10 Fantastic Stocks To Invest In The Post-COVID Digital Economy

More than six months into a global pandemic, our economy has shifted to digital at an accelerated pace.

There is an expectation that things will get back to "normal" eventually. But some of these changes are profound and here to stay.

To celebrate the second anniversary of the App Economy Portfolio, I'm giving readers a glimpse into some winners of the service that are cornerstones of their respective categories.

To do so, I'm covering 10 essential themes of the digital economy and select for each of them a stock worth adding to any long-term focused portfolio.

As we go through a very volatile time, I believe these 10 companies will beat the market comfortably in the decade ahead based on their track-record and secular grower nature.

Looking for a portfolio of ideas like this one? Members of App Economy Portfolio get exclusive access to our model portfolio. Get started today »

The COVID-19 global pandemic has propelled forward the rise of our digital economy. In the words of Satya Nadella, CEO of Microsoft (MSFT):

"We've seen two years' worth of digital transformation in two months. From remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security-we are working alongside customers every day to help them adapt and stay open for business in a world of remote everything."

Investing in the digital economy went from being a "nice to have" strategy for a well-balanced investment portfolio, to a "need to have" for anyone who wants to be exposed to the most promising and fastest-growing businesses of our time.

This week marks the second anniversary of the launch of my marketplace service the App Economy Portfolio. To celebrate the 2-year mark of the service, I wanted to take a step back and share with readers a special list of stocks that perfectly encapsulate the rise of the app economy across 10 big themes of the digital transformation the world is currently undergoing. For each theme, I selected a best-of-breed company that should do wonders for investors with a five-to-ten year time horizon.

The way I invest follows substantially several of Warren Buffett's tenets:

- Focus on the business, not the market, the economy, or investor sentiment.

- Look for a consistent operating history.

- Ascertain whether the business has favorable long-term prospects.

- Make sure that management is rational, honest and strategic.

- Focus on companies that have high return on equity and high margins.

- Accumulate shares at a price that can be justified by future earnings.

- Buy with the intention to hold for no less than 10 years.

- Don't sell unless you have a very compelling reason to.

The App Economy Portfolio goes beyond offering a thematic portfolio. An idea only has value when combined with proper implementation. My goal has been to offer an all-in-one service that combines all the key aspects of a successful investment strategy:

- Stock ideas with detailed business analysis every 1st of the month.

- Best timely buys every 15th of the month.

- Live trade alerts showing in real time where I invest my own money.

- Full real-money portfolio shared in real time with allocations and KPIs.

- Best practices on asset allocation: geography, sector, size.

- Tips on portfolio management and building positions.

Why should you care? The App Economy Portfolio has a 34% internal rate of return annually since I started tracking it at the end of 2014 (returns as of end of August 2020). That compares with 10% annualized return for the S&P 500 over the same period. These are real returns, not a back-tested strategy. The portfolio has 64 positions, but is fairly concentrated with the top 10 holdings representing half of the portfolio allocation. In 2020 alone, the portfolio has returned almost 50% to date.

To get there, I have applied a top-down approach, selecting the most important digital trends of the beginning of the 21st century. I applied this strategy in conjunction with a bottom-up selection focused on the best-of-breed businesses that appear to benefit the most from these trends.

So what are some of the big themes in the portfolio that have been reinforced through the global pandemic? And what are the stocks that encapsulate these trends?

Let's dig in!

1) Etsy and the rise of e-commerce

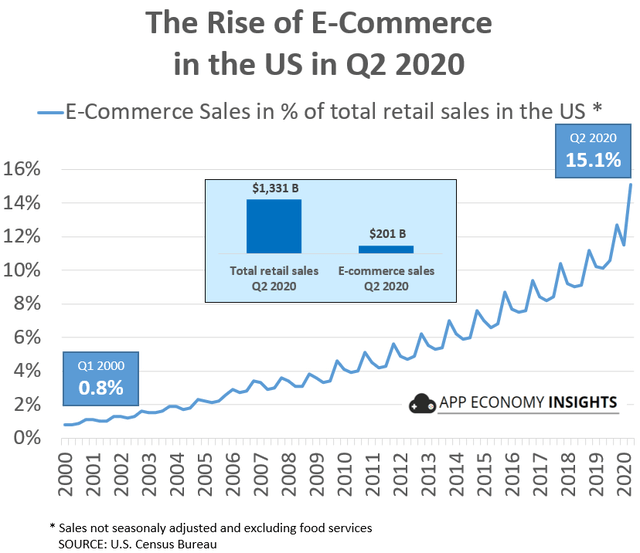

If you've paid attention to the early impact of COVID-19 on retail sales, chances are you have seen one version or another of the graph below.

With US e-commerce penetration reaching a record 15.1% in Q2 2020, I believe two things should remain with you:

- COVID-19 has dramatically accelerated e-commerce adoption.

- The penetration remains very low at 15% and still has a long way to go.

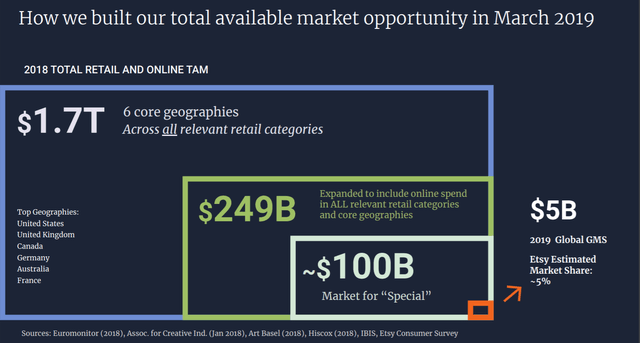

In this context, I believe one of the very best companies particularly well-positioned to benefit from this ongoing trend is Etsy (ETSY). This two-sided marketplace is only capturing about 5% of the market for "special" items online. Not only can the company grow its share of the pie over time, the total addressable market is likely to continue to expand along with e-commerce penetration in % of retail sales.

If we look at Etsy's KPIs in the aftermath of the global pandemic, the growth numbers are ridiculously high, with revenue rising +137% Y/Y to $429 million. And it came with a very comfortable adjusted EBITDA margin at 35%.

Many observers will point out that these numbers were a result of a strong demand for masks when they were hard to find elsewhere. Masks were merely 13% of the Gross Merchandise Sales on the platform, so there is a lot more to the story than a rush for homemade masks.

ETSY more than doubled since I published my original bullish thesis at the end of last year. The company has a proven track record of growing its marketplace with consistency over the years, both on the buyers' and the sellers' side. With 60 million active buyers and 3 million active sellers in Q2 2020, the company is benefiting from a strong network effect that could reinforce its leadership position for many years.

