Alphabet Is The Value Pick In FAAANNG+MT

Alphabet's valuation story against big tech peers is getting hard to ignore, particularly using price to sales, free cash flow and book value.

Little debt, super-high profit margins, and above-average growth projections vs. the overall economy are quite desirable.

Alphabet could be headed for a temporary sell-off on a U.S. Justice Department antitrust lawsuit, with a unique buy opportunity resulting.

Overvaluations in big tech should guide investors into cheaper sector picks, as a booming investment cycle turns to bust in coming years.

Alphabet (GOOG) (GOOGL), formerly listed as Google, is the "value" pick from the gang of high-growth, high-tech darlings in October 2020. The original FANG subset of Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google has expanded in 2019-20 to include a few extra fad stocks carrying the bulk of gains in the U.S. stock market the last several years. Adding Apple (AAPL), Adobe (ADBE), Nvidia (NVDA), Microsoft (MSFT) and Tesla (TSLA), we have a nearly comprehensive collection of the names keeping the Nasdaq 100 and S&P 500 indexes afloat during the late stages of the 2019 economic upturn and this year's coronavirus recession. Together the nine companies account for $7.97 trillion (23%) of today's total U.S. stock market value of $34.47 trillion, as measured by the Wilshire 5000 index.

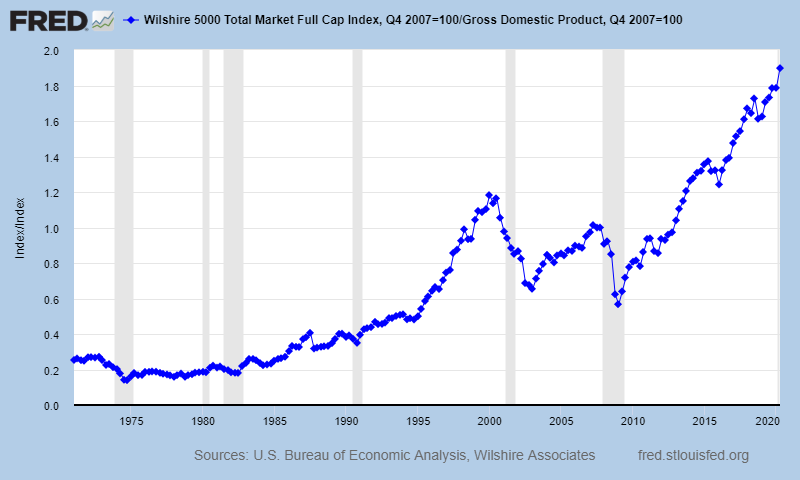

When analysts say we are in a 1990s-type Tech Bubble 2.0, they are not kidding. In fact, the present overall 180% stock market valuation vs. GDP is far ABOVE the year 2000 record peak level, using all of the nation’s storied financial trading history as a yardstick. This situation is pictured below.

Image Source: St. Louis Fed Website

When you factor in nominal GDP has contracted -9% YoY in the June Q2 period, and U.S. stock prices have extended above the pre-pandemic level, economists are scratching their heads wondering how quotes can be supported near the late-summer all-time overvaluation. One of Warren Buffett’s favorite long-term indicators to determine portfolio cash weightings, it’s no wonder he is holding record cash reserves this year. Believe it or not, a 50% stock market crash would still place Wall Street's valuation vs. GDP in an abnormally rich zone!

In terms of risk-adjusted analysis, I thought it would be useful to clarify which name of the go-go tech stocks has the best valuation characteristics to survive a massive tech bust, better than the others. Why do fundamental valuations matter? I traded through the 2000-2002 tech bust, and the difference between a 90-100% dot-com loss disaster and a 30-50% bear market drop boiled down to old-fashioned valuation metrics. My choice for the strongest value argument, out of the mega-cap tech sector, in a 2020-22 bust or crash scenario is Alphabet.

