5G And Nvidia: Just Getting Started

5G, in its various forms, is just getting started.

The opportunity is huge, and it touches many businesses across most industries.

Nvidia is an exceptional example of a stock that will benefit far and wide from the shift to 5G.

In this report, we provide an overview of 5G, we discuss the many opportunities it creates, and we dig into the detail on Nvidia in particular.

5G, in its various forms, is about to become the reality for most data consumers. And the transition (from 4G to 5G) will be consequential across nearly all industries and companies. In this report, we review how 5G will transform our ecosystem, and how to position your portfolio to benefit. We pay special attention to Nvidia (NVDA), considering it is a superior vehicle to play the broader 5G story.

What is the 5G hype all about?

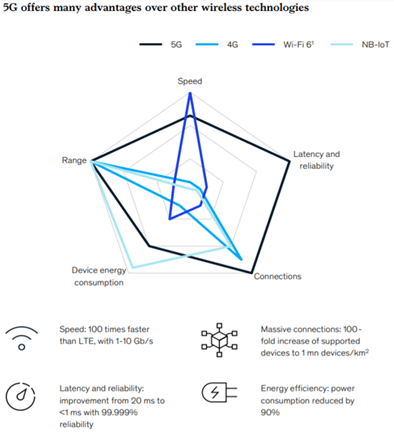

5G is the latest generation technology standard for mobile internet connection. The 5th generation wireless mobile network is expected to bring about a significant upgrade relative to the legacy 4G technology by not only improving the ways in which people connect with one another but also how they connect with machines, objects and devices. Apart from higher bandwidth (i.e. network capacity to help connect billions of devices simultaneously), the 3 major advantages that 5G has over 4G are faster speed, significantly low latency rates and higher reliability.

Speed: This is where 5G dominates 4G the most. At peak data rates, 5G can deliver speed of up to 20 Gigabits per second which is almost 100 times that of current speed enabled by 4G technology.

Latency: Latency refers to the time taken for a request to travel from the sender to the receiver and for the receiver to process the request. 5G offers latency of just 1 millisecond which is substantially better than 20 milliseconds that 4G offers. Lower latency rates will help in improvement of several upcoming technologies such as VR gaming, remote surgical operations and communications between autonomous vehicles, to name a few.

Capacity: The network bandwidth offered by 5G is 100 times that of 4G. While 4G can support about 10,000 devices per square kilometer, 5G has the capacity to connect 1 million devices in the same area. With the world becoming increasingly connected over the internet as a greater number of devices come online, higher network capacity is a critical factor to drive future technology shift.

Reliability: While high bandwidth spectrum provides superior speed, improved latency, and network capacity, it is generally less reliable as it has a short range and can be easily blocked by walls or trees. To combat this issue, 5G has been designed to extract the most out of `network slicing’ technology. Network slicing refers to the splitting of the network to create a separate network with controlled speed, coverage, and capacity for reliable communication. Reliability and service quality are of the utmost importance for technologies such as autonomous vehicles, remote health services, traffic management and more. 5G guarantees nearly 100% up-time and very consistent network services.

Source: McKinsey & Company, The 5G era report

How will 5G impact various industry segments?

The deployment of 5G technology is expected to create a technological transformation in nearly every business segment. During this upgradation process, both enablers and users of 5G will derive benefits out of the transformation in the following ways:

Semiconductors, network devices, telecom and consumer electronics: Initially, the direct beneficiaries will be global semi-conductor companies. Semiconductors include chips that are used in several digital consumer products such as mobile phones, tablets, cameras, smart TVs, smart refrigerators and other IoTs. As 5G adoption is expected to result in an exponential increase in connected devices on a global scale, it will lead to significant increases in demand for advanced chips that can process information and power these devices. Leading semiconductor companies such as Broadcom (AVGO), Qualcomm (QCOM), Intel (INTC), Xilinx (XLNX), Skyworks Solutions (SWKS) etc. are poised to benefit from the planned network upgrades lined up in the future. Additionally, Apple (AAPL) and Samsung (OTC:SSNLF) will benefit from an upgrade cycle as consumers will have more of an incentive to switch from 4G to 5G enabled phones.

