, LP Palos Verdes, CA:$225,000

- 7/11/2013, UBS Wealth Management New York, NY: $225,000

- 8/7/2013, Global Business Travel Association San Diego, CA: $225,000

- 8/12/2013, National Association of Chain Drug Stores Las Vegas, NV: $225,000

- 9/18/2013, American Society for Clinical Pathology Chicago, IL: $225,000

- 9/19/2013, American Society of Travel Agents, Inc. Miami, FL: $225,000

- 10/4/2013, Long Island Association Long Island, NY: $225,000

- 10/15/2013, National Association of Convenience Stores Atlanta, GA: $265,000

- 10/23/2013, SAP Global Marketing, Inc. New York, NY: $225,000

- 10/24/2013, Accenture New York, NY: $225,000

- 10/24/2013, The Goldman Sachs Group New York, NY: $225,000

- 10/27/2013, Beth El Synagogue Minneapolis, AIN: $225,000

- 10/28/2013, Jewish United Fund/Jewish Federation of Metropolitan Chicago Chicago, IL: $400,000

- 10/29/2013, The Goldman Sachs Group Tuscon, AZ: $225,000

- 11/4/2013, Mase Productions, Inc. Orlando, FL: $225,000

- 11/4/2013, London Drugs, Ltd. Mississauga, ON: $225,000

- 11/6/2013, Beaumont Health System Troy, 111: $305,000

- 11/7/2013, Golden Tree Asset Management New York, NY: $275,000

- 11/9/2013, National Association of Realtors San Francisco, CA: $225,000

- 11/13/2013, Mediacorp Canada, Inc. Toronto, Canada: $225,000

- 11/13/2013, Bank of America Bluffton, SC: $225,000

- 11/14/2013, CB Richard Ellis, Inc. New York, NY: $250,000

- 11/18/2013, CIIE Group Naples, FL: $225,000

- 11/18/2013, Press Ganey Orlando, FL: $225,000

- 11/21/2013, U.S. Green Building Council Philadelphia, PA: $225,000

- 01/06/2014, GE Boca Raton, Fl.: $225,500

- 01/27/2014, National Automobile Dealers Association New Orleans, La.:$325,500

- 01/27/2014, Premier Health Alliance Miami, Fl.: $225,500

- 02/06/2014, Salesforce.com Las Vegas, Nv.: $225,500

- 02/17/2014, Novo Nordisk A/S Mexico City, Mexico: $125,000

- 02/26/2014, Healthcare Information and Management Systems Society Orlando, Fl.: $225,500

- 02/27/2014, A&E Television Networks New York, N.Y.: $280,000

- 03/04/2014, Association of Corporate Counsel – Southern California Los Angeles, Ca.: $225,500

- 03/05/2014, The Vancouver Board of Trade Vancouver, Canada: $275,500

- 03/06/2014, tinePublic Inc. Calgary, Canada: $225,500

- Canadian Imperial Bank of Commerce and TD Bank

- 03/13/2014, Pharmaceutical Care Management Association Orlando, Fl.:$225,500

- 03/13/2014, Drug Chemical and Associated Technologies New York, N.Y.:$250,000

- 03/18/2014, Xerox Corporation New York, N.Y.: $225,000

- 03/18/2014, Board of Trade of Metropolitan Montreal Montreal, Canada:$275,000

- 03/24/2014, Academic Partnerships Dallas, Tx.: $225,500

- 04/08/2014, Market° Inc. San Francisco, Ca.: $225,500

- 04/08/2014, World Affairs Council Portland, Or.: $250,500

- 04/10/2014, Institute of Scrap Recycling Industries Inc. Las Vegas, Nv.: $225,500

- 04/10/2014, Lees Talk Entertainment San Jose, Ca.: $265,000

- 04/11/2014, California Medical Association (via satellite) San Diego, Ca.: $100,000

- 05/06/2014, National Council for Behavioral Healthcare Washington D.C.:$225,500

