William Barr - Comey's FBI - Root of Problem

VDH - The Irreplacables

Hope

VDH - New Book July of 2021

Political Activist Academics Face Backlash

William Barr - Comey's FBI - Root of Problem

VDH - The Irreplacables

Hope

VDH - New Book July of 2021

Political Activist Academics Face Backlash

Over the Christmas weekend AT&T Inc. (T) officially started their hybrid movie program with Wonder Woman 1984 being released both in movie theaters as well as direct to viewers' homes through HBO Max.

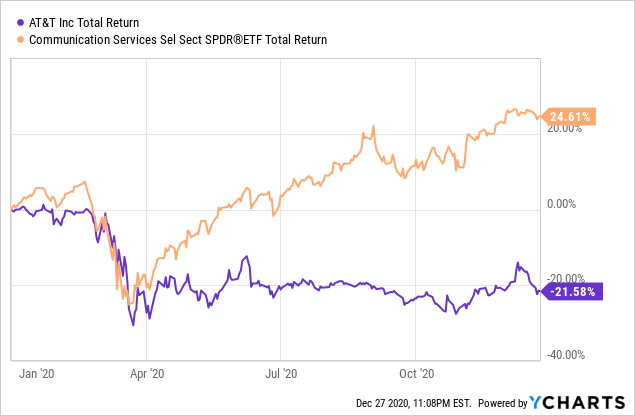

Despite all the success AT&T has had this year in growing their business and repositioning their debt, the company's stock has declined more than 20% while the broader Communications Services Sector, as measured by State Street's Communications Services Sector ETF (XLC) is up nearly 25%. If AT&T's stock kept pace with peers for 2020, the stock would be trading in the mid-$40s.

Year to Date Total Return for AT&T and State Street's Communications Services Sector ETF

Data by YCharts

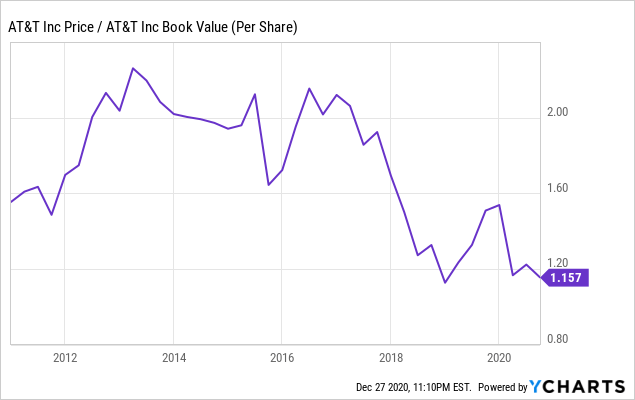

Data by YChartsTurning from peers to AT&T's historical valuations, the company's stock is also exceptionally cheap. One of our favorite metrics to use in valuing an asset-heavy company is their book value per share. Historically, AT&T has traded around 2x book value over the past decade. Not surprisingly, as AT&T's debt level hit all-time highs in 2018, this multiple dropped precipitously. While management worked to improve the balance sheet and integrate the acquisition of Time Warner, this multiple rapidly moved towards its historical level.

With the COVID Pandemic, investors shunned the company's stock and saw this multiple drop back to the lowest levels seen over the past 10 years. With the company better positioned for growth, a highly attractive dividend yield of 7%, and a sustainable dividend that should continue to grow as the payout ratio is now roughly 50%, the company should quickly move back to their historical valuation. This should drive the stock price for AT&T to $50 per share.

AT&T's Historical Price to Book Value - Past 10 Years

Data by YCharts

Data by YChartsInvestors in AT&T should also closely evaluate the potential risks that can materially change the way the company delivers on their growth goals.

The results of AT&T's hybrid release of Wonder Woman 1984 continue to build on our view that AT&T is well-positioned for 2021. In addition to the good steps the management team has taken to grow the business in 2020 and reduce the company's debt load, the ability to successfully pivot on a Pandemic-constrained world should give investors comfort. Additionally, AT&T has proven that it is uniquely positioned to deliver premium content to their customers through HBO Max. With AT&T still trading at their lowest valuation level in the past ten years, AT&T's stock is a great addition to one's portfolio.

