A SaaS company is a company that hosts an application and makes it available to customers over the internet. SaaS stands for Software as a Service. This infers that the software sits on a SaaS company's server while the user accesses it remotely.Apr 30, 2020

10 SaaS For 2021 And Beyond

Summary

- Two years ago, I introduced a basket of "10 SaaS Under $10B": a group of highly promising companies likely to beat the market over five years.

- They were young, small, fast-growing and under-followed companies with strong cultures and huge total addressable markets.

- The basket has done incredibly well so far at the two-year mark, so much so that I have to rebrand them. They are now "10 SaaS Under $50B."

- The basket is up +213% since 2019, which means you would have more than tripled your money over the last two years investing alongside me.

- I continue to believe the alpha generated will be even more impressive in 2021 and beyond.

- Looking for a portfolio of ideas like this one? Members of App Economy Portfolio get exclusive access to our model portfolio. Get started today »

I introduced two years ago a basket of "10 SaaS Under $10B," projecting that they would do better than the S&P 500 over the next five years.

Little did I know that after two years, the basket would achieve almost 5X the S&P 500 returns. This group of stocks more than tripled in the last 24 months, with 7 out of the 10 stocks delivering multi-bagger returns. In fact, I had to check a few times my two-year-old article, because I couldn't believe how much smaller these companies were when I originally featured them.

These 10 companies are particularly relevant together as part of a basket strategy and have been hand-selected following a series of KPIs, screeners, and scorecards.

Source: App Economy Insights.

The ingredients of this recipe:

- Significant addressable markets.

- Strong leadership teams and culture.

- Companies still small enough to generate significant returns.

- Winning software businesses with high retention and expansion rates.

- Winning stocks with price appreciating over the last 12 months.

- Undiscovered or under-followed tickers.

At the time, I explained that you should consider that you are shooting for 50% accuracy. Chances were that at least a few of these fast-growing disruptive SaaS businesses would compound to significant returns -- as long as you can hold on to them.

Given the high-risk/high-reward nature of these companies, even if the majority of them turn out to be losers, the few winners should be enough to more than offset the losers and beat the market averages. As we review the performance of these companies in the past two years, you'll see that this assumption holds true.

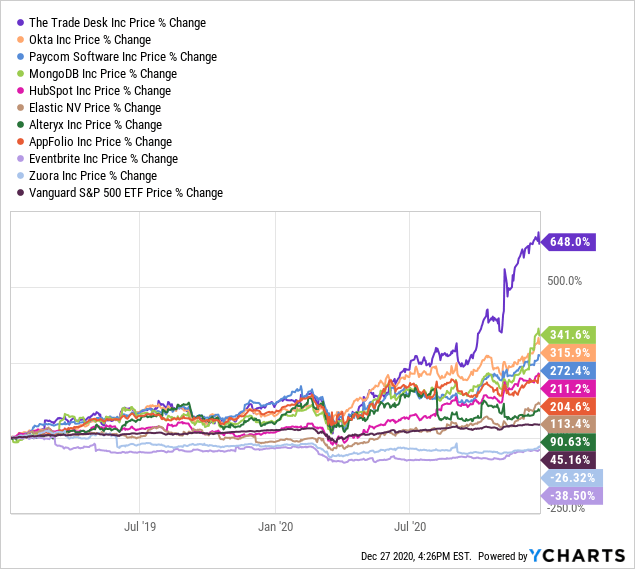

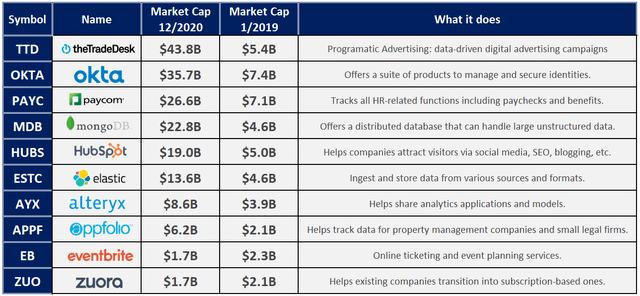

As you can tell by the chart below, I had to rebrand my basket from "10 SaaS Under $10B" to "10 SaaS Under $50B" following astonishing performances already delivered in both 2019 and 2020 for the majority of them.

Companies in the chart: The Trade Desk (TTD), Okta (OKTA), Paycom Software (PAYC), MongoDB (MDB), HubSpot (HUBS), Elastic (ESTC), Alteryx (AYX), AppFolio (APPF), Eventbrite (EB), Zuora (ZUO).

Source: Chart by author. Market Cap from Yahoo Finance 12/27/2020.

The key metrics of evaluating SaaS businesses

While investors typically use key metrics such as P/E (Price to earnings ratio) or EV/FCF (Enterprise Value to Free Cash Flow) to gauge the valuation of a company, the analysis has to be different for young SaaS businesses.

