What Is Rivian? Behind the $2.2 Billion "Tesla Killer"

Rivian is an electric vehicle manufacturer, best known for its SUVs and pickup trucks.

The company was founded by Robert Scaringe in 2009, after he graduated from MIT. Just 11 years later, the company already has more than 1,000 employees.

Because it remains a private company, financial details are scarce.

We do know the company has massive potential.

Rivian's most notable vehicle is the R1S. It's an SUV meant to rival Tesla Inc.'s (NASDAQ: TSLA) Model X. The company claims the R1S can drive between 240 and 410 miles on a single charge. If true, that would significantly outpace the Model X's range of 237 to 295 miles. Rivian's version is expected to retail between $70,000 and $90,000.

While those expectations are promising, they are still just expectations. Rivian has yet to sell a single passenger vehicle.

So why does the company, and a potential IPO, have so much hype if it isn't selling cars?

Jeff Bezos.

The world's richest man and founder of Amazon visited the company's headquarters in Michigan in the fall of 2019. After seeing its operations, he pledged to buy 100,000 of its vans for Amazon's delivery services.

Delivery of these vehicles is expected in 2021. Amazon hopes to have 10,000 of the vehicles in operation by 2022. The full delivery of 100,000 electric vans isn't expected until 2030.

Since then, speculation has run rampant about a potential IPO for Rivian stock.

But does all that hype mean that Rivian stock is a "Buy" after the IPO? Here's the full answer…

Should I Buy Rivian Stock After the IPO?

For advice on how to handle the Rivian IPO, I turned to Money Morning Defense and Tech Specialist Michael A. Robinson.

In his 35 years as a Silicon Valley insider, Michael has seen hundreds (and maybe even thousands) of these "hot" new tech IPOs. There might not be anyone more qualified on the topic.

"For years now, I've advised my readers about how the average retail investor should avoid buying high-tech IPOs when they first start trading," Michael said. "When you buy at the open, you really risk losing your hard-earned money. Problem is, people just can't wait. They want in – and they want in fast."

It's that temptation to buy right at the open that ends up crushing retail investors like us.

You see, the large institutional investors (think big banks and billionaire hedge fund owners) get to buy in at the "IPO price."

So on the day of an IPO, you'll often hear about the stock's IPO price. But that is very different from the "opening price" that you and I can buy in at.

Let's look at the infamous GoPro Inc. (NASDAQ: GPRO) IPO from 2014.

Before shares went public, GPRO set an IPO price of $24 for shares. That's where the big institutions got in. But when the stock opened on the market, demand was so high that shares immediately started trading at $35.76. That's where you and I could have bought in.

Think of that. We would have immediately paid 49% more per share than the Wall Street insiders did.

But that's not where the fleecing ends.

Those institutional investors typically need to hold shares for 90 to 180 days before they can sell. This is called a "lockup period." In the case of GoPro, the lockup period was 180 days.

After 180 days, GoPro stock was priced near $69 per share. Institutional investors who sold then made a 188% gain.

But in the year following GPRO's lockup period, shares tanked an incredible 75%. So if you had bought in at $35.76, you'd have lost 50% of your investment in just 18 months. Today, shares trade for just over $4. That's a loss of almost 89% from that opening price.

No wonder Michael calls IPOs a "rigged game."

Instead, Michael recommends waiting until after the lockup period ends before even thinking about buying into one of these hot tech stocks.

"It's much better to hold off for a little more than six months from when the stock hits the market," Michael said. "That's when insiders can sell, an event that usually means a big drop in price. Then, healthy companies start to see their shares push higher…"

After those six months pass, you'll have two earnings reports that you can review. With those, you'll have a much clearer picture of where the company has been and where it's headed. Plus, shares are typically trading cheaper than they were during the hysteria of the opening.

We recommend this same strategy when it comes to Rivian stock. Leading up to the IPO, very little financial information about the company will be available to you. It's better to wait the six months for the hype to die down and see what you're really getting with the stock.

If you're looking for a way to profit from an explosive industry immediately, we have more information for you below.

Action to Take: We're still waiting to find out the Rivian IPO date, but our advice will be the same whenever the company goes public. Wait at least six months after the stock has begun trading before you think about buying in. Continue following along at Money Morning in the lead-up to the IPO. We'll keep you up to date as more details emerge.