- 06/02/2014, International Deli-Dairy-Bakery Association Denver, Co.: $225,500

- 06/02/2014, Lees Talk Entertainment Denver, Co.: $265,000

- 06/10/2014, United Fresh Produce Association Chicago, II.: $225,000

- 06/16/2014, tinePublic Inc. Toronto, Canada: $150,000

- Canadian Imperial Bank of Commerce and TD Bank

- 06/18/2014, tinePublic Inc. Edmonton, Canada: $100,000

- Canadian Imperial Bank of Commerce and TD Bank

- 06/20/2014, Innovation Arts and Entertainment Austin, Tx.: $150,000

- 06/25/2014, Biotechnology Industry Organization San Diego, Ca.: $335,000

- 06/25/2014, Innovation Arts and Entertainment San Francisco, Ca.: $150,000

- 06/26/2014, GTCR Chicago, II.: $280,000

- 07/22/2014, Knewton, Inc. San Francisco, Ca.: $225,500

- 07/26/2014, Ameriprise Boston, Ma.: $225,500

- 07/29/2014, Coming, Inc. Coming, N.Y.: $225,500

- 08/28/2014, Nexenta Systems, Inc. San Francisco, Ca.: $300,000

- 08/28/2014, Cisco Las Vegas, Nv.: $325,000

- 09/04/2014, Robbins Geller Rudman & Dowd LLP San Diego, Ca.: $225,500

- 09/15/2014, Caridovascular Research Foundation Washington D.C.: $275,000

- 10/02/2014, Commercial Real Estate Women Network Miami Beach, Fl.:$225,500

- 10/06/2014, Canada 2020 Ottawa, Canada: $215,500 Keystone Pipeline

- 10/07/2014, Deutsche Bank AG New York, N.Y.: $280,000

- 10/08/2014, Advanced Medical Technology Association (AdvaMed) Chicago, II.:$265,000

- 10/13/2014, Council of Insurance Agents and Brokers Colorado Springs, Co.:$225,500

- 10/14/2014, Salesforce.com San Francisco, Ca.: $225,500

- 10/14/2014, Qualcomm Incorporated San Diego, Ca.: $335,000

- 12/04/2014, Massachusetts Conference for Women Boston, Ma.: $205,500

- 01/21/2015, tinePublic Inc. Winnipeg, Canada: $262,000

- Canadian Imperial Bank of Commerce and TD Bank

- 01/21/2015, tinePublic Inc. Saskatoon, Canada: $262,500

- Canadian Imperial Bank of Commerce and TD Bank

- 01/22/2015, Canadian Imperial Bank of Commerce Whistler, Canada: $150,000

- 02/24/2015, Watermark Silicon Valley Conference for Women Santa Clara, Ca.:$225,500

- 03/11/2015, eBay Inc. San Jose, Ca.: $315,000

- 03/19/2015, American Camping Association Atlantic City, NJ.: $260,000

Total: $21,667,000

Sunday, May 22, 2016

Who are the real deniers of science?

Why do liberals hate science?

The Left has long claimed that it has something of a monopoly on scientific expertise. For instance, long before Al Gore started making millions by claiming that anyone who disagreed with his apocalyptic prophecies was “anti-science,” there were the “scientific socialists.” “Social engineer” is now rightly seen as a term of scorn and derision, but it was once a label that progressive eggheads eagerly accepted

.

The real problem is that in politics, invocations of science are very often marketing techniques masquerading as appeals to irrefutable authority. Credit: Twenty20

Masking opinions in a white smock is a brilliant, albeit infuriating and shabby, rhetorical tactic. As the late Daniel Patrick Moynihan famously said, “Everyone is entitled to his own opinion, but not his own facts.” Science is the language of facts, and when people pretend to be speaking it, they’re not only claiming that their preferences are more than mere opinions, they’re also insinuating that anyone who disagrees is a fool or a zealot for objecting to “settled science.”