These companies tend to have growth stories that can be hard to evaluate and project over the long term and they are re-investing heavily in themselves, making them look richly valued based on backward-looking metrics.

From ARR (Annual Recurring Revenue) to DBNE (Dollar-Based Net Expansion rate), there are many ways to evaluate how healthy a SaaS business is. I covered previously the five essential traits to look for when investing in SaaS businesses.

Overall, a strong business model should require less spending on sales & marketing over time proportionally to revenue.

I have broken down previously the three pillars of cloud businesses:

- Acquisition: How efficiently is the company acquiring new customers? Is that cost increasing or dropping over time? This could depend on TAM or how specific the service provided really is, among other things.

- Retention: Are customers sticking with the product? How many customers from the 2017 cohort are still around? What is the Net Retention on a revenue basis (overall dollar amount made from the same cohort of customers over time).

- Monetization: Are existing customers spending more money on additional products? Are they spending more in year 2 compared to year 1? Is the company providing Life Time Value per customer and how fast is it offsetting Customer Acquisition Costs (LTV/CAC)?

SaaS businesses are rarely a home run on all KPIs, but when they are, their valuations tend to reflect it with a huge premium up to 20+ times sales.

If you are focusing on valuation metrics such as P/E or PEG, you are wasting your time here. There is a leap of faith needed when you invest in a loss-making company growing its revenue more than 50% year-on-year report after report.

Some of them will eventually show cracks in their growth story that can lead to dramatic draw-downs in their share price. Some others will see their growth accelerate and will go on to become the Atlassian (TEAM), Shopify (SHOP), Square (SQ) or even Salesforce.com (CRM) of tomorrow.

The common denominators: a screener for the winners

Out of some of the top performing SaaS stocks, some similarities begin to appear in their stories and fundamentals. Here is a list of commonalities I have found between them when I selected them originally:

- They were making half a billion or less in yearly revenue.

- They were still losing money.

- They were growing fast (>25%).

- They often had high insider ownership (>5%).

- They had low trading volume on average.

- They were cash flow positive.

- They had outstanding management teams and culture.

- They were mostly under-followed by Wall Street (less than ~10 analysts).

- They had high valuations by most standard metrics.

- Their price had appreciated over the last 12 months (winners win).

As part of the screening process, I considered the three following as the sine qua non of KPIs in order to filter out companies that would fall out of an acceptable spectrum:

- CEO approval ratings on Glassdoor > 80%.

- Fast growing top line > 25%.

- Stock price movement over the last 12 months positive.

By selecting only companies that deliver at least on the three KPIs above, I am most likely looking at companies that have a strong leadership, fast-growing business, and a winning stock.

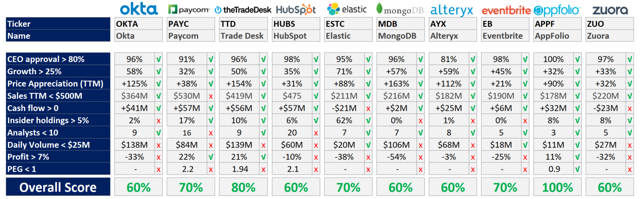

The Small Cap Scorecard

Following the 10 criteria above, I built a Scorecard for evaluating small caps in order to identify potential high performers for the years to come.

These criteria add more traditional valuation metrics in the mix such as profitability, PEG, cash flow and also address if the company remains fairly "undiscovered" by Wall Street.

- CEO Approval on Glassdoor > 80%

- Growth > 25%

- Price Appreciation TTM

- Sales TTM < $500M

- Cash Flow > 0

- Insider Holdings > 5%

- Analysts < 10

- Daily trading volume < $25M

- Profit > 7%

- PEG < 1

While the overall score is certainly not an end-all-be-all kind of indicator, it forces me into having a full picture of the pros and cons and comes handy when comparing a large number of companies to see which ones stand out.

With new promising growth stories every other month and head-scratching valuations, I have come to appreciate relying on such a screener.

Here is how they scored in the beginning of 2019:

Source: Chart by author. Financials from Yahoo Finance 1/7/2019 and CEO approval rating from Glassdoor.com. Companies in the chart: Okta, Paycom Software, The Trade Desk, HubSpot, Elastic, MongoDB, Alteryx, Eventbrite, Appfolio, Zuora.

The 10 companies of the basket were relatively high on the scorecard with overall scores ranging from 60% to 100%. As expected, they tend to fall short on backward-looking valuation metrics based on earnings but show spectacular results otherwise.

While a high score on the card is not sufficient to determine a winner, you will rarely see a big loser score high across these KPIs. The screener is a tool to separate the wheat from the chaff.