The Clock Is Ticking…

The most-requested teaser to start this fresh new year is probably the Blue Gas/Tesla Killer one from Jimmy Mengel, in an ad for The Crow’s Nest ($99/yr) — and today I’m finally getting to it. If you’re keeping track, we first saw these “Blue Gas” iterations of the ad around December 18 (though different “Tesla Killer” ads for different kinds of batteries or motors have cycled through our stories here several times over the past few years).

The spiel is all about something he calls “Blue Gas”, and it’s a little bit reminiscent of all the natural gas vehicle teaser pitches we saw eight or ten years ago… but the technology is a little different. The ad starts out with Mengel’s visit to California to try out a “blue gas” car in person, in a place where it’s poised to, he implies, take over the trucking industry…

“On the road out here you’ll see more Priuses and Teslas than in any other city in America. But this has nothing to do with either.

“In fact, here at this unknown site, salt-of-the-earth truck drivers are making the carbon-free energy revolution possible.

“You see, this gas station is at the epicenter of a $2.5 trillion revolution in energy.

“One that involves a weird form of fuel known as ‘Blue Gas.'”

So what is this magical blue gas?

“It doesn’t involve lithium or batteries or rare earths.

“It doesn’t involve solar, wind, water, biofuels, or any other form of renewable energy you’ve heard of.

“And of course it doesn’t involve oil, coal, or any other fossil fuel.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Best of all, it’s 100% emissions free…

“It takes moments to fill up…

“And it’s 300% more powerful than oil.”

So that sounds perfect, right? No long recharge waits like for an electric car, not dirty like oil or gas. Magical!

How, then, does one make money from this technology?

“My research shows that one $3 stock at the epicenter of the ‘Blue Gas’ revolution is set to trade higher than Tesla.

“Delivering earth-shattering gains of 11,666%.

“Not nine years down the road. Or even five years.

“A massive catalyst in the next few months, that I’ll reveal today, is ready to launch its share price vertical.”

Drooling yet? Don’t worry, that’s mostly the marketing — these gains never, of course, show up overnight… and, sadly, such information is never held solely in the hand of one dude who’s selling a newsletter for 99 bucks.

Which doesn’t mean it won’t be a worthwhile investment to consider, of course, just that we should get the daydreams of 11,000% returns in a few months out of our heads first.

How about some more clues to lead us to the prize?

“The ports of Long Beach and Los Angeles, two of the nation’s largest shipping points, are now deploying a fleet of “Blue Gas” trucks…”

So at this point it’s pretty clear that Mengel is talking up hydrogen fuel cells… which he does “reveal” later on. Fuel cells are not particularly new technology, but they have made some jumps forward in recent years.

And like all new transportation fuels or strategies, the easiest way to start is with local fleet vehicles — garbage trucks, delivery trucks, and other vehicles where fuel is a major cost and where they travel in a small enough area that they can depend on a very limited refueling infrastructure.

And this is positioned as competition for electric vehicles, and particularly for Tesla….

“The Budweiser company Anheuser-Busch is now planning a complete makeover of its truck fleet. It wants to be completely emission-free in the next few years.

“And it’s using ‘Blue Gas’ to make that transition possible.

“That’s why the beer giant recently bought 800 tractor trailers fueled by ‘Blue Gas.’

“That’s almost the entire company’s shipping fleet.

“Just to round it out, it purchased a mere 40 trucks from Tesla….

“When it comes to heavy-duty trucking power, ‘Blue Gas’ beats Tesla hands down.”

But it’s not just big fleet trucks that are going to switch over…

“Today there are only 11,000 vehicles powered by ‘Blue Gas.’ We’re on the ground floor.

“But according to the big car giants…

“There will be over 10 million ‘Blue Gas’ vehicles on the road in the next few years.”

I wouldn’t say that’s the stance of the “car giants” … but it is the goal of some governments and other bodies that are pushing for fuel cell adoption — the last conference included that 10 million vehicle “pledge” (in ten years).

And apparently there is some progress in building out the infrastructure…

“Just a few years ago, there were virtually no “Blue Gas” stations. Today, there are 300 worldwide.

“But as more gas stations switch from serving oil to “Blue Gas”…

“That number is projected to surge to over 5,000 in a few short years.”