One final note: I hope you enjoyed this article and my analysis of the company above. One favor that I ask is that you click the "Follow" button so that you can receive real-time e-mails for the articles that I publish and so I can grow my Seeking Alpha community. I value this as a personal Thank You for this article and a vote of support as I share my experience and views in the markets to the broader Seeking Alpha Community.

A SaaS company is a company that hosts an application and makes it available to customers over the internet. SaaS stands for Software as a Service. This infers that the software sits on a SaaS company's server while the user accesses it remotely.Apr 30, 2020

I introduced two years ago a basket of "10 SaaS Under $10B," projecting that they would do better than the S&P 500 over the next five years.

Little did I know that after two years, the basket would achieve almost 5X the S&P 500 returns. This group of stocks more than tripled in the last 24 months, with 7 out of the 10 stocks delivering multi-bagger returns. In fact, I had to check a few times my two-year-old article, because I couldn't believe how much smaller these companies were when I originally featured them.

These 10 companies are particularly relevant together as part of a basket strategy and have been hand-selected following a series of KPIs, screeners, and scorecards.

Source: App Economy Insights.

The ingredients of this recipe:

At the time, I explained that you should consider that you are shooting for 50% accuracy. Chances were that at least a few of these fast-growing disruptive SaaS businesses would compound to significant returns -- as long as you can hold on to them.

Given the high-risk/high-reward nature of these companies, even if the majority of them turn out to be losers, the few winners should be enough to more than offset the losers and beat the market averages. As we review the performance of these companies in the past two years, you'll see that this assumption holds true.

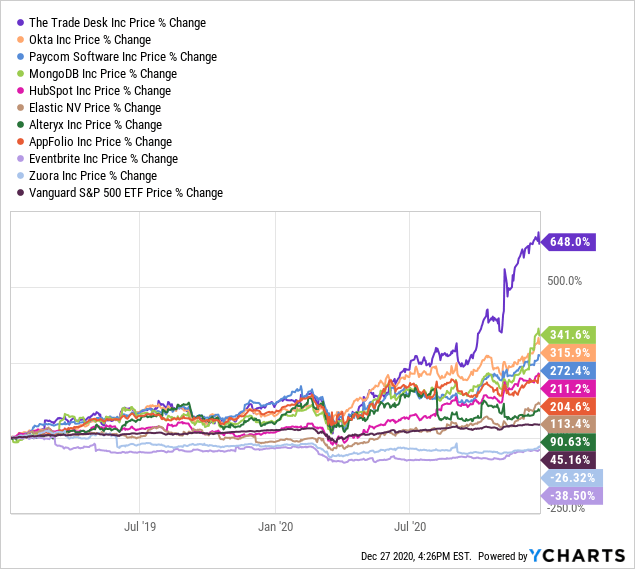

As you can tell by the chart below, I had to rebrand my basket from "10 SaaS Under $10B" to "10 SaaS Under $50B" following astonishing performances already delivered in both 2019 and 2020 for the majority of them.

Companies in the chart: The Trade Desk (TTD), Okta (OKTA), Paycom Software (PAYC), MongoDB (MDB), HubSpot (HUBS), Elastic (ESTC), Alteryx (AYX), AppFolio (APPF), Eventbrite (EB), Zuora (ZUO).

Source: Chart by author. Market Cap from Yahoo Finance 12/27/2020.

While investors typically use key metrics such as P/E (Price to earnings ratio) or EV/FCF (Enterprise Value to Free Cash Flow) to gauge the valuation of a company, the analysis has to be different for young SaaS businesses.

These companies tend to have growth stories that can be hard to evaluate and project over the long term and they are re-investing heavily in themselves, making them look richly valued based on backward-looking metrics.

From ARR (Annual Recurring Revenue) to DBNE (Dollar-Based Net Expansion rate), there are many ways to evaluate how healthy a SaaS business is. I covered previously the five essential traits to look for when investing in SaaS businesses.

Overall, a strong business model should require less spending on sales & marketing over time proportionally to revenue.

I have broken down previously the three pillars of cloud businesses:

SaaS businesses are rarely a home run on all KPIs, but when they are, their valuations tend to reflect it with a huge premium up to 20+ times sales.