2) Huya and the rise of e-sports

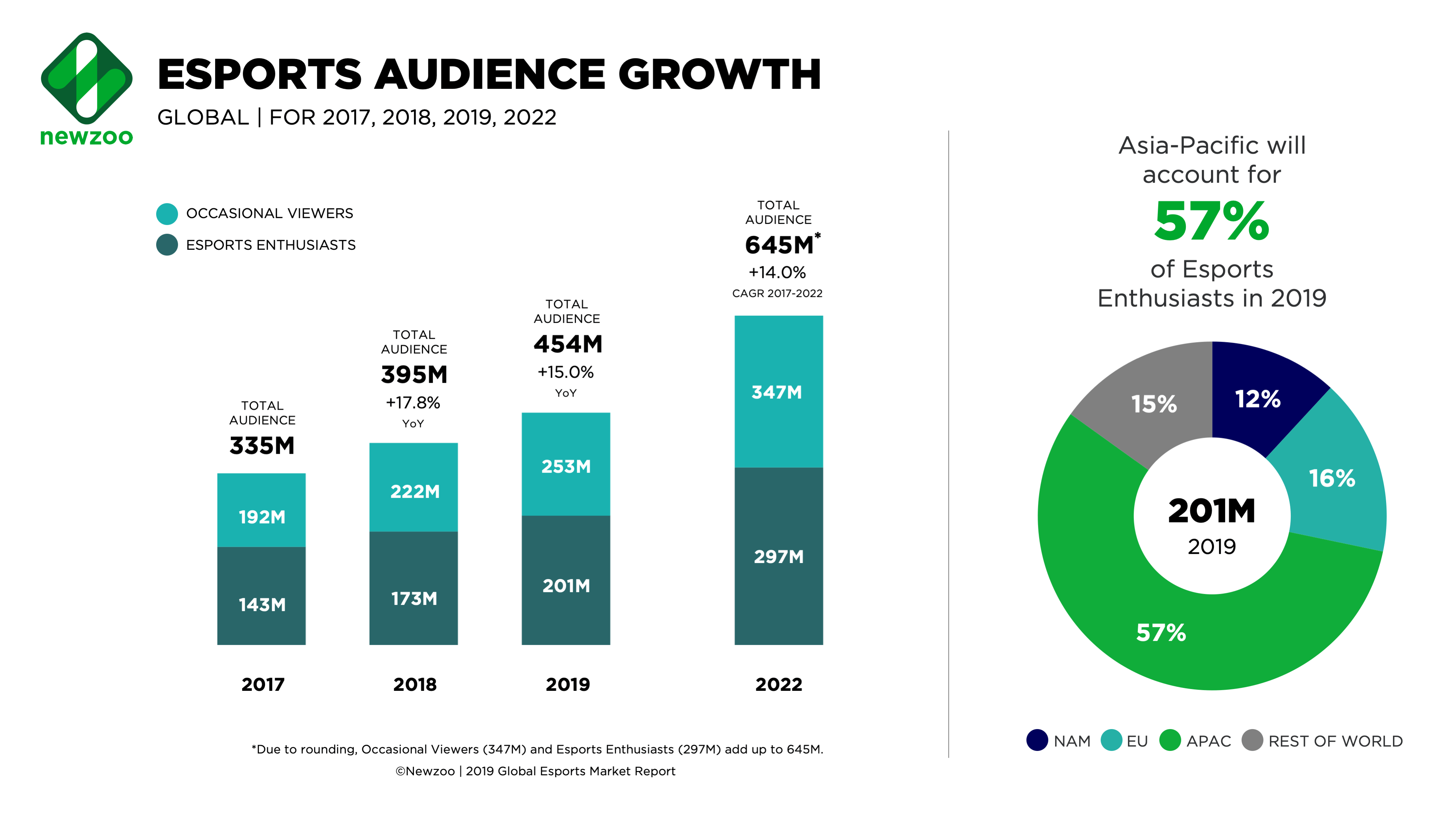

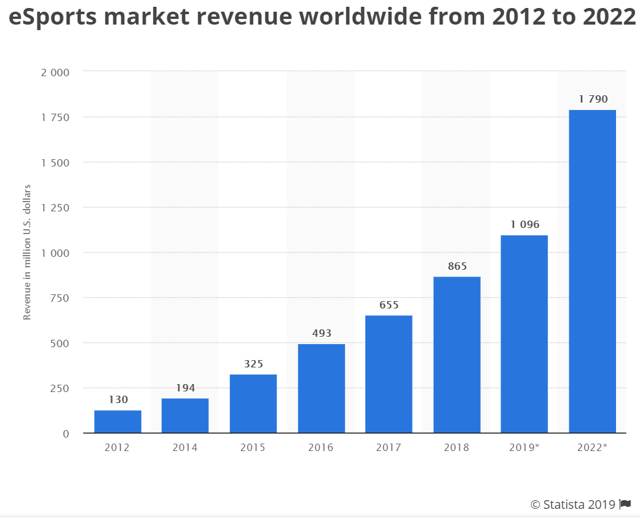

E-sports are still a nascent industry and the upside potential is outstanding for first movers in this category. Worldwide revenue from the sector (sponsorship, media rights, advertising, ticketing) is expected to grow at an 18% CAGR in the next three years.

More specifically, Asia-Pacific is the leading region for the category with 57% of the world's e-sports enthusiasts in 2019 according to Newzoo. Overall, 72% of the worldwide e-sports audience is outside the US and Europe. E-sports are even perceived positively by the Chinese government, despite its tendency to heavily regulate games.

With all this in mind, you could do a lot worse than investing in the clear leader in this category in Asia. Enter Huya (HUYA), one of the largest live streaming platforms in China focused on gaming content. The company is backed by the largest gaming company in the world, Tencent (OTCPK:TCEHY) and may soon merge with its sister company DouYu (DOYU), its closest competitor in Asia. Not only is Huya the clear leader in video game streaming content in emerging countries, the company is also building a moat around organizing its own e-sports events to own the entire value chain of content. The company owns several e-sports teams and has a wide range of exclusive deals with teams or specific e-sports competitions that are broadcasted exclusively on its platform.

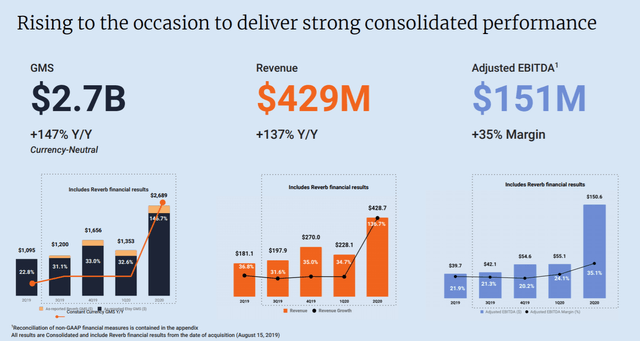

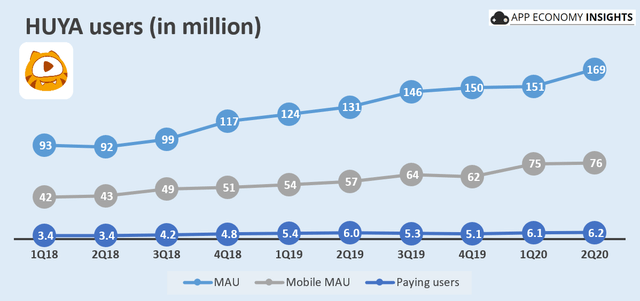

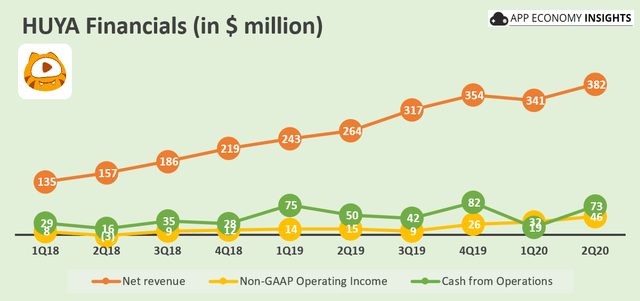

Huya recently reached 169 million monthly average users, with more than six million paying users among them. The steady and consistent growth of the community ever since the company went public in 2018 has been remarkable.