Image Source: TripSavvy Website - Googleplex, Mountain View, CA

Image Source: TripSavvy Website - Googleplex, Mountain View, CA

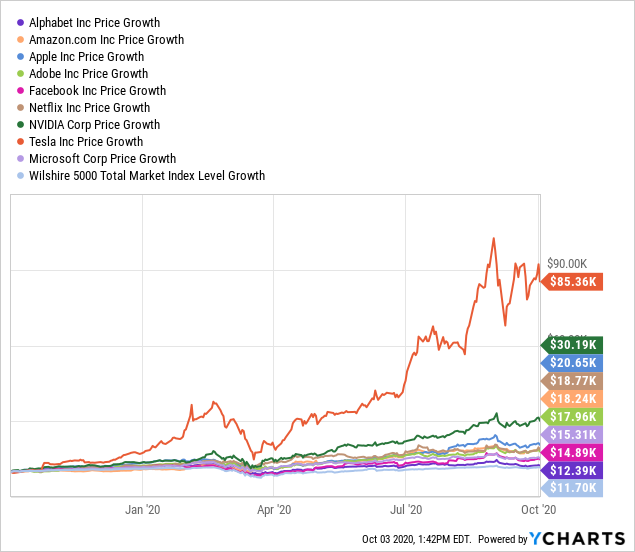

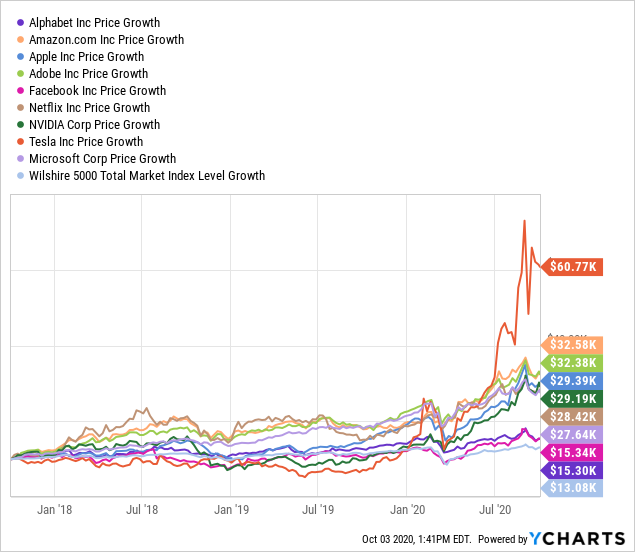

Recent Performance Comparisons

Reviewing individual big tech performance vs. the Wilshire 5000 total U.S. market cap index helps to illustrate investment price gains the last 1-year and 3-year periods. If you haven’t heard yet, Tesla has been the runaway winner.

There are reasons Alphabet's quote is fading vs. others in the group. Antitrust concerns from the U.S. government have been the biggest drag on the share quote. Lagging investment gains by a significant distance vs. the high-tech sector in 2019-20, Alphabet appears to be getting less expensive vs. peers almost daily. It is widely expected the Justice Department will file a lawsuit against the company for abusive and monopolistic practices as soon as this week. And, if such is the case, Alphabet’s stock quote could get considerably cheaper in the days ahead.

The biggest negative development for shareholders by this effort would be a sizable antitrust fine levied by Washington politicians and state attorney generals. My guesstimate is an agreement to split the company would be the main compromise, with limited penalties paid to appease the powers that be.

In the end, it is entirely possible Uncle Sam will require the company to split into two or three companies to create more competition in online search, video broadcasting and advertising access. The idea is the new entities would compete against each other, as well as the few existing competitors in each space. Would that necessarily be a catastrophic event for investors in the long term, if you kept all the segments in your portfolio after the breakup? My thinking is growth in Google search, YouTube video sharing, Google Cloud, Android and Chrome software, plus Waymo self-driving car revenue (and reach) may not be affected much by a breakup decision, especially if it takes a year or two to finalize with the government.