If you are focusing on valuation metrics such as P/E or PEG, you are wasting your time here. There is a leap of faith needed when you invest in a loss-making company growing its revenue more than 50% year-on-year report after report.

Some of them will eventually show cracks in their growth story that can lead to dramatic draw-downs in their share price. Some others will see their growth accelerate and will go on to become the Atlassian (TEAM), Shopify (SHOP), Square (SQ) or even Salesforce.com (CRM) of tomorrow.

Out of some of the top performing SaaS stocks, some similarities begin to appear in their stories and fundamentals. Here is a list of commonalities I have found between them when I selected them originally:

As part of the screening process, I considered the three following as the sine qua non of KPIs in order to filter out companies that would fall out of an acceptable spectrum:

By selecting only companies that deliver at least on the three KPIs above, I am most likely looking at companies that have a strong leadership, fast-growing business, and a winning stock.

Following the 10 criteria above, I built a Scorecard for evaluating small caps in order to identify potential high performers for the years to come.

These criteria add more traditional valuation metrics in the mix such as profitability, PEG, cash flow and also address if the company remains fairly "undiscovered" by Wall Street.

While the overall score is certainly not an end-all-be-all kind of indicator, it forces me into having a full picture of the pros and cons and comes handy when comparing a large number of companies to see which ones stand out.

With new promising growth stories every other month and head-scratching valuations, I have come to appreciate relying on such a screener.

Here is how they scored in the beginning of 2019:

Source: Chart by author. Financials from Yahoo Finance 1/7/2019 and CEO approval rating from Glassdoor.com. Companies in the chart: Okta, Paycom Software, The Trade Desk, HubSpot, Elastic, MongoDB, Alteryx, Eventbrite, Appfolio, Zuora.

The 10 companies of the basket were relatively high on the scorecard with overall scores ranging from 60% to 100%. As expected, they tend to fall short on backward-looking valuation metrics based on earnings but show spectacular results otherwise.

While a high score on the card is not sufficient to determine a winner, you will rarely see a big loser score high across these KPIs. The screener is a tool to separate the wheat from the chaff.

Let's not forget the importance and relevance of the basket approach. Again, you don't have to be right on each individual company when you diversify your investment across a wide range of promising growth stories. While they could all deliver for their own individual compelling reasons, even a 50% success rate will be more than enough to deliver a market-beating performance.

Indeed, high flyers in the SaaS category tend to deliver spectacular returns. All you need is to capture some, one, or two in your fishnet and let them compound over the years.

Eventbrite and Zuora would fail on my selection criteria today. Their respective top-line growth has slowed down below the 25% mark and their stock performance is negative over the trailing 24 months. Does this mean they are not worth holding? Certainly not. Most companies don't grow in a straight line up and to the right. The very premise of my selection two years ago was to give at least five years to this basket to give enough time for the story to unfold. The laggards of the past two years could become the leaders of the next three.

The biggest challenge in the basket approach is investor behavior. With high volatility come emotions, second-guessing and temptation to bail as soon as a company underperforms for more than a year or even a few months. Another immense temptation is to part ways with your winners. The Trade Desk is almost a 16-bagger in the App Economy Portfolio (up almost 1,500%) as of this writing. I have not felt any desire to trim or sell my position because I rarely ever sell.

Only investors with the temperament to go through highs and lows and an ability to keep their positions intact for years should consider this approach.

The movements of a stock remain unpredictable over the short term, but it eventually catches up to the performance of the underlying business. Here is how the basket has done over the past 24 months and how it compares to the S&P 500 benchmark (SPY) (IVV) (VOO).

Performance in the past 24 months:

Data by YCharts

Data by YChartsFor the past 24 months, the basket has delivered +213% on average compared to +45% for the S&P 500 benchmark.

That's +168% of alpha generated in only two years from a group of 10 companies and almost 5 times the returns of the market. Remarkable.

As expected, the alpha generated by the basket is driven by a few big winners that more than offset the underperformers. The accuracy of this selection turns out to be particularly impressive here with 6 stocks more than tripling in just two years. These big winners might seem very obvious picks today. Similarly, it might seem foolish to have invested in the two losers of this basket in retrospect. Hindsight is 20/20.