Let's not forget the importance and relevance of the basket approach. Again, you don't have to be right on each individual company when you diversify your investment across a wide range of promising growth stories. While they could all deliver for their own individual compelling reasons, even a 50% success rate will be more than enough to deliver a market-beating performance.

Indeed, high flyers in the SaaS category tend to deliver spectacular returns. All you need is to capture some, one, or two in your fishnet and let them compound over the years.

Eventbrite and Zuora would fail on my selection criteria today. Their respective top-line growth has slowed down below the 25% mark and their stock performance is negative over the trailing 24 months. Does this mean they are not worth holding? Certainly not. Most companies don't grow in a straight line up and to the right. The very premise of my selection two years ago was to give at least five years to this basket to give enough time for the story to unfold. The laggards of the past two years could become the leaders of the next three.

The biggest challenge in the basket approach is investor behavior. With high volatility come emotions, second-guessing and temptation to bail as soon as a company underperforms for more than a year or even a few months. Another immense temptation is to part ways with your winners. The Trade Desk is almost a 16-bagger in the App Economy Portfolio (up almost 1,500%) as of this writing. I have not felt any desire to trim or sell my position because I rarely ever sell.

Only investors with the temperament to go through highs and lows and an ability to keep their positions intact for years should consider this approach.

A look back at the past two years

The movements of a stock remain unpredictable over the short term, but it eventually catches up to the performance of the underlying business. Here is how the basket has done over the past 24 months and how it compares to the S&P 500 benchmark (SPY) (IVV) (VOO).

Performance in the past 24 months:

Data by YCharts

Data by YChartsFor the past 24 months, the basket has delivered +213% on average compared to +45% for the S&P 500 benchmark.

That's +168% of alpha generated in only two years from a group of 10 companies and almost 5 times the returns of the market. Remarkable.

As expected, the alpha generated by the basket is driven by a few big winners that more than offset the underperformers. The accuracy of this selection turns out to be particularly impressive here with 6 stocks more than tripling in just two years. These big winners might seem very obvious picks today. Similarly, it might seem foolish to have invested in the two losers of this basket in retrospect. Hindsight is 20/20.

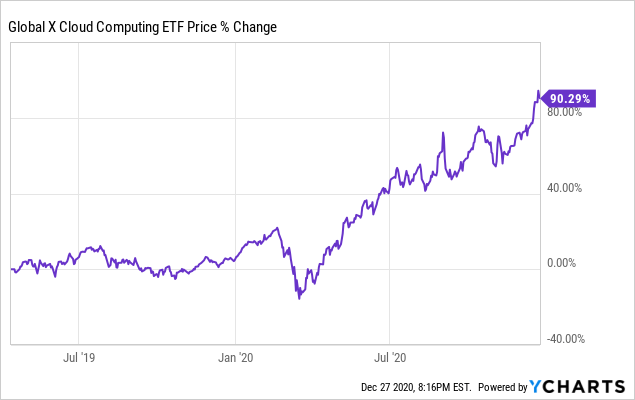

And before you claim that all cloud businesses have crushed the market, note that the Global X Cloud Computing ETF (CLOU) is only up +90% in the past two years, far short of the average of the curated basket discussed today.

Data by YCharts

Data by YChartsWhat else makes these 10 SaaS under $50B so special?

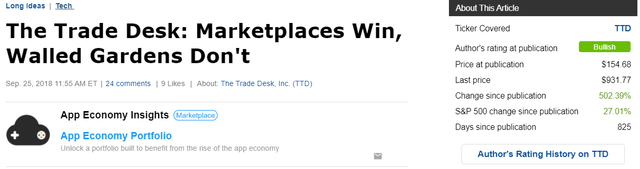

The Trade Desk is a digital ad platform, serving the programmatic ad market. The company is covering the entire digital advertising market: Connected TVs, Mobile, Video, Audio, Displays, Social, Native. The worldwide advertising market is expected to reach about one $1 trillion in 2022. The company is growing at a fast clip and is retaining 95% of its customers. You can find my bullish thesis about The Trade Desk here.

Source (article screenshot as of 12/27/2020).

Okta is an identity-management service built for the cloud, empowering IT departments to manage any employee's access to any application or device. The company reported a dollar-based retention rate of 123% for the trailing 12 months ending October 31, meaning that not only customers are staying around, but they are also adding more functionality over time.

Paycom Software is offering a platform for all HR-related functions such as paycheck, recruitment, benefits and time management. The company has been able to grow its retention rate to 93% pre-COVID, a very high number considering the failure rate of small businesses, the main market Paycom is serving.

MongoDB might well be the next Oracle (ORCL). It is a free and open-source document database designed for ease of development and scaling. It offers a superior option when it comes to storage capacity and speed for the modern databases that require greater reliability and efficiency. Net ARR expansion rate is above 120% consistently. I have added to this winning position of the App Economy Portfolio over time and explained why in this article.