Put aside the fact that there is no such thing as settled science. Scientists are constantly questioning their understanding of things; that is what science does. All the great scientists of history are justly famous for overturning the assumptions of their fields. The real problem is that in politics, invocations of science are very often marketing techniques masquerading as appeals to irrefutable authority. In an increasingly secular society, having science on your side is better than having God on your side – at least in an argument.

I’m not saying that you can’t have science in your corner, or that lawmakers shouldn’t look to science when making policy. (Legislation that rejects the existence of gravity makes for very silly laws indeed.) But the real intent behind so many claims to “settled science” is to avoid having to make your case. It’s an undemocratic technique for delegitimizing opposing views and saying “shut up” to dissenters.

For example, even if the existence of global warming is “settled,” the policies for how to best respond to it are not. But in the political debates about climate change, activists say that their climatological claims are irrefutable and so are their preferred remedies.

If climate change is the threat they claim, I’d rather spend billions on geoengineering to fix it than trillions on impoverishing economic policies that at best slightly delay it. It doesn’t matter; I’m the Luddite buffoon for thinking ethanol subsidies and windmills are boondoggles.

]

Even more outrageous: If you dispute, say, the necessity of spending billions on windmills or on killing the coal industry, you are not merely wrong on climate change, you are “anti-science.”

Intellectually, this is a monument of asininity so wide and tall, even the mind’s eye cannot glimpse its horizon or peak.

For starters, why are liberalism’s pet issues the lodestars of what constitutes scientific fact? Medical science informs us fetuses are human beings. The liberal response? “Who cares?” Genetically modified foods are safe, sayeth the scientists. “Shut up,” reply the liberal activists. IQ is partly heritable, the neuroscientists tell us. “Shut up, bigot,” the liberals shriek.

Which brings me to the raging hysteria over the plight of transgendered people who need to use the bathroom.

The New York Times recently reported about A. J. Jackson’s travails in a Vermont high school. “There were practical issues,” Anemona Hartocollis writes. “When he had his period, he wondered if he should revert to the girls’ bathroom, because there was no place to throw away his used tampons.”

Now, one can have sympathy for the transgendered – I certainly do – while simultaneously holding to the scientific fact that boys do not menstruate. This is a fact far more settled than the very best climate science. Perhaps it’s rude to say so, but facts do not cease to be facts simply because they offend.

In New York City, Mayor Bill de Blasio is pushing to fine businesses that do not address customers by their “preferred name, pronoun and title (e.g., Ms./Mrs.) regardless of the individual’s sex assigned at birth, anatomy, gender, medical history, appearance, or the sex indicated on the individual’s identification.” The NYC Commission on Human Rights can penalize offenders up to $250,000.

Many liberals believe that “denying” climate science should be a criminal offense while also believing that denying biological science is a moral obligation.

In the law, truth is a defense against the charge of slander, but for liberals, inconvenient truth is no defense against the charge of bigotry.

Saturday, May 21, 2016

Venezuela’s Economic Calamity Caused No Surprise At Cafe Hayek

Venezuela’s Economic Calamity Caused No Surprise At Cafe Hayek

by DON BOUDREAUX on MAY 21, 2016

Rita Varela does not like my criticism of Joseph Stiglitz’s generally happy assessment, in the Fall of 2007, of Hugo Chavez’s economic policies imposed on Venezuelans. Ms. Varela scolds, by e-mail:

You [Boudreaux] find it simple to look out your rear view window to see what happened. It was not so simple to see nine years [ago] that the oil price would fall so far.

Ms. Varela:

No sensible economist could have looked at Venezuela in 2007 – or in whatever year the price of oil recently peaked – and predicted anything but the general state of economic calamity that reigns there today. Stiglitz’s 2007 assessment of Chavez’s policies wasn’t wrong because Stiglitz failed to account for falling oil prices. His assessment was wrong because every good economist understands that making property rights more insecure, centralizing more and more economic decisions in a government bureaucracy, and preventing market prices from rising and falling as the forces of supply and demand would push those prices unavoidably cause economic damage – and that the greater these interventions the greater the extent and depth of the resulting damage.

