Small Investors Uprising (E Times)Whose Stock Is It Anyway? |

Toby Howell

Over the past week, the business world’s attention has been hijacked wholesale by an army of amateur traders looking to make fools of the traditional finance industry. Yesterday brought more absurdity:

The run-up in GameStop was so dramatic that short-seller Citron Research, which bet on the stock to drop, was forced to close out most of its position “at a loss of 100%,” according to managing partner Andrew Left. Let’s get deepThere’s a general feeling that the GameStop saga speaks to something larger about the nature of financial markets, and even our culture. To try to make sense of it all, we’ve distilled some of the most popular theories that...try to make sense of it all. 1. The “stick it to the man” theory: This theory suggests that these traders are motivated primarily by their disdain for “suits,” the longtime wardens of Wall Street, who, Redditors argue, exploited the little guy to get filthy rich.

2. The “everyone’s super bored” theory: Without much else to do during the pandemic, people have turned to the stock market as a form of entertainment...and to make a lot of money. Last summer, individual investors accounted for roughly 20% of stock market activity on average, up from 10% in 2019. 3. The “Robinhood” theory: The rise of the amateur investor can be traced back to Robinhood, the app that pioneered no-fee trading and empowered individuals to influence the stock market like never before. 4. The “memeification of society” theory: Some observers have linked the behavior of Reddit’s trading army to other online communities like 4chan that engage in “astroturfing” campaigns. “If you can create enough hype around something, through memes, conspiracy theories, and harassment campaigns, you can manifest it into reality via capital,” Ryan Broderick writes. Looking ahead...the community behind these frenzied trades ran into some trouble last night. Discord banned the r/WallStreetBets server for violating its policies on hate speech, and moderators of the Reddit forum briefly made it private. _____________________________________________________________ The Next GameStop: Highly Shorted Stocks That Are Popping - Or On The Verge Of CrashingSteven Cress 960 Followers Summary

Analysis

As the Head of Quantitative Strategy at Seeking Alpha, I am immersed in data. In fact, data analysis and the interpretation of data have taken center stage in my career. The interpretation of data is the process of making sense of statistics that have been collected, analyzed, and scored. This skill set has served as a solid foundation for me to identify trends and make transparent predictions in the course of money management. It has also allowed me to develop user-friendly web-based tools that furnish individuals with the indicators and signals required to instantly interpret the strength or weakness of a stock. Importantly, one of the signals we do measure is short term interest as a factor (investment metric). This financial factor, notorious for being a very poor metric for forecasting stock price predictability, had a great 2020 and a better January 2021 as a leading investment metric linked to positive stock price performance. On this note, all one can really say is wow! In over 30 years of researching stocks, I have never seen this level of enthusiasm in short-interest data points. Notably, it is not unprecedented to find euphoria over a single factor (investment metric). Sometimes single factors work great - until they don’t. The "don't" is one of the reasons we use a multi-faceted and multi-factor approach to our quantitative algorithms. Years of experience managing money for a hedge fund and a proprietary trading desk have taught me that putting all your eggs into a single investment theme is very dangerous over a long period. We do not want to get pigeonholed when the irrational exuberance of investors for the factor-of-the-month turns into fervor for another factor. When the investment cycle on a factor turns, investors can take a beating. Instead of focusing on a single metric, like percentage of short interest, we blend together investment metrics based on value, growth, profitability, earnings, and momentum. This balanced approach has worked very well over the long term, as seen on the graph below. Seeking Alpha Very Bullish recommendations are up YTD 11.94% compared with the S&P 500 - up 2.73% Source: S&P CapIQ and Seeking Alpha (1/26/21) The blended approach employing a multitude of investment characteristics alleviates a lot of the risk carried when one uses a single factor. In a nutshell, you are not putting all of your eggs in one basket. Inherently, betting your capital on a single factor, such as percentage of short interest, carries significant risk. Especially when investors are whipped up to a frenzy. Seeking Alpha’s Quant Ratings and Factor GradesSeeking Alpha’s Quant Ratings Factor Grades provide investors with an instant characterization of each stock. This makes it easy to find or rule out stocks based on your investment criteria. Below is an example of how the quant factor grades and quant ranking are displayed. Big 5 Sporting Goods (BGFV) - A Top Five Quant Recommendation

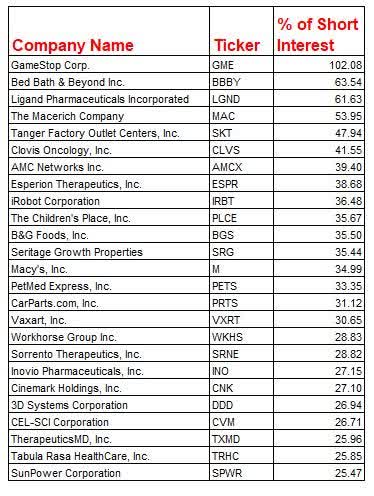

For investors wanting to do more research, the Quant Ratings and Factor Grades provide a springboard for further research. You can quickly see where a stock is strong or weak, and with one click you can view the underlying data and sector averages to perform your own evaluation. The Quant Ratings and Factor Grades are appropriate for both short- and long-term investors. The Value, Growth and Profitability factors identify mispriced securities, and the Momentum and EPS Revisions factors identify timeliness. The culmination of our quantitative rankings can be found in our ratings screener. Additionally, Top Rated Stocks, the display of top buy recommendations for Seeking Alpha Authors, Wall Street Analysts, and SA Quantitative metrics can be found on the Seeking Alpha dashboard. This is available for all Premium subscribers and they only need to scroll down as it does not even require a click. Top Rated Stocks Displayed Daily On The Seeking Alpha Dashboard The stocks ranked above are a convenient display of Seeking Alpha top-rated stocks across many metrics. The screen combines the directional recommendation from Seeking Alpha Authors, Wall Street Analysts, and SA Quantitative ratings along with the quant roll-up grades for the investment characteristics that represent Value, Growth, Profitability, Momentum, and EPS Revisions. These are the core investment metrics that are measured to support our quantitative algorithms. Short Interest as a Percentage of Shares OutstandingWith the long-standing successful multi-factor strategy in mind, market timing is currently revolving around one single factor that has a very poor history of market timing: Short Interest as a Percentage of Shares Outstanding. Retail investors, with the help of those on a social media platform and a handful of billionaires, have joined forces to zero in on this metric. To the agony of hedge funds shorting stocks with the highest levels of short interest, listed below, investors in these stocks have seen their profits shoot up like an Elon Musk Falcon 9 rocket.

The table displays 25 stocks with a short interest percent above 25%. Short interest data is updated twice a month - on the 15th and at the end of the month. The data displayed in the table is from S&P CapIQ as recorded on January 27th, 2021. Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short interest is often exhibited as a percentage and has traditionally been viewed as an indicator of market sentiment. This year, as exhibited by the performance below, it has been a leading indicator.

Source: Xignite and Seeking Alpha Investing in stocks, whether with long positions or short positions that have a high level of short interest, is extremely risky. The risk is so great that many traders will not carry the positions overnight and look to reestablish positions each morning. When investing in these stocks one of Wall Street's oldest adages comes to mind. Bulls can make money, Bears can make money, Pigs get slaughtered. |

No comments:

Post a Comment