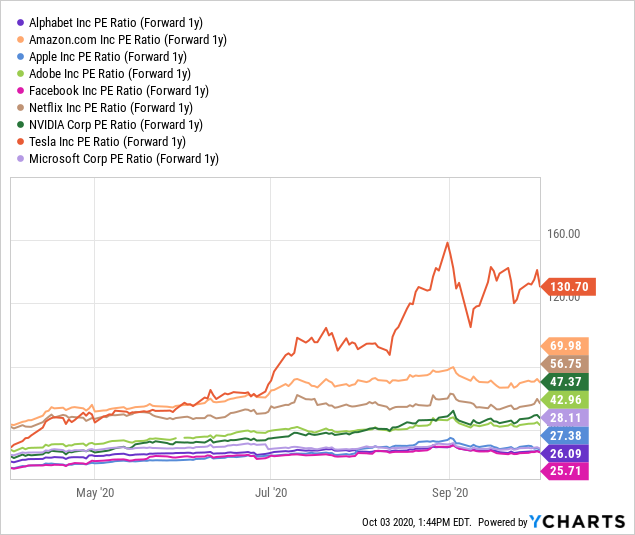

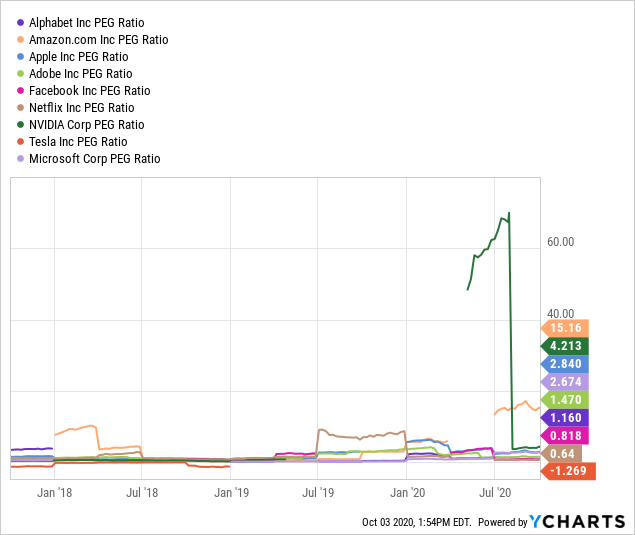

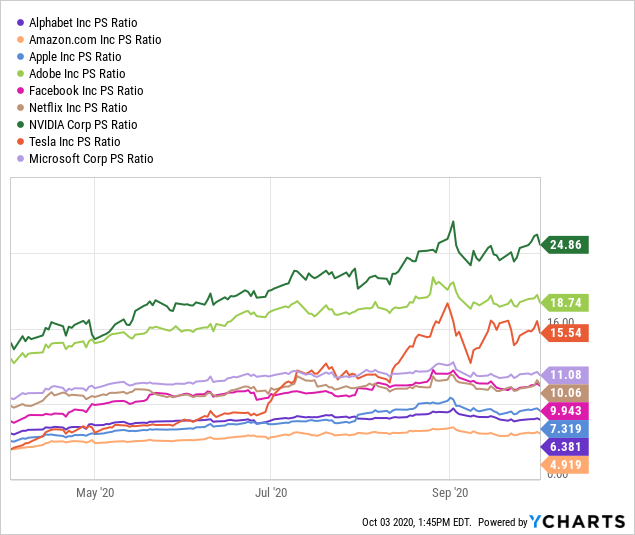

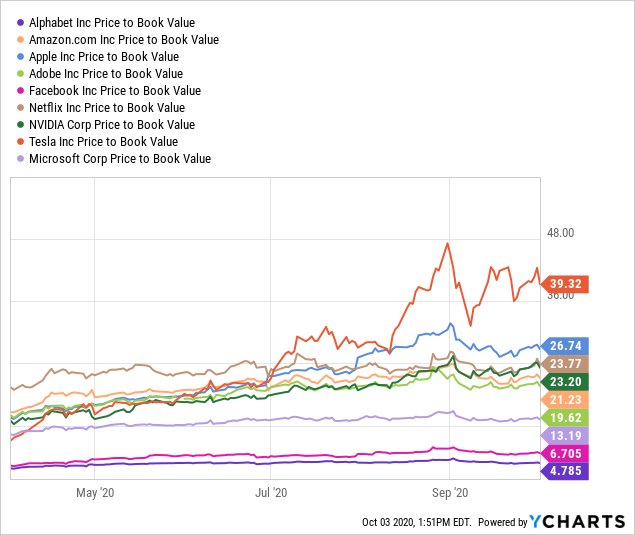

Fundamental Valuations

My bullish argument is Alphabet-Google holds the most credible real-world valuation of the tech giants vs. Wall Street expected growth futures. Google email and search, Chrome and Android foundational software, plus the YouTube broadcasting service are embedded online tools we all use daily. If you can acquire these assets on the cheap, when bad news is the focus, a golden opportunity (and outperformance pick) may develop for investors. Using forward 1-year price to earnings of 26x and trailing price to earnings growth [PEG] rates near 1.1x, Alphabet looks quite compelling as a buy candidate vs. the big tech alternatives.