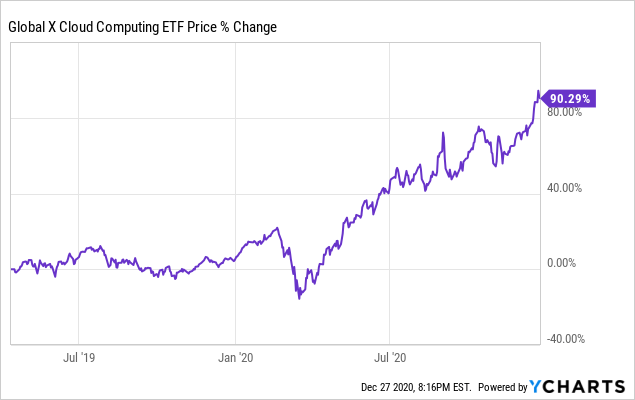

And before you claim that all cloud businesses have crushed the market, note that the Global X Cloud Computing ETF (CLOU) is only up +90% in the past two years, far short of the average of the curated basket discussed today.

Data by YCharts

Data by YChartsThe Trade Desk is a digital ad platform, serving the programmatic ad market. The company is covering the entire digital advertising market: Connected TVs, Mobile, Video, Audio, Displays, Social, Native. The worldwide advertising market is expected to reach about one $1 trillion in 2022. The company is growing at a fast clip and is retaining 95% of its customers. You can find my bullish thesis about The Trade Desk here.

Source (article screenshot as of 12/27/2020).

Okta is an identity-management service built for the cloud, empowering IT departments to manage any employee's access to any application or device. The company reported a dollar-based retention rate of 123% for the trailing 12 months ending October 31, meaning that not only customers are staying around, but they are also adding more functionality over time.

Paycom Software is offering a platform for all HR-related functions such as paycheck, recruitment, benefits and time management. The company has been able to grow its retention rate to 93% pre-COVID, a very high number considering the failure rate of small businesses, the main market Paycom is serving.

MongoDB might well be the next Oracle (ORCL). It is a free and open-source document database designed for ease of development and scaling. It offers a superior option when it comes to storage capacity and speed for the modern databases that require greater reliability and efficiency. Net ARR expansion rate is above 120% consistently. I have added to this winning position of the App Economy Portfolio over time and explained why in this article.

Source (article screenshot as of 12/27/2020).

HubSpot might be the next Salesforce.com. The company helps small and medium-size businesses draw customers in and close sales with its inbound marketing and sales software (SEO, website, marketing automation, social media, landing pages, blogs). Revenue retention rate was over 100% in its last earnings report. The company was voted the #1 Best Place to Work in 2020 by the Glassdoor Employees' Choice Award. You can find my detailed write-up about Hubspot here.

Source (article screenshot as of 12/27/2020).

Elastic offers Elasticsearch, the most popular enterprise search engine according to the DB-Engines ranking. They are used in a wide range of applications: from connecting you to your next Uber driver or to your next Tinder match. The company's Net Expansion Rate was over 130% as of October 31, 2020, making it probably the most promising business of this group.

Source (article screenshot as of 12/27/2020).

Alteryx is a provider of self-serve data analytics. It empowers what it calls "data citizens," people without data science or coding experience, to make sense of the overflow of data. Its addressable market is limitless if it can become the go-to analytics tool across IT, data scientists and data analysts. Dollar-based net expansion rate was 124% in its most recent quarter.

AppFolio has its own niche: a focus on small and medium-sized property management. Better yet, management expects new verticals to be added in the coming years. The company's dollar-based net expansion rate was 133% for property management. You can find my write-up about AppFolio here.

Source (article screenshot as of 12/27/2020).

Eventbrite provides online ticketing and event planning services. It has a large TAM thanks to its leading position in the mid-market: "not birthday parties and not Taylor Swift at Madison Square Garden, but everything in between," as CEO Julia Hartz puts it. 60% of the gross profit of the company came from self sign-on in 2019. The freemium model is converting 17% of users per the company as disclosed in the S-1. The company has struggled to migrate customers from the acquired platform Ticketfly in 2019, and the global pandemic has put a halt to Eventbrite's business in 2020. But as investors, we ought to look forward, not backwards. You can find my detailed write-up about Eventbrite pre-COVID here.