But lest you or anyone else suppose that good economists have only after the fact concluded that Chavez’s (and Maduro’s) economic policies spell doom for the Venezuelan economy – and greater tyranny for Venezuelan society – here are a few Cafe Hayek blog posts from years ago: February 7, 2007; February 8, 2007; also February 8, 2007; December 26, 2009; September 26, 2010; and April 22, 2012.

___________________________________________

ORIGINAL:

___________________________________________

ORIGINAL:

Joseph Stiglitz Praised Hugo Chavez’s Economic Policies

by DON BOUDREAUX on MAY 21, 2016

I either had never learned, or I have completely forgotten, that in 2007 Nobel laureate economist Joseph Stiglitz predicted that Hugo Chavez’s brand of socialism in Venezuela would succeed.

(I thank the indispensable Yevdokiya Zagumenova for alerting me to Stiglitz’s 2007 positive assessment of Chavez’s economic policies.)

That Stiglitz said (quoting the above-report’s summary of his opinion) that “relatively high inflation isn’t necessarily harmful to the economy” is bad enough. What’s worse is Stiglitz’s obliviousness to the inevitable ill-effects of the centralization of economic decision-making authority in state officials and its resulting insecurity of property rights.

F.A. Hayek or Milton Friedman or Ludwig von Mises or Adam Smith or Edwin Cannan or Deirdre McCloskey or Armen Alchian or Bill Allen or Elinor Ostrom or Harold Demsetz or Israel Kirzner or Bob Higgs or Russ Roberts or Steve Landsburg or Don Lavoie or Julian Simon or Warren Nutter or George Stigler or Gary Becker or Ronald Coase or Bruce Yandle or Roger Meiners or Andy Morriss or Hugh Macaulay or Randy Holcombe or Steve Pejovich or Dwight Lee or Vernon Smith or Larry White or James Buchanan or Gordon Tullock or Walter Williams or Thomas Sowell or Leland Yeager or Roger Garrison or Bob Tollison or Bob Ekelund or Mario Rizzo or Dan Klein or Roger Koppl or George Selgin or Sandy Ikeda or Steve Horwitz or Pete Boettke or Jim Gwartney or Dick Wagner or Bill Easterly or Ken Elzinga or Chris Coyne or Bryan Caplan or David Henderson or Arnold Kling or John Cochrane or John Taylor or Alex Tabarrok or David Friedman or Bob Murphy or Liya Palagashvili or Abby Hall Blanco or… (wow, the list can be extended much longer) would have predicted without hesitation in 2007 that Chavez’s highly interventionist policies would impoverish Venezuela’s masses regardless of how many goodies the Venezuelan state managed at first to bestow upon those masses

Indeed, a GMU economics major with a GPA higher than 1.9 would have predicted the same.

Good economists understand that while a wealthy, market-oriented society such as the United States can tolerate a bit of forced ‘redistribution’ and can mask the relatively small amounts of wealth and opportunities that are destroyed by the likes of a bit of occupational licensing, some government wage-setting, a dash of export subsidies, and comparatively modest tariffs, these policies over time nevertheless make most people poorer, not richer, than they would be in the absence of these policies.

Good economists are ever-attentive to unintended consequences as well as to the sound incentives generated by private-property-based free markets and the unsound incentives created by the ability to impose decisions by force. Good economists understand the prudential case for not only having good rules (such as those of a system of private property rights) but also that rules become meaningless – they cease to exist – when they can be easily violated. Good economists understand that the expression of excellent intentions is not remotely sufficient to achieve excellent results. Good economists understand that sustainable economic prosperity can only emerge through the spontaneous-ordering forces of the market; there is no way that attempts to create prosperity by any different means will result in any outcome other than impoverishment of the masses and tyranny by government officials. Joseph Stiglitz seems to be oblivious to these realities.

Subscribe to:

Posts (Atom)