That same International conference included the goal of 10,000 fueling stations to serve those ten million vehicles, with a real push from Japan… not surprising, since Toyota is the major automaker that’s most invested in hydrogen fuel cells.

And he goes into why hydrogen fuel cells are a better option…

“Unlike batteries… the engine technology behind ‘Blue Gas’ is:

“Safe and non-explosive.

“Takes under five minutes to refill.

“Lasts days or even weeks.

“And it’s incredibly lightweight.

“In the race for clean trucks, trains, and buses, “Blue Gas” is second to none.”

A big part of the reason why he thinks it’s going to be big is that China is pushing fuel cell tech forward…

“China’s ‘Elon Musk.’ recently made a stunning announcement…

“In short, he called for a complete shift in China to ‘Blue Gas.’

“And when this guy speaks, the Chinese government acts.

“After all, he was responsible for the country’s electric car revolution to begin with.

“The Chinese are committing a stunning $66 billion to back ‘Blue Gas.’

“In fact, the world’s largest ‘Blue Gas’ station just opened in Shanghai.”

And what’s the stock? We finally get a few clues…

“… the $3 tech stock that first began this revolution 40 years ago.”

And some hype, for good measure….

“This Is More Lucrative Than Any Pot Stock I’ve Recommended

“Even more than Bitcoin and other cryptos…

“That’s because it’s moving to the epicenter of the trillion-dollar electric vehicle revolution…

“A historic trillion-dollar energy shift that’s already transforming the way that millions power their cars…”

That “40 years ago” bit is relevant, this company is somehow connected to the “father of fuel cells”…

“… except for a few ‘niche’ markets like submarines or spacecraft, fuel cells weren’t used much.

“They simply weren’t inexpensive and small enough for everyday cars and trucks.

“In 1987, everything changed.

“One energy legend, now known as the ‘father of fuel cell technology’, made a historic discovery that put…

“Fuel Cells on the Inevitable Path to Energy Dominance”

And he talks about some fuel cell stocks that surged last year, Plug Power (PLUG), Proton Power Systems (PPS on the AIM in London), and Hydrogenics… and Hydrogenics was bought by Cummins (CMI), which leads Mengel to anticipate a “buyout surge” that will lead to a takeover frenzy for his favorite secret stock…

“A buyout frenzy is underway on small companies that are deploying the technology.

“And I’ve identified the next big takeout target…

“The tiny $3 stock I mentioned today, the one founded by the innovator behind the fuel cell revolution.”

Other clues about this one $3 stock? We get this…

“… after signing $200 million worth of deals with China’s largest engine and auto parts companies…

“It’s the frontrunner for the world’s biggest fuel cell market…

“In Shandong province alone, it’s rolling out 2,000 fuel cell buses.

“And this company is supplying it all.”

So who’s our little target? What’s “the $3 tech stock that first began this revolution 40 years ago?”

This must be little Ballard Power Systems (BLDP)… which is not a $3 stock anymore, and hasn’t been for more than six months (it was right around $7 the first time I saw this teaser ad, about six weeks ago), but it is connected to (the late) Geoffrey Ballard, the father of the fuel cell and founder of the company… and it would not be surprising if they just repurposed the spiel from a recommendation that was made a few months earlier to Jimmy Mengel’s subscribers (that’s just a guess, but it’s pretty common practice for newsletter ad copywriters).

Geoffrey Ballard left active management at Ballard Power almost 20 years ago, and, in fact, formed another company that was subsequently sold to Plug Power, another oft-touted fuel cell company, but he certainly left a legacy at BLDP.

And yes, China is a big market for fuel cells (and everything else, pretty much), and Ballard does have an “in” thanks to the fact that they sold out part of the company to form a Chinese joint venture with Weichai Power.

All of the fuel cell stocks have gone bonkers at one point or another in the past few months, driving this particular one up above $10 for a while (the stock touched $12 last week, though it’s below $10 again now)… so what’s the story?