Source: Company earnings

The company saw a slight slow-down in the first quarter of the year induced by the pandemic hitting China hard at the time, but has already rebounded nicely in Q2. The company is growing its top line at a fast clip, reaching $382 million in revenue in the most recent quarter.

Huya is already profitable, generating healthy cash flow, and has a pristine balance sheet. You'd be hard-pressed to find a more compelling investment in this category. You can find more details about Huya in my previous bullish thesis.

Source: Company earnings

3) Match Group and the rise of online dating

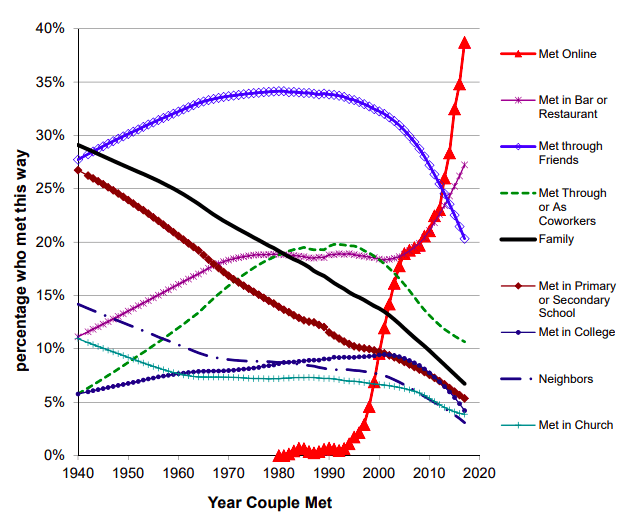

If you still believe online dating is a fad and not a serious business, I'm afraid you're going to be on the wrong side of history. People meet online more than ever, and this trend is not slowing down anytime soon. Here is the only chart you need to see to understand how couples meet:

After separating from IAC (IAC) earlier this year, Match Group (MTCH) has continued to impress throughout the summer by showing the resilience of its dating platforms even through a global pandemic.

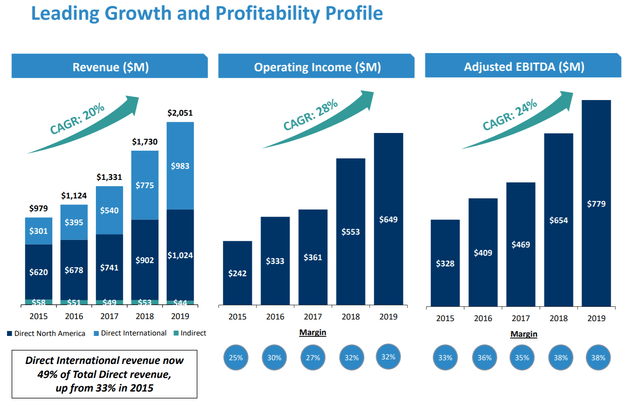

The world leader in online dating has been a Wall Street darling since its 2015 IPO. And for good reasons. In the past five years, revenue grew at 20% CAGR and operating income grew at 28% CAGR.

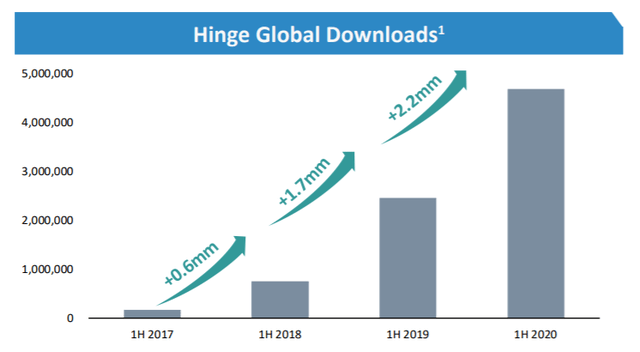

The company has been extremely successful in growing Tinder into a global category leader. But Match Group has many more platforms currently gaining traction and growing at a fast clip such as Hinge, Pairs, BLK and Chispa. Management has an outstanding track record of growing successful apps, whether they're developed internally or opportunistically acquired.

Match Group is a category leader by leaps and bounds, and has proven that even Facebook (FB) and its dating initiative could not really impede its growth trajectory. Overall, I would break down the company's tailwinds into five key themes:

- An expanding and under-penetrated total addressable market (the stigma is still strong, and some emerging countries are catching up).

- ARPU (Average Revenue Per User) growth untapped (advertising revenue is almost non-existent and the company has barely touched the surface of how it can charge premium features).

- Consistent track-record of successful platform expansion over time.

- A business that is scalable, highly profitable and sustainable by generating impressive cash flows.

- An impressive board of directors with years of experience in viral marketing and digital adoption.

I have pounded the table about MTCH for years now and it remains one of the top performers of the App Economy Portfolio to date.

4) MongoDB and the rise of big data

For decades, relational databases, also called SQL for "structured query language" have been the status quo. SQL was first introduced as a commercial database system in 1979 by Oracle (ORCL).

While the world's data is changing, with more granularity and complexity than ever before, so does the need for efficient and flexible databases.

Eliot Horowitz, co-founder and CTO of MongoDB (MDB), explained:

A relational database is fundamentally Microsoft Excel on steroids. Both are made of rows and columns organized into tables or sheets.

Since its first release in 2009, MongoDB has offered a new approach to database design, freeing developers from the constraints of legacy SQL databases. Faster, more flexible and easier to scale.

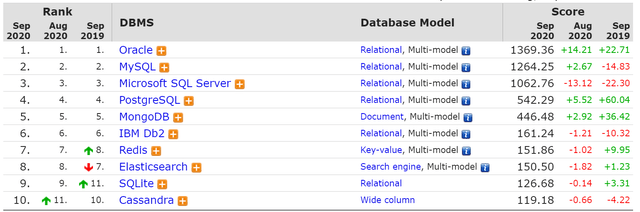

MongoDB has become extremely popular with developers. Don't take it from me, but from the reputable DB-engines ranking, showing MDB as the most popular database that is not relying on the relational model.