Zuora is helping companies transition to the "subscription economy." The company's applications are designed to automate recurring billing, collections, quoting and revenue recognition. Zuora's dollar-based retention rate was 99% in the most recent quarter. The company had to reorganize its sales force in 2019 and has yet to resume its growth path. With an anemic growth of 8% Y/Y in the most recent quarter, the company is the laggard of this group and in the penalty box for now. But don't give up on them yet given their strong leadership with Tien Tzuo at the helm.

These companies are relatively small and several of them have yet to be profitable. Their businesses are subject to disruption with new competitors, regulations or breakthrough innovations around the corner.

Volatility should be expected, with moves 50% up or down in a matter of weeks for no apparent reason. Ask yourself if you can cope with that before considering this kind of investment.

While it may sound less risky to spread an investment across 10 companies, this basket does NOT constitute a diversified portfolio in and of itself. They all belong to the same sector, size, and geography, which makes them likely to move together and be subject to the same risks at a macro level.

This basket strategy should only represent a specific sub-category of your overall portfolio and should be understood as an alternative to an investment in a single SaaS company.

To illustrate, the App Economy Portfolio holds most of the companies from this basket, but they represent less than 25% of the portfolio.

2020 was a fantastic year for many Enterprise Software stocks. And they should continue to do well, even as we enter a world post-pandemic.

Mean regression is always lurking and extreme volatility should be expected for any small growth company. But I believe 2021 remains a great year to start or add to these positions with a multi-year horizon in mind.

While nothing is certain in the short term, particularly on an individual company basis, I am confident that this basket will do very well over a five-year time frame and beyond. And this sentiment is now bolstered by two first years of astounding performance.

I'll continue to review every year how these 10 companies originally under $10 billion are getting it done compared to the S&P 500.

This month, I picked a new very promising SaaS under $10B exclusively for App Economy Portfolio members. You can read my bullish thesis here.

Let me know in the comments!

If you are looking for a portfolio of actionable ideas like this one, please consider joining the App Economy Portfolio. Start your free trial today!

SNOWFALLS ARE NOW JUST A THING OF THE PAST:

Bill Gates Had a Plan to Stop Global Warming—Until Science Got in the Way.

The Harvard Project is called the Stratospheric Controlled Perturbation Experiment (SCoPex). To most of us, it sounds like a project that will severely tick off the stratosphere. And opponents of the project fear it will. They fear these projects will lead to attempts to engineer climate with artificial sunshade. The sunshade would essentially consist of blowing a bunch of dust into the stratosphere.

No one knows what this could do to life on earth because it is an insane proposition. We could end up living in a world that looks like the set of Dune. Or causing unknown changes to weather patterns. Dust is a well know respiratory irritant. What if it floats back down to earth?

Or we could freeze our tails off since we are in what is called a solar minimum, projected to last from now until 2053. The last time this happened, in the Middle Ages, we went through what is known as the Little Ice Age. But the geniuses in the climate cabal want to assure you that means nothing; we will still see global warming. Never mind that science can’t accurately predict the weather, and none of them were around in the Middle Ages. They just know, so shut up.

I’m so old, I can remember when this was President Obama’s “Science” “Czar’s” Dr. Strangelove-esque pet project:

Bill Gates, the computer nerd-turned-billionaire-turned left-wing activist wants to save humanity.

He wants to dim the sun.

That’s right, the founder of Microsoft apparently thinks that the sun is the Blue Screen of Death in the sky and is funding research at Harvard University into dimming the sun to cool the earth. The solar geoengineering project, called Stratospheric Controlled Perturbation Experiment (SCoPEx), will be flying a test balloon above Sweden next year as part of this research. The plan is to eventually release 2 kg of calcium carbonate dust into the atmosphere in a year or two to study how what impact it may have.

You read that correctly. They want to put chalk dust in the atmosphere. Are you old enough to have ever cleaned blackboard erasers for your teacher? That nasty cloud of chalk dust you inhaled during that process is what they want to put into the atmosphere.

What could possibly go wrong?

Who would have thought that the answer to “man-made climate change” would be more man-made climate change?