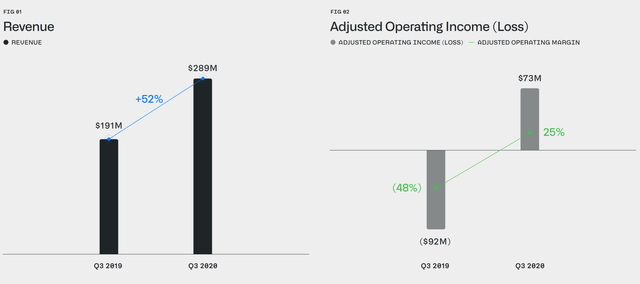

Well, frankly, the most obvious thing you note upon a quick look at the financials is that Ballard is trading like one of the crazy cloud software stocks — at a valuation of $2 billion, it’s trading at more than 20X sales, is nowhere near profitability, and is expected to grow sales at about 35-40% a year as they sell fuel cell stacks into their buses/trucks joint venture in China as well as for existing markets (backup power, forklifts).

The future is very much lined up with China and their technology transfer to their Weichai joint venture (agreed to in early 2018), which is causing some fears and also some profit lust — which probably explains some of the surge in the past few months, as trade war fears have ebbed a bit and the stock has more than doubled in the past six months.

Not for the first time, I should note. The stock has been teased in the past as fuel cell excitement has heated up, and it has surged a few times before — particularly in 2014 and 2017. So the warning signal for investors is that things didn’t work out very well for those who bought Ballard Power the last couple times it surged quickly higher like this.

As with Plug Power and Fuel Cell and the rest of the industry, presumably a lot of the future for Ballard depends on what governments or larger companies do to push forward with hydrogen fueling stations… either in China or the US, or elsewhere… and whether alternative energy makes it far enough that generating, storing and transporting hydrogen ends up being efficient and feasible on a large scale (the government lays out some of the challenges here, in case you’re curious).

There’s some interesting bigger-picture thinking here from a couple years ago that makes some sense to me, though I’m far from being an expert on the science. Hydrogen is a challenge both because of the energy cost to create it, and because it can be challenging to store and transport safely (though natural gas and gasoline are also a challenge on that front, to be fair, and, yes, lithium batteries pose fire risks).

So the dream is that refueling stations will create their own hydrogen from electrolysis instead of having to set up a transportation infrastructure of pipelines or trucks for liquid hydrogen, and that hydrogen generation would take a lot of electricity — hopefully, for the sake of reducing reliance on fossil fuels, electricity from solar and wind and other relatively clean sources… though there are other ways to generate hydrogen as well, of course, with probably the most likely first wave using natural gas as a feedstock and fuel. Though the real hope for the next few years is not from hydrogen-powered cars, it’s all about those predictable and restricted fleet vehicles like port trucks and delivery trucks and buses — which should ring a bell for those who hoped for great riches from the natural gasification of trucking fleets a decade ago.

As an aside… remember Clean Energy Fuels (CLNE) and Westport (WPRT), the standard bearers of the natural gas transportation revolution that was heavily talked up just after the global financial crisis? They’re still around, and still generally growing revenue, but their share prices are down ~90% from their story-driven highs of early 2012, and I’d be surprised if they regain those highs in my lifetime.

So maybe hydrogen ends up being a better solution for a battery-powered fleet (hydrogen fuel cells are essentially batteries that get their charge from hydrogen, with the real advantage being that fuel cell refueling is faster than recharging, and the fuel cells have longer useful lives)… though the established electricity infrastructure (power lines, etc.) and lack of a hydrogen infrastructure means that hydrogen would also presumably have a pretty short time period in which it could “win” over batteries (assuming, of course, that battery technology continues to improve).

Ballard’s latest quarterly presentation is full of future promise but not terribly inspiring on the financial front. Yes, the promise is real, things could work out well… but right now, they aren’t. There’s an interesting Bloomberg interview with Ballard’s CEO Randy MacEwen here, essentially pointing to 2021 or 2022 as the first time investors begin to envision a future profit for BLDP, and 2025 as the forecasted beginning of the rapid growth trajectory that he envisions.

So, again, this is buying the future — or, more specifically, buying one future in which hydrogen fuel cells build on their early success in forklifts to take a huge market share in heavy trucks and buses, and hoping that Ballard will lead in this future. That’s been promoted many times in Ballard’s history, and past dreams haven’t materialized, but that doesn’t mean it’s impossible this time… just that we should check our assumptions and be skeptical of the promotions. I don’t know whether this hydrogen fuel cell future will come, or if Ballard will remain a leader, but I’d bet on it continuing to be a very volatile ride.

Thoughts, comments, questions? Let ’em loose with a comment below… and thanks for reading!