Another important aspect of MongoDB's business is that it is open source. A recent interview of Chetan Puttagunta and Jeremiah Lowin by Patrick O'shaughnessy can give you a sense of why the open source approach is an important factor in MDB's success with developers.

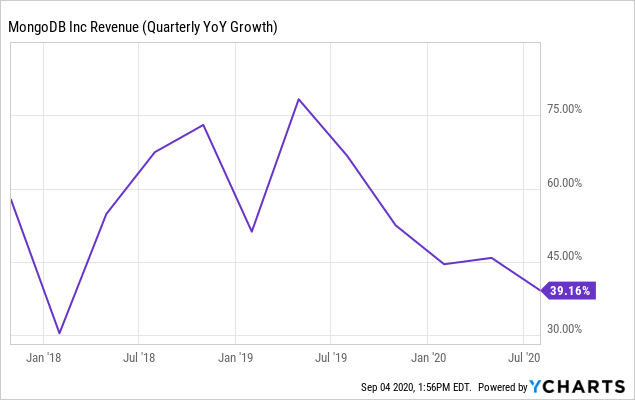

MongoDB is walking to the beat of its own drum, and that's something very exciting to watch when you invest for the long haul. Since going public, MDB has yet to show a revenue growth below +30% Y/Y.

Data by YCharts

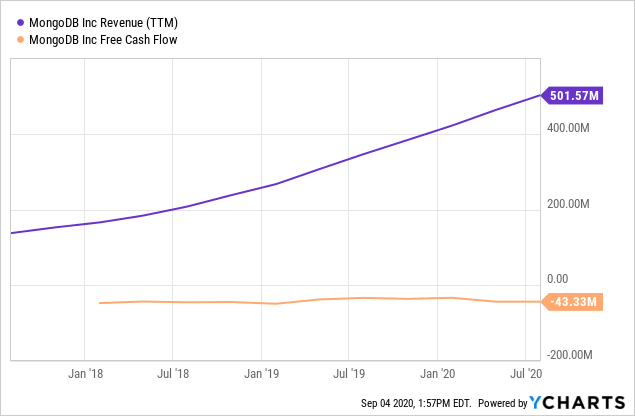

Data by YChartsThe company has yet to turn a profit. But with $1 billion on its balance sheet, the company has plenty of time to scale and improve its margins.

Data by YCharts

Data by YChartsMongoDB CEO Dev Ittycheria is highly praised by his own employees with an approval rating of 98% on Glassdoor. If you want to get a feel of his personality, you can find below an interview he gave on CNBC.

5) Pinterest and the rise of social commerce

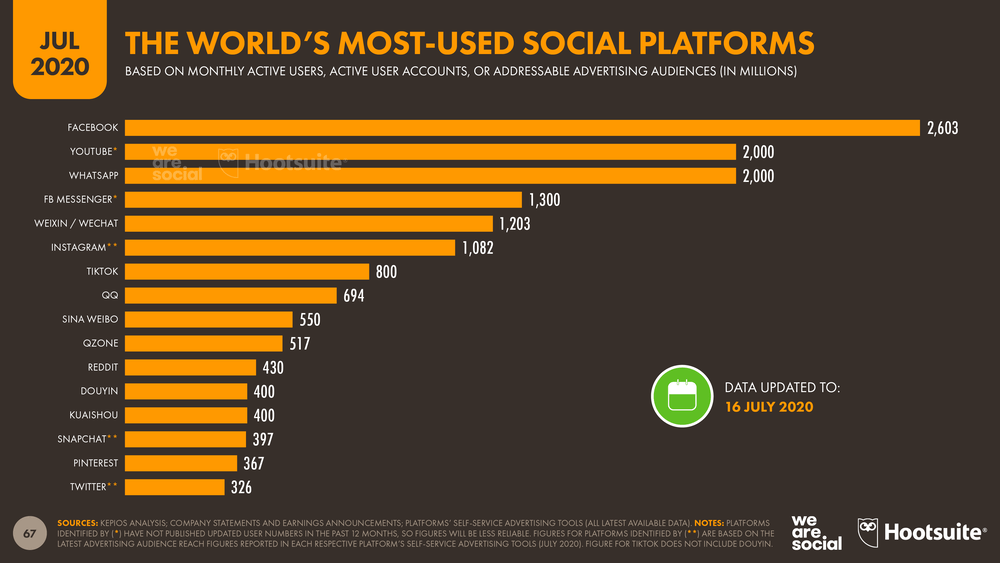

In the ocean of social platforms, Pinterest (PINS) has been an island of positivity. Forget about Twitter (TWTR) or Facebook (FB). On Pinterest, the community is inclusive and focused on hobbies and passion.

Many investors are surprised when they learn that Pinterest has more monthly users than a platform like Twitter.

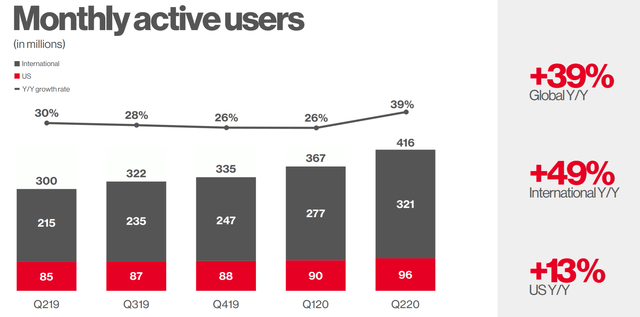

MAU (Monthly Average Users) has improved by +26% or more year over year in the past five quarters. The company saw an uptick in engagement recently with the pandemic, reaching an impressive 416 million MAU.

With the challenged advertising landscape in April, Pinterest has yet to see this growth of the community translate into a strong revenue growth. But I believe it's only a matter of time. The untapped potential is phenomenal when you consider the very low average revenue per user at this point in time. Source

Source

An important aspect of the bullish thesis is how well-positioned Pinterest is to capture a share of the rise of social commerce. In May, Pinterest announced a partnership with Shopify (SHOP) to give merchants "a quick way to upload catalogs to Pinterest and turn their products into shoppable Product Pins, in just a few clicks."

The Pinterest app on Shopify includes a suite of shopping features like tag installation, catalog ingestion, automatic daily updating of products, and an ads buying interface. For Shopify merchants, this means easy set up and access to distribution across Pinterest with or without ads, as well as reporting and results tracking to maximize reach. The app automatically creates a connection between the individual store and Pinterest, so the merchant doesn't need to edit code or add development resources, making it seamless for businesses of all sizes.