Ericsson (ERIC) which is one of the market leaders in manufacturing networking equipment such as antennas, radio systems etc., as well as real estate players that own, operate and lease wireless communication towers such as Crown Castle International (CCI) and American Tower Corp (AMT) are also well positioned to benefit from the planned networking expansion and upgradations.

Finally, T-Mobile (TMUS), Verizon (VZ) and AT&T (T) will be able to enhance network performance, capacity, and overall customer experience via the installation of 5G networks.

Manufacturing: 5G technology will lead to accelerated adoption of Industry 4.0 standards i.e. ongoing automation of traditional manufacturing and industrial processes. For example, high network speed and low latency will facilitate real time collection and analysis of data from sensors installed on machines operating in a factory which will help derive maximum efficiency and productivity.

Transportation: 5G network acts as a key driver in development of autonomous vehicle technology. The technology will enable communication between vehicle-to-vehicle(V2V) as well as vehicle-to-road infrastructure(V2I) such as traffic lights, obstacles or nearby buildings, which is difficult to achieve in 4G networks because of low speed and higher latency rates. Besides, an autonomous vehicle uses hundreds of sensors that collect large amounts of unstructured data to create a 3D map for navigating the vehicle. 5G networks can enable reliable and latency free real-time exchange of this crucial information. Ride hailing companies such as Uber (UBER) or Lyft (LYFT) as well as delivery services providers including DoorDash, GrubHub (GRUB) etc. will be major beneficiaries of the autonomous vehicle technology as driver costs make up the biggest chunk of their operating expenditures.

Healthcare: 5G will accelerate development of technologies such as m-health (mobile health or telehealth) for people located in underserved geographies, remote monitoring of patients, remote surgical procedures, AI & machine learning to detect diseases etc. Companies at the forefront of telehealth such as Teledoc (TDOC) as well as medical device companies such as Medtronic (MDT) are well-positioned to benefit from 5G applications in healthcare.

Media and Entertainment: Fast speed offered by 5G will provide consumers with seamless video streaming, music streaming and gaming experience. It will also promote interactive technologies such as augmented reality (AR) and virtual reality (VR). Video streaming service providers such as Netflix (NFLX) as well as gaming companies including Electronic Arts (EA), Sea Ltd. (SE) and Nintendo (OTCPK:NTDOY) are well placed to gain from 5G deployment.

5G networks will also lead to technological advancements in other industries such as Agriculture for crop monitoring, financial services, and hospitality for delivering more personalized consumer services.

NVIDIA, a superior 5G play

NVIDIA is an exceptional way to play 5G. For starters, here is our high-level overview of the stock in this video.

Specifically, the company is exposed to sectors that are likely to be major beneficiaries of the shift. Specifically, more complex games and higher levels of data (that will be generated in a 5G world) will help the company’s gaming and data center customers respectively which in turn will drive demand for NVIDIA’s GPUs. Other important catalysts include Nvidia Aerial, the global digitization trend and the recent Arm acquisition.

Nvidia Aerial: More recently, to tap the growing 5G network deployment market, the company has released its new offering “Nvidia Aerial”, a software development kit for telecom operators building 5G wireless Radio Access Networks (RANs). Nvidia GPUs can be used to intelligently build and deploy software defined virtual Radio Access Networks (vRAN) that run on virtual machines. Since these virtual networks are not tied to any hardware equipment, they can be easily controlled, optimized, or even transferred to any other location based on user needs or bandwidth requirements, thereby reducing both capital and operating costs. As per Fior markets 2019 study, global vRAN market size stood at $200 million in 2019 and is expected to reach $28.5 billion by 2024 thereby growing at a CAGR of 128.2%. Although still at a very nascent stage, Aerial can be a business growth catalyst for the company in the long-term when 5G use becomes more mainstream.