That said, environmentalists aren’t entirely on board. “There is no merit in this test except to enable the next step. You can’t test the trigger of a bomb and say ‘This can’t possibly do any harm’,” said Nicklas Hällström, director of the Swedish green think-tank WhatNext?

Of course, Hällström’s biggest issue with this concept is that he thinks that it will create the impression that we can still use fossil fuels.

There are several problems with this whole thing.

For starters, radical environmentalists can’t seem to decide whether man-made climate change is causing the earth to warm or cool. That’s why what was once referred to as “global warming” is now called by the more vague term “climate change.”

Second, even if you ascribe to the idea that climate change is man-made and not part of a natural cycle, even the most radical of predictions refer to its impact of fractions of a degree over many, many decades. Dimming the sun would likely have a more dramatic impact on global temperatures. It is widely believed that the reason why dinosaurs were wiped out was an asteroid impact that released particles into the atmosphere, blocking the sun and causing a dramatic drop in global temperatures. Is this really something we want to try ourselves?

Third, how would adding particles in the air contribute to the greenhouse effect? Do we really want to find out?

Obama, Biden Oval Office Meeting On January 5 Was Key To Entire Anti-Trump Operation

Information released in the Justice Department’s motion to dismiss the case it brought against Lt. Gen. Michael Flynn confirms the significance of a January 5, 2017, meeting at the Obama White House. It was at this meeting that Obama gave guidance to key officials who would be tasked with protecting his administration’s utilization of secretly funded Clinton campaign research, which alleged Trump was involved in a treasonous plot to collude with Russia, from being discovered or stopped by the incoming administration.

“President Obama said he wants to be sure that, as we engage with the incoming team, we are mindful to ascertain if there is any reason that we cannot share information fully as it relates to Russia,” National Security Advisor Susan Rice wrote in an unusual email to herself about the meeting that was also attended by Deputy Attorney General Sally Yates, FBI Director James Comey, and Vice President Joe Biden.

A clearer picture is emerging of the drastic steps that were taken to accomplish Obama’s goal in the following weeks and months. Shortly thereafter, high-level operatives began intensely leaking selective information supporting a supposed Russia-Trump conspiracy theory, the incoming National Security Advisor was ambushed, and the incoming Attorney General was forced to recuse himself from oversight of investigations of President Trump. At each major point in the operation, explosive media leaks were a key strategy in the operation to take down Trump.

Not only was information on Russia not fully shared with the incoming Trump team, as Obama directs, the leaks and ambushes made the transition chaotic, scared quality individuals away from working in the administration, made effective governance almost impossible, and materially damaged national security. When Comey was finally fired on May 9, in part for his duplicitousness regarding his handling of the Russia collusion theory, he orchestrated the launch of a Special Counsel probe that continued his efforts for another two years. That probe ended with Mueller finding no evidence of any American colluding with Russia to steal the 2016 election, much less Trump or anyone connected to him.

An analysis of the timeline from early 2017 shows a clear pattern of behavior from the federal officials running the collusion operation against the Trump campaign. It also shows how essential media leaks were to their strategy to sideline key law enforcement and intelligence officials and cripple the ability of the incoming Trump administration to run the country.

Here’s a timeline of the key moments and news articles of the efforts, per Obama’s direction, to prevent the Trump administration from learning about the FBI’s operation against it.

January 4: Following the closure of a pretextually dubious and politically motivated FBI investigation of Flynn at the beginning of January, the leadership of the FBI scrambled to reopen a case against Flynn, the man who in his role as National Security Advisor would have to review their Russia collusion investigation. FBI officials openly discussed their concern about briefing the veteran intelligence official on what they had done to the Trump campaign and transition team and what they were planning to do to the incoming Trump administration. Flynn had to be dealt with. The FBI’s top counterintelligence official would later memorialize discussions about the FBI’s attempts to “get [Flynn] fired.” No reopening was needed, they determined, when they discovered they had failed to close the previous investigation. They found this mistake “amazing” and “serendipitously good” and said “our utter incompetence actually helps us.” Even more noteworthy were texts from FBI’s #2 counterintelligence official Peter Strzok to FBI lawyer Lisa Page noting that the “7th floor,” a reference to Comey and his deputy director Andrew McCabe, was running the show.