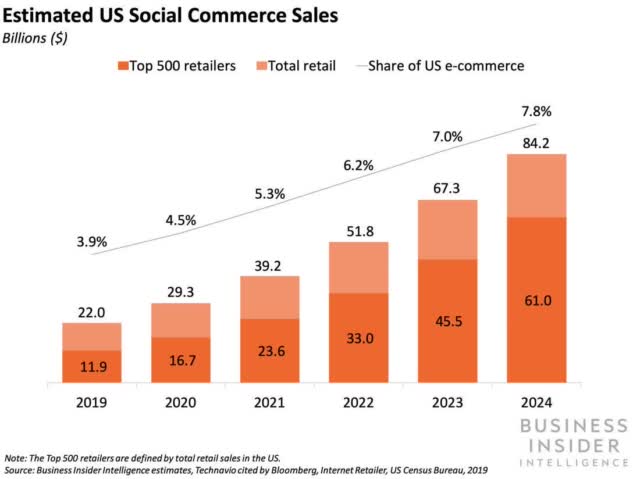

According to Business Insider Intelligence estimates, US social commerce sales could almost quadruple from 2019 to 2024. This is another major component of my bullish thesis as social platforms become a conduit to influence and prompt e-commerce purchases of all sorts.

Facebook introduced Facebook Shops in May and it's easy to see how most social platforms will eventually expand their commerce implementation. Pinterest doesn't have to beat Facebook at this game. Given how fast the market is expanding, many companies will benefit and succeed in this space. I believe Pinterest is extremely well-positioned to drive social commerce sales beyond the clear leaders Facebook (FB) and Instagram.

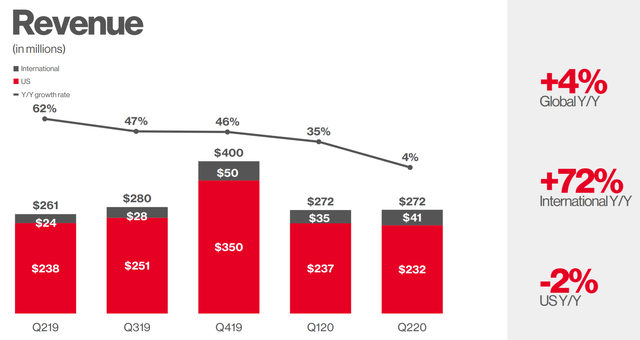

6) Roku and the shift to streaming

Cable and satellite TV companies are slowly dying due to subscriber losses, with most consumers shifting to streaming services.

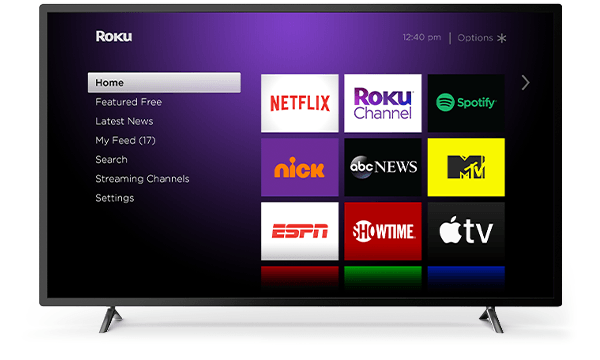

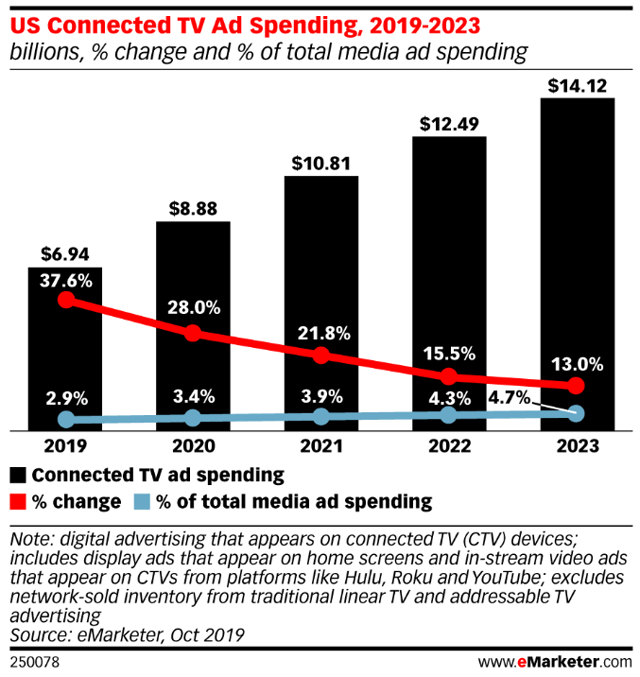

Roku (ROKU) is emerging as the clear leading service-agnostic platform offering an all-in-one place to select and enjoy TV content. As a result, the company is poised to drive publishers' interest and ARPU higher via its CTV (Connected TV) ads.

CTV ads offer the best of two worlds:

- The targeting of programmatic ads you usually see on mobile or desktop, optimized and cost-efficient.

- The engagement of TV ads, capturing the viewer attention with high-quality setup and high completion rate.

Programmatic advertising alone is projected to grow at a 22% CAGR. Even by simply growing with the market, Roku is already positioned to grow at a very rapid pace.

It's reasonable to expect that linear TV advertising spend will continue to shift to CTV, reflecting growing investments in ad-supported streaming services as they attempt to compensate for the cord-cutting trend.

Total ad spend in CTV is forecasted to exceed $10 billion by 2021 according to eMarketer.

Roku is perfectly positioned to benefit from multiple tailwinds:

- Rise of digital marketing

- Rise of connected TV ad inventory

- Rise of programmatic ads with publishers and brands looking for measurability and optimization they have become familiar with on desktop and mobile platforms.

- Secular shift from linear TV to OTT streaming service

Roku was the top CTV platform in the US last year with 85 million users, according to emarketer. They estimate that Roku users will make up 33% of US internet users and 47% of CTV users in 2020.

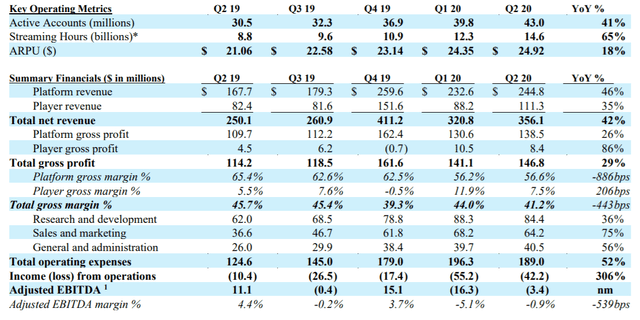

Beyond its existing leading position, I believe the most exciting part of Roku's bullish thesis is that the company is delivering strong KPIs on all three pillars of its growth:

- User growth via partnerships with TV makers, hardware sales.

- Engagement growth with users spending more time watching content.

- ARPU growth with revenue per user/hour improving over time.

While the company has yet to show strong economies of scale, its most recent quarter was encouraging with adjusted EBITDA being mostly breakeven.