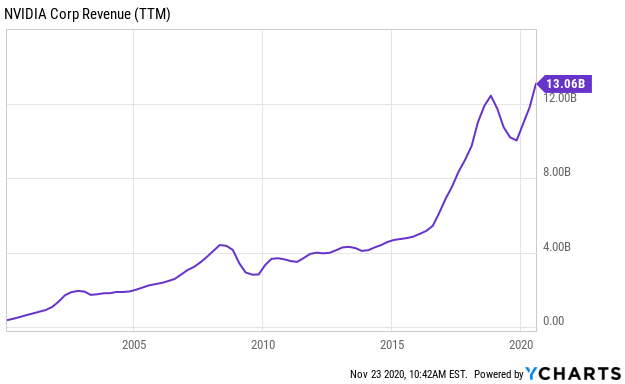

Global Digitization: Also, the global push towards business digitization in the post pandemic world as well as the current “work-from-home” economy have boosted demand for GPUs used in data centers as well as gaming consoles. In Q3 2020, Nvidia reported its highest ever total revenue of $4.7 billion, which represents YoY growth of 57%. The recent launch of its Ampere-based processor GeForce RTX 30 series has helped the gaming segment. While Gaming was strong, Nvidia’s data center business significantly outperformed all other segments by delivering an organic growth rate of 77% on a YoY basis. Its high-performance computing technology is used by every major cloud provider including AWS (AMZN), Azure (MSFT, and Google Cloud (GOOGL). The company is experiencing strong traction in demand for its A100 GPUs that run on Ampere technology and are designed specifically for improving data center processing speed. Google Cloud was the first to bring A100 to the market and it is now being incorporated in data centers by all other cloud computing service providers globally. According to Nvidia CEO Jensen Huang, during the Q3 earnings call:

“I think starting this quarter, we’re now in every, every major cloud provider in the world, including Alibaba, Oracle and of course the giants, the Amazons, the Azure, and Google Clouds. And we’re going to continue to ramp into that. And then of course, we’re starting to ramp into enterprise which in my estimation, long-term, will still be the largest growth opportunity for us, turning every industry into an AI, turning every company into AI and augment it with AI and bring the iPhone moment to all of the world’s largest industries.”

Arm Acquisition: Additionally, Nvidia recently announced the acquisition of Arm Ltd. from Softbank Group for $40 billion. Arm Ltd. is largest designer of microprocessor chips globally and it licenses its technology to semiconductor manufacturers and earns royalties in return. Arm’s chip designs are currently used in more than 50% of the smart devices in the world. With this acquisition, Nvidia can leverage Arm’s industry leading position in larger CPU based end markets to expand its AI computing platform, while Arm can benefit from Nvidia’s dominant position in the datacenter business. Overall, we believe Arm acquisition significantly increases Nvidia’s addressable market going forward.

“Data centers are the new unit of computing. Someday, we believe there will be millions of autonomous data centers distributed all over the globe. NVIDIA’s BlueField DPU programmable data center on a chip in our rich software stack will help place AI data centers in factories, warehouses, 5G base stations and even on wheels. And with our pending acquisition of Arm, the company that builds the most — the world’s most popular CPU, we will create the computing company for the age of AI with computing extending from the cloud to trillions of devices.”- Jensen Huang, Founder and CEO in Q3 earnings call.

Nvidia’s Valuation:

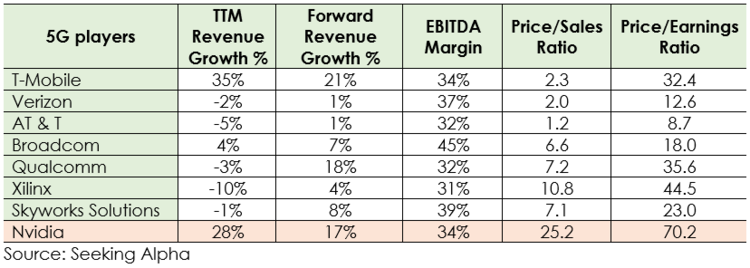

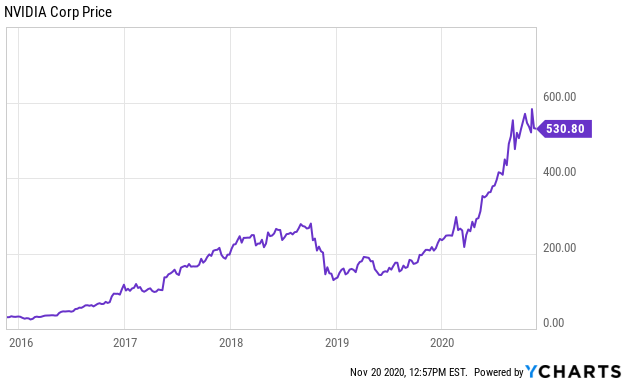

Valuation multiples of almost all major 5G technology players have expanded in the last few quarters as investors become more confident about gains that the companies can derive from the shift to upgraded networks. Given the massive investment required to upgrade networks and associated refresh cycle in devices such as smartphones, we believe stocks such as NVIDIA, Qualcomm and Broadcom have a long way to go before revenue growth stalls. As such, we believe current valuations are attractive from a long term perspective.

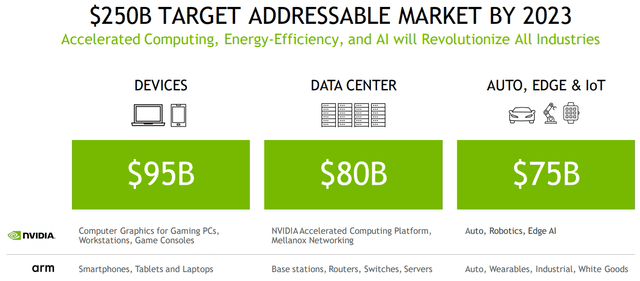

For a little more perspective on Nvidia's current valuation, it makes sense to consider it in relation to its total addressable market. As per company estimates, the combined entity’s total addressable market is expected to grow to $250 billion by 2023.

(image source: company presentation)

And considering the company's recent twelve-trailing-months revenue was approximately $13 billion, there is enormous room for continued rapid growth that more than justifies the relatively higher price-to-sales ratio versus peers in our earlier table (especially considering Nvidia's dominant leadership position).

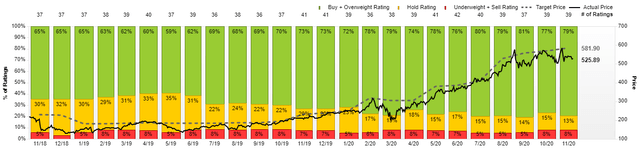

For still more perspective on Nvidia's current price versus its valuation, here is a look at the average price target of the 39 Wall Street analyst covering the stock and reporting to Factset.

In our view, these analysts are notoriously too short-term focused (because they're more interested in modeling only the next few quarters or 1-2 years than the true long-term total addressable market opportunity), but even these analysts believe the shares have more than 10% upside right away (and 79% of them have "Buy" ratings on the stock). And considering the long-term market size, Nvidia has much more long-term price appreciation potential, in our view.

Valuation Risk: Valuation multiples of most 5G players have gone up in the last few quarters. While 5G deployment has begun in certain geographies, the journey is not going to be linear and as such associated revenues could be lumpy. Having said that, we believe long term approach will mitigate this risk.

You can also access our previous Nvidia quick-look report here:

The Bottom Line

The shift to 5G is just getting started, and Nvidia is an exceptional way to play it (considering the company touches so many different industries and opportunities). And despite what seems to be a rich near-term valuation (25.2x price-to-sales ratio), Nvidia still stands out as attractive (thanks to its exceptional leader—Jensen Huang, the massive total addressable market, and the company’s ongoing leadership position). We believe that the shift to 5G is one of the biggest themes that investors can benefit from as the ongoing worldwide cloud-based digital transformation rages on (other digital transformation themes we’ve recently written about include cybersecurity, optimization of cloud-speed and non-US digitization-such as our report on Sea Limited (SE), to name a few). We understand that Nvidia’s share price has historically experienced sharp pullbacks, but rather than trying to time the near-term market moves, a better strategy is to simply buy good businesses (such as Nvidia) and then hang on throughout the ups and downs. In our view, Nvidia has a lot more long-term upside ahead, thanks in large part to its important role in the shift to 5G.

No comments:

Post a Comment