January 5: Yates, Comey, CIA Director John Brennan, and Director of National Intelligence James Clapper briefed Obama on Russia-related matters in the Oval Office. Biden and Rice also attended. After the Obama briefing, the intelligence chiefs who would be leaving at the end of the term were dismissed and Yates and Comey, who would continue in the Trump administration, were asked to stay. Not only did Obama give his guidance about how to perpetuate the Russia collusion theory investigations, he also talked about Flynn’s conversations with Russian Ambassador Sergey Kislyak, according to both Comey and Yates. Interestingly, Clapper, Comey, and Yates all said that they did not brief Obama about these phone calls. Clapper testified he did not brief Obama on the calls, Yates learned about the calls from Obama himself during that meeting, and Comey also testified he didn’t brief Obama about the calls, even though the intelligence was an FBI product. Rice, who publicly lied but later admitted under oath to her widespread use of unmasked intelligence at the end of the Obama administration, likely briefed Obama on the calls and would have had access to the intelligence. Comey mentions the Logan Act at this meeting.

It was this meeting that Rice memorialized in a bizarre inauguration-day email to herself that claimed Obama told the gathered to do everything “by the book.” But Rice also noted in her email that the key point of discussion in that meeting was whether and how to withhold national security information, likely including details of the investigation into Trump himself, from the incoming Trump national security team.

January 6: An ostensibly similar briefing about Russian interference efforts during the 2016 campaign was given to President-elect Trump. After that briefing, Comey privately briefed Trump on the most salacious and absurd “pee tape” allegation in the Christopher Steele dossier, a document the FBI had already used to obtain a warrant to spy on Trump campaign affiliate Carter Page. Comey told Trump he was telling him because CNN was looking for any reason it could find to publish a story about Russia having compromising information on him, and he wanted to warn Trump about it. He did not mention the dossier was completely unverified or that it was the product of a secretly funded operation by the Clinton campaign and Democratic National Committee.

January 10: In an amazing coincidence, CNN found the excuse to publish the Russia claims after a high-level Obama intelligence operative leaked that Comey had briefed Trump about the dossier. This selective leak, which was credulously accepted by CNN reporters Evan Perez, Jim Sciutto, Jake Tapper and Carl Bernstein, may have been the most important step in the operation to harm the incoming Trump administration. The leak of the briefing of Trump was used to legitimize a ridiculous dossier full of allegations the FBI knew to be false that multiple news organizations had previously refused to report on for lack of substantiation, and created a cloud of suspicion over Trump’s campaign and administration by insinuating he was being blackmailed by Russia.

January 12: The next part of the strategy was the explosive leak to David Ignatius of the Washington Post to legitimize the use against Flynn of the Logan Act, a likely unconstitutional 1799 law prohibiting private individuals, not public incoming national security advisors, from discussing foreign policy with foreign governments. Ignatius accepted the leak from the Obama official. He wrote that Flynn had called Kislyak. “What did Flynn say, and did it undercut the U.S. sanctions? The Logan Act (though never enforced) bars U.S. citizens from correspondence intending to influence a foreign government about ‘disputes’ with the United States. Was its spirit violated?” Flynn’s routine and appropriate phone call became fodder for a developing grand conspiracy theory of Russia collusion. In discussions with investigators, both DOJ’s Mary McCord and Comey conspicuously cite this Ignatius column as somehow meaningful in the approach they would take with Flynn. “Nothing, to my mind, happens until the 13th of January, when David Ignatius publishes a column that contains a reference to communication Michael Flynn had with the Russians. That was on the 13th of January,” Comey said of the column that ran online on January 12. In fact, quite a bit had happened at the FBI prior to that leak, with much conversation about how to utilize the Logan Act against Flynn. And the leak-fueled Ignatius column would later be used by FBI officials to justify an illegal ambush interview of Flynn in the White House.