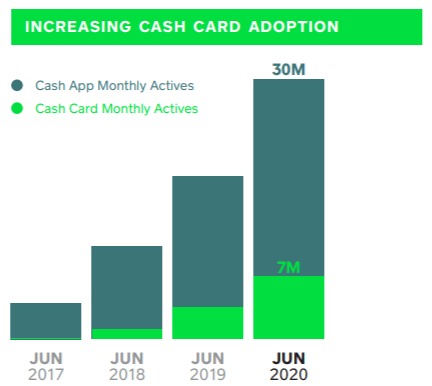

7) Square and the rise of digital wallets

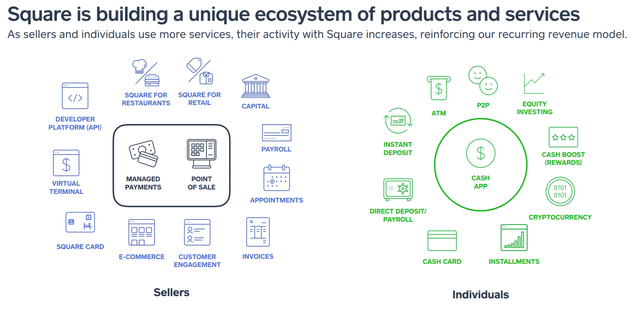

When it comes to Square (SQ), many investors are narrowly focused on its POS (point-of-sale) system for small brick-and-mortar merchants. "Sidecar payments" were the primary source of gross profit for the company back in 2016. But the fastest-growing segment in Square's gross profit is one that targets an entirely different ecosystem: individuals. The product behind this growth is a platform called Cash App.

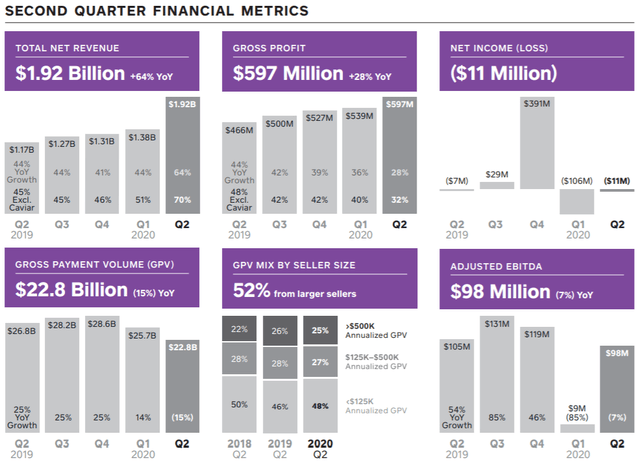

Back in April, I wrote an article breaking down why Cash App could drive Square's valuation much higher. SQ has more than doubled since then. As expected, in the most recent quarter, Cash App grew +140% Y/Y and now represents 47% of Square's gross profit.

Naysayers often compare Square to American banks to suggest that the company is overvalued. I believe they couldn't be further from the truth and it shows a complete misunderstanding of Square's competitive advantage.

Square can use its POS on the seller side and Cash App on the consumer side to funnel merchants and users into other products of its ecosystem. This is a powerful flywheel model. Square is so much more than a bank. From e-commerce to payment solutions to equity and cryptocurrency investing, what remains the most exciting feature of the company is its optionality. Is Square going to grow into an e-commerce giant? Will Cash App become the preferred platform to trade and exchange cryptocurrencies? The future looks bright.

All KPIs could expand even more over time with new use cases on Square's platforms. Given how engaged existing users are, it's easy to see how future features could find success and further expand conversion and ARPU.

8) Teladoc and the shift to telehealth and virtual care:

Teladoc Health (TDOC) is a first mover in telemedicine and is positioned to continue to do so for years to come.

The numbers are staggering if we look at the most recent quarter:

- 52 million paid members.

- 2.8 million virtual doctor visits just in Q2 2020.

- 55,000 physicians in all 50 states.

- 450 medical subspecialties (everyday care, children & family, mental health, diagnostic of experts, wellness).

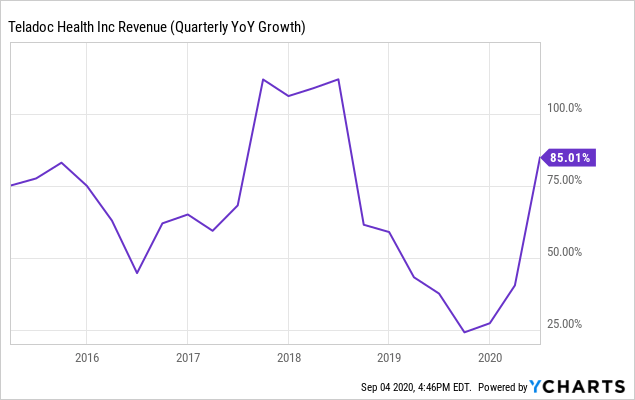

- 85% revenue growth Y/Y.

The simplicity and convenience of telehealth was already undeniable before COVID-19. But the global pandemic has placed it front and center. For a few weeks, almost all visits that could be done virtually were done this way, which has been a boon for Teladoc's business.

Just like working from home has become the norm overnight for most corporations, telemedicine has experienced a forced mainstream adoption that should push the industry forward by a few years and radically change the public's perception. It's not hard to imagine a not-so-distant future where the default is to have an online appointment before you consider seeing a doctor physically.

As a true disruptor should, Teladoc has experienced tremendous revenue growth since going public in 2015.

Data by YCharts

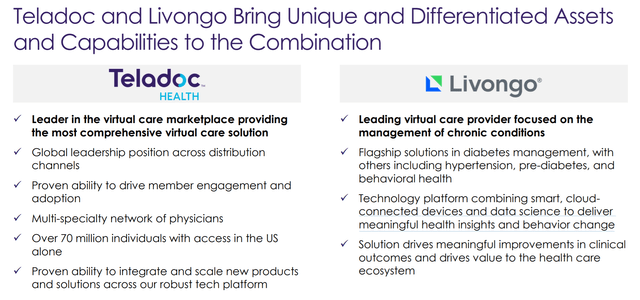

Data by YChartsAs if the existing secular trend boosted by COVID-19 weren't enough, another major announcement occurred in 2020: A merger with Livongo Health (LVGO).

With the transaction valuing Livongo at approximately $18.5 billion at the time, this blockbuster merger is setting a new standard for the delivery, access and experience of healthcare.

The rationale behind the merger is simple. The two companies offer technology platforms that are complementary in the way they offer virtual care. One is focused on visits and distribution and the other on smart devices and data science to deliver meaningful health insights and behavior change.

Teladoc and Livongo were worth a combined $8.5 billion market cap at the start of 2020. It can sound daunting to realize that number is about $28.5 billion as of this writing. But as investors, we ought to look forward, not backward.

Have we reached the peak of telemedicine? Probably not. Is virtual care only in its infancy? Most likely. Teladoc and Livongo, by joining their distribution network and data, are a lot more valuable than the sum of their parts. The synergies and possibilities for this new virtual care giant are very exciting and make TDOC an obvious pick of the digital economy.