Source (article screenshot as of 12/27/2020).

HubSpot might be the next Salesforce.com. The company helps small and medium-size businesses draw customers in and close sales with its inbound marketing and sales software (SEO, website, marketing automation, social media, landing pages, blogs). Revenue retention rate was over 100% in its last earnings report. The company was voted the #1 Best Place to Work in 2020 by the Glassdoor Employees' Choice Award. You can find my detailed write-up about Hubspot here.

Source (article screenshot as of 12/27/2020).

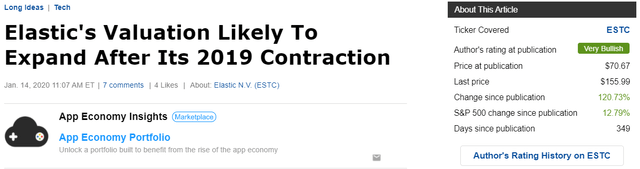

Elastic offers Elasticsearch, the most popular enterprise search engine according to the DB-Engines ranking. They are used in a wide range of applications: from connecting you to your next Uber driver or to your next Tinder match. The company's Net Expansion Rate was over 130% as of October 31, 2020, making it probably the most promising business of this group.

Source (article screenshot as of 12/27/2020).

Alteryx is a provider of self-serve data analytics. It empowers what it calls "data citizens," people without data science or coding experience, to make sense of the overflow of data. Its addressable market is limitless if it can become the go-to analytics tool across IT, data scientists and data analysts. Dollar-based net expansion rate was 124% in its most recent quarter.

AppFolio has its own niche: a focus on small and medium-sized property management. Better yet, management expects new verticals to be added in the coming years. The company's dollar-based net expansion rate was 133% for property management. You can find my write-up about AppFolio here.

Source (article screenshot as of 12/27/2020).

Eventbrite provides online ticketing and event planning services. It has a large TAM thanks to its leading position in the mid-market: "not birthday parties and not Taylor Swift at Madison Square Garden, but everything in between," as CEO Julia Hartz puts it. 60% of the gross profit of the company came from self sign-on in 2019. The freemium model is converting 17% of users per the company as disclosed in the S-1. The company has struggled to migrate customers from the acquired platform Ticketfly in 2019, and the global pandemic has put a halt to Eventbrite's business in 2020. But as investors, we ought to look forward, not backwards. You can find my detailed write-up about Eventbrite pre-COVID here.

Zuora is helping companies transition to the "subscription economy." The company's applications are designed to automate recurring billing, collections, quoting and revenue recognition. Zuora's dollar-based retention rate was 99% in the most recent quarter. The company had to reorganize its sales force in 2019 and has yet to resume its growth path. With an anemic growth of 8% Y/Y in the most recent quarter, the company is the laggard of this group and in the penalty box for now. But don't give up on them yet given their strong leadership with Tien Tzuo at the helm.

A word of caution

These companies are relatively small and several of them have yet to be profitable. Their businesses are subject to disruption with new competitors, regulations or breakthrough innovations around the corner.

Volatility should be expected, with moves 50% up or down in a matter of weeks for no apparent reason. Ask yourself if you can cope with that before considering this kind of investment.

While it may sound less risky to spread an investment across 10 companies, this basket does NOT constitute a diversified portfolio in and of itself. They all belong to the same sector, size, and geography, which makes them likely to move together and be subject to the same risks at a macro level.

This basket strategy should only represent a specific sub-category of your overall portfolio and should be understood as an alternative to an investment in a single SaaS company.

To illustrate, the App Economy Portfolio holds most of the companies from this basket, but they represent less than 25% of the portfolio.

Bottom Line

2020 was a fantastic year for many Enterprise Software stocks. And they should continue to do well, even as we enter a world post-pandemic.

Mean regression is always lurking and extreme volatility should be expected for any small growth company. But I believe 2021 remains a great year to start or add to these positions with a multi-year horizon in mind.

While nothing is certain in the short term, particularly on an individual company basis, I am confident that this basket will do very well over a five-year time frame and beyond. And this sentiment is now bolstered by two first years of astounding performance.

I'll continue to review every year how these 10 companies originally under $10 billion are getting it done compared to the S&P 500.

This month, I picked a new very promising SaaS under $10B exclusively for App Economy Portfolio members. You can read my bullish thesis here.

- Are any of these companies in your portfolio?

- What would be your top picks for 2021 and beyond?

- Are there any criteria you would add to the scorecard discussed here?

Let me know in the comments!

If you are looking for a portfolio of actionable ideas like this one, please consider joining the App Economy Portfolio. Start your free trial today!

No comments:

Post a Comment