January 23: Another important criminal leak was given to Ellen Nakashima and Greg Miller of the Washington Post, also based on criminal leaks. Their article, headlined “FBI reviewed Flynn’s calls with Russian ambassador but found nothing illicit,” was intended to make Flynn feel safe and put him at ease about the FBI stance on those calls the day before they planned to ambush him in an interview. The article was used to publicize false information when it said, “Although Flynn’s contacts with Russian Ambassador Sergey Kislyak were listened to, Flynn himself is not the active target of an investigation, U.S. officials said.” In fact, emails prior to this date confirm Flynn was their prime target. This article was later cited by McCabe as the reason why they were justified in concealing from Flynn the real purpose of their interview. Flynn later asked McCabe if he knew how all the information about his phone calls had been made public and whether it had been leaked. Any potential response from McCabe to Flynn has been redacted from his own notes about the conversation.

January 24: Comey later admitted he broke every protocol to send agents to interview Flynn and try to catch him in a lie. FBI officials strategized how to keep Flynn from knowing he was a target of the investigation or asking for an attorney to represent him in the interview. The January 23 Washington Post article, which falsely stated that Flynn was not an FBI target, was key to that strategy. Though the interviewing agents said they could detect no “tells” indicating he lied, and he carefully phrased everything in the interview, he later was induced to plead guilty to lying in this interview. Ostensibly because White House officials downplayed the Kislyak phone calls, presumably in light of what Flynn had told them about the calls, Yates would go to the White House the next day and insinuate Flynn should probably be fired.

February 9: The strategy to get Flynn fired didn’t immediately work so another leak was deployed to Greg Miller, Adam Entous and Ellen Nakashima of the Washington Post. That article, headline “National security adviser Flynn discussed sanctions with Russian ambassador, despite denials, officials say,” was sourced to people who happened to share senior FBI leadership’s views on the Logan Act. This article was also based on criminal leaks of top secret information of phone call intercepts and laid out the FBI’s case for why Flynn’s contacts with a foreign adversary were a problem. The fact that such phone calls are routine, not to mention Flynn’s case that improved relations with Russia in a world where China, North Korea, and Iran were posing increasing threats, never made it into these articles for context.

February 13: The operation finally succeeded in getting Flynn fired and rendering him unable to review the operations against the Trump campaign, Trump transition team, and Trump administration.

March 1: Flynn was the first obstacle who had to be overcome. Attorney General Jeff Sessions was the next. The Trump loyalist with a strong Department of Justice background would also need to be briefed on the anti-Trump efforts unless he could be sidelined. Comey admitted that early in Sessions’ tenure, he deliberately hid Russia-related information from Sessions because, “it made little sense to report it to Attorney General Sessions, who we expected would likely recuse himself from involvement in Russia-related investigations.” To secure that recusal, yet another leak was deployed to the Washington Post’s Adam Entous, Ellen Nakashima and Greg Miller. The leak was intended to tar Sessions as a secret Russian agent and was dramatically spun as “Sessions Spoke Twice To Russian Envoy: Revelation contradicts his testimony at confirmation hearing.” One meeting was in passing and the other was in his function as a United States Senator, but the hysteria was such that the Post authors could get away with suggesting Sessions was too compromised to oversee the Department of Justice’s counterintelligence operations involving Russia. It is perhaps worth noting that the Special Counsel idea was pushed in this article.

March 2: Sessions recused himself from oversight of the FBI’s anti-Trump operation, providing no meaningful oversight to an operation that would be spun into a Special Counsel by mid-May. With the removal of Trump’s National Security Advisor and his Attorney General, there was no longer any chance of Trump loyalists discovering what Obama holdovers at the FBI were actually doing to get Trump thrown out of office. After Trump fired Comey for managerial incompetence on May 9, deceptively edited and misleading leaks to the New York Times ordered by Comey himself were used to gin up a Special Counsel run exclusively by left-wing anti-Trump partisans who continued the operation without any meaningful oversight for another two years.

This stunning operation was not just a typical battle between political foes, nor merely an example of media bias against political enemies. Instead, this entire operation was a deliberate and direct attack on the foundation of American governance. In light of the newly declassified documents released in recent days, it is clear that understanding what happened in that January 5 Oval Office meeting is essential to understanding the full scope and breadth of the corrupt operation against the Trump administration. It is long past time for lawmakers in Congress who are actually interested in oversight of the federal government and the media to demand answers about what really happened in that meeting from every single participant, including Obama and Biden.