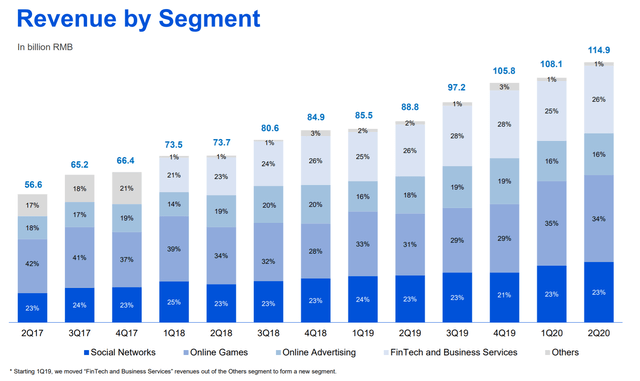

9) Tencent and everything gaming

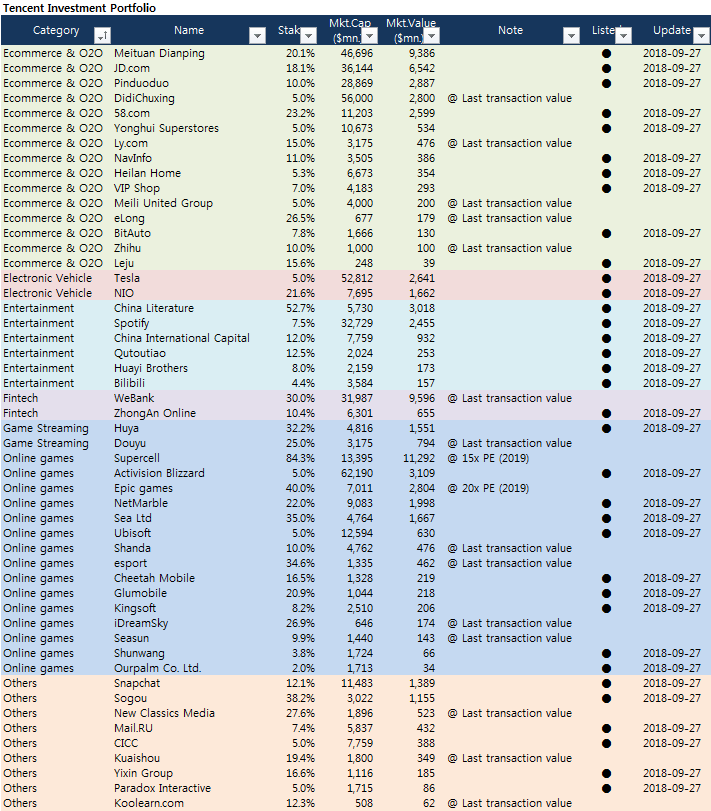

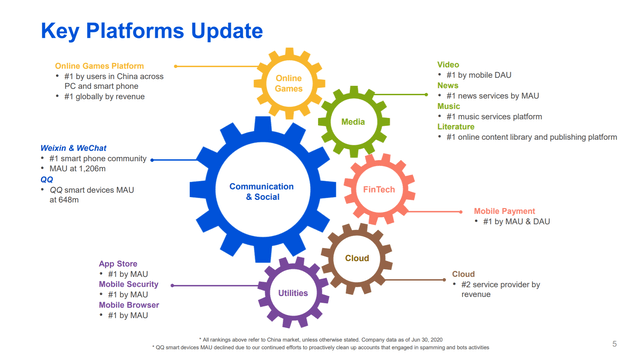

Tencent is a gigantic Chinese conglomerate of almost $700 billion market cap. The company is behind WeChat (Weixin in China), the largest community on smartphone in the country with 1.2 billion monthly average users. Tencent is also one of the world's most successful investment funds with stakes in many innovative companies around the world.

Tencent's ecosystems are inter-connected, with its social platforms serving as a gateway to its games, entertainment segment, payments, cloud services and more.

A third of Tencent's revenue is coming from gaming. Online games are also the fastest-growing segment of the company, rising +40% Y/Y in the most recent quarter.

Tencent is the biggest video game publisher in the world today thanks to its large, autonomous studios that have experience in developing and operating category-leading games. Tencent has a portfolio of game studios with a proven track record in creating popular games and successful live operations. The studios under Tencent's umbrella have a high degree of creative autonomy while leveraging Tencent's publishing resources.

The list below (updated in 2019) shows the list of companies in Tencent's investment portfolio. With e-commerce, EVs, entertainment, fintech, online games and more, Tencent has its fingers in all aspects of the digital economy and beyond. You are probably familiar with many names on this list, and they tend to have done extremely well over time. The biggest positions include public companies like Meituan Dianping (OTCPK:MPNGF), JD.com (JD), Pinduoduo (PDD), Activision Blizzard (ATVI), Tesla (TSLA), Huya, DouYu, Snapchat (SNAP), Spotify (SPOT). The company also owns a 40% stake in Epic games, the company behind Fortnite and the Unreal Engine.

In many ways, owning Tencent is like owning an ETF exposed primarily to the Chinese digital economy, with a third of its allocation to gaming.

You could do a lot worse than investing in the leader in social media and online games in the biggest gaming market in the world. And if we have learned anything in the past five years, big can always get bigger if you look at big tech in the US.

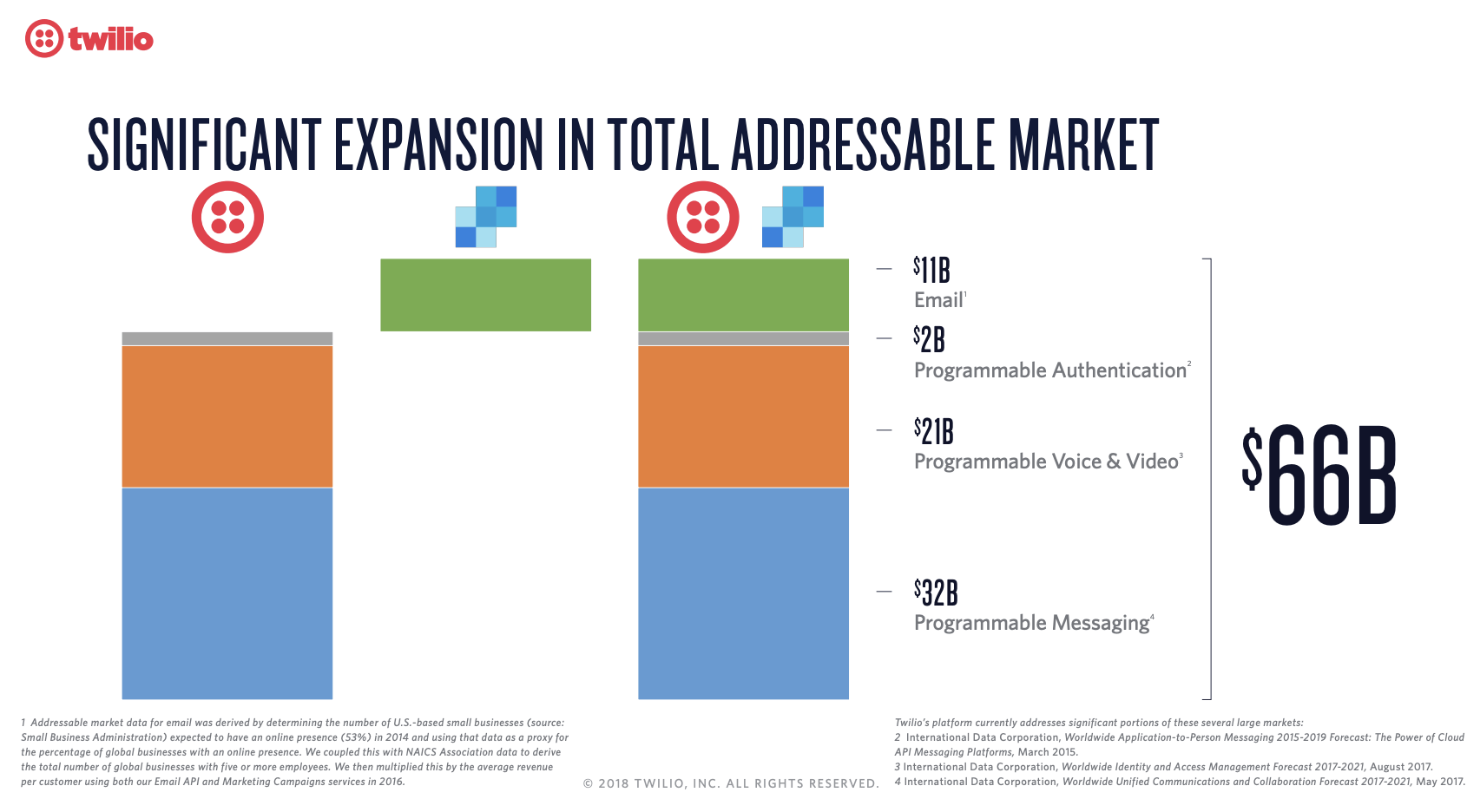

10) Twilio and the role of artificial intelligence

Twilio's (NYSE:TWLO) mission is to "fuel the future of communications."

Most apps on your phone are using Twilio to communicate with you. Lyft (LYFT), Airbnb (AIRB), Reddit, Twitch, Hulu, you name it. Many Enterprise Software solutions are also Twilio's customers. Shopify, MongoDB, HubSpot, Salesforce (CRM) among others.

Twilio provides a communications platform for businesses to interact with their customers. It allows developers to add voice, video, and messaging to their apps without having to build a real-time communications stack.

Twilio has been hailed as the next AWS by analysts like Patrick Walravens from JMP Securities. He explains:

AWS started with three very commoditized products - compute, storage and bandwidth - but then they built layer upon layer on top of that. Twilio in a very similar way begins with a couple of equally commoditized products, which is voice and messaging, and built a set of more sophisticated tools, and on top of more sophisticated tools they've built what is effectively applications."

The implication here is that it wouldn't be shocking to see Twilio continue to build new tools on its software infrastructure that serve new use cases. As a result, the company could keep expanding its revenue potential in the process.

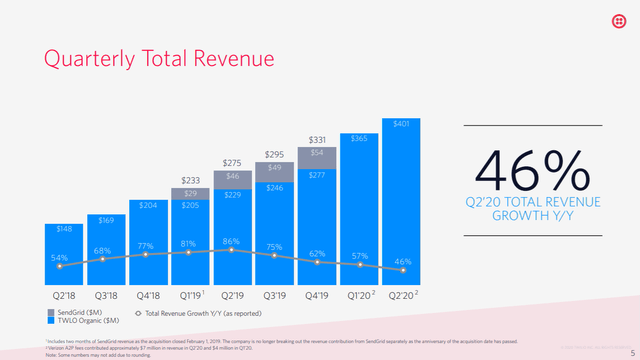

If you like strong and consistent revenue growth over time, there's a lot to like with Twilio. The company has crossed $400 million in the most recent quarter, still growing +46% Y/Y.

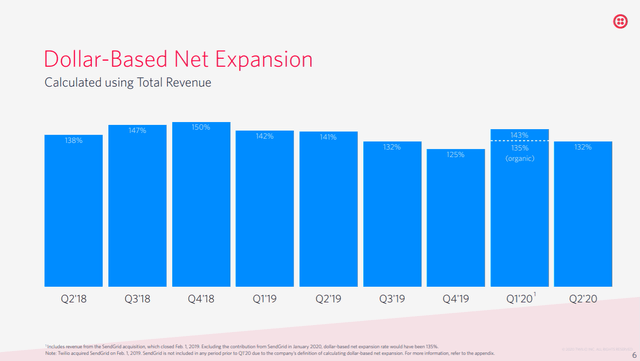

Twilio has one of the most impressive Dollar-Based Net Expansion on the public markets, illustrating the company's capacity to upsell and cross-sell its customers over time as they expand their use of the tools.

Twilio is still only a $35 billion company. If the company truly is the next AWS for cloud communication, there is still plenty of room for the business to become much larger in the next decade.

Wrapping it up

Having a clear top-down view of the digital trends that are shaping our society can be a wonderful tool to shape your portfolio allocation.

But to be executed properly, I believe it has to be done in conjunction with a surgical bottom-up selection that focuses on the best-of-breed businesses that are leading these trends.

But wait, what about the upcoming market crash, you ask? Both the S&P 500 (SPY) and the Nasdaq (QQQ) have already returned close to their all-time-highs. You may have noticed that many analysts and market observers will point out that a market crash is looming. This is not a reason not to invest in the best companies of our time. A significant market sell-off is always potentially around the corner. But if you have a long-term horizon, it shouldn't prevent you from investing. As an example, it took only three years after the Great Recession in 2008 (the market fell by 50%) for stocks to be back at their all-time high. As explained by legendary investor Peter Lynch:

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

I have written extensively about the importance of staying in the market rather than trying to time it. This is covered in my posts about The Art Of Not Selling and the 5 Ways To Prepare For The Next Market Crash.

Even in the middle of what many would consider irrational exuberance in the technology sector, I believe all these businesses should have a spot in your portfolio. More importantly, these companies should comfortably beat the S&P 500 in the next decade given how well they are positioned to benefit from the secular tailwinds generated by COVID-19 and the subsequent fundamental societal changes that come with it.

- Are you invested in the 10 categories defined above?

- If so, what companies would you add to the ones I've already selected?

Let me know in the comment!

If you are looking for a portfolio of actionable ideas like this one, please consider joining the App Economy Portfolio. Start your free trial today!

The rise of the App Economy is disrupting many industries: retail, entertainment, financials, media, social platforms, healthcare, enterprise software and more.

Disclosure: I am/we are long CRM ETSY FB HUBS HUYA JD MDB MTCH PINS ROKU SHOP SQ TCEHY TDOC TWLO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This professional hacker is absolutely reliable and I strongly recommend him for any type of hack you require. I know this because I have hired him severally for various hacks and he has never disappointed me nor any of my friends who have hired him too, he can help you with any of the following hacks:

ReplyDelete-Phone hacks (remotely)

-Credit repair

-Bitcoin recovery (any cryptocurrency)

-Make money from home (USA only)

-Social media hacks

-Website hacks

-Erase criminal records (USA & Canada only)

-Grade change

-funds recovery

Email: onlineghosthacker247@ gmail .com