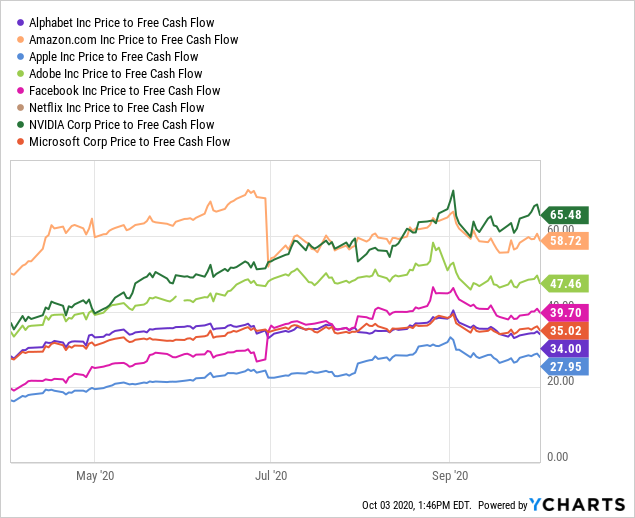

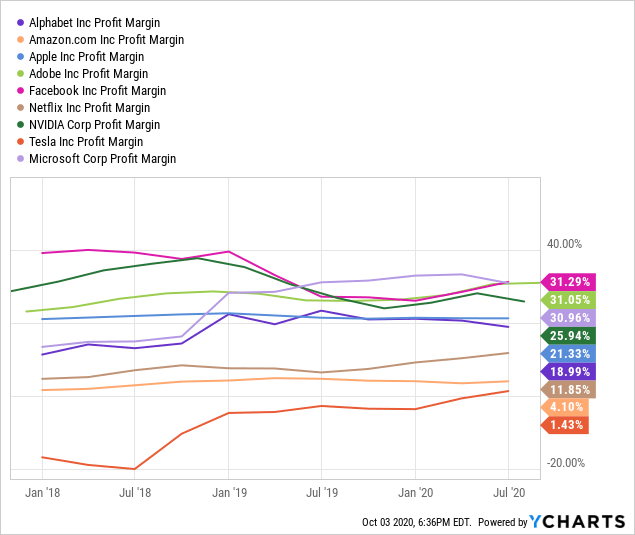

Trailing price to sales, book value and free cash flow calculations also highlight a “value” proposition for the shares against peers. [Tesla does not have free cash flow yet, and has been eliminated from that graph.] Net-net, Alphabet is clearly the “valuation” winner of this group for new investment capital.

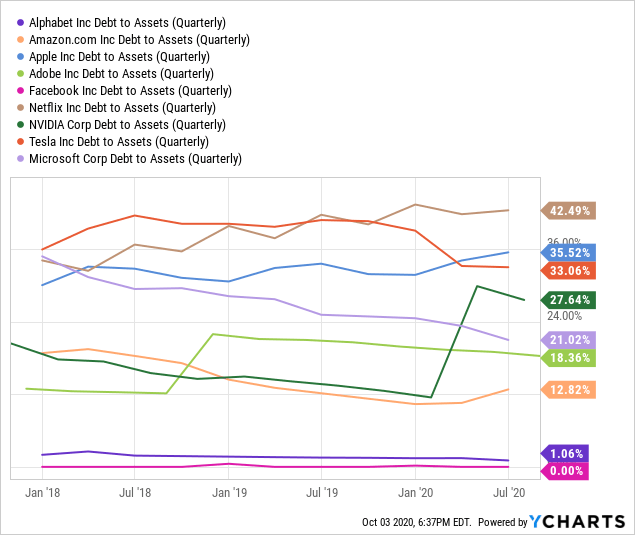

Lastly, in terms of business operating risk, Alphabet is an ultra-conservative choice after reviewing its balance sheet and margins. It holds almost no debt, with a top-tier net profit margin on sales around 20% during 2019-20.

Technical Chart

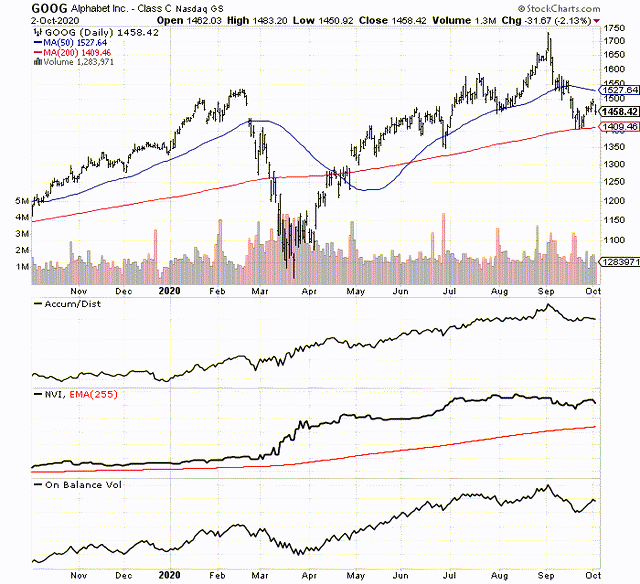

Alphabet’s momentum pattern is incredibly positive currently. The stock quote has bested the Wilshire 5000 and S&P 500 index advance the last 12-months by about +5% and +10%, respectively. In addition, some of my favorite technical indicators of underlying strength in price and volume, the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume indicator have been in steadily rising channels all of 2020. Does this mean the stock quote cannot decline appreciably? No, but it may telegraph unusual future price declines like the February-March pandemic drawdown should be bought by smart investors.

Final Thoughts

Final Thoughts

If you are concerned about the stock market’s abnormally extended valuation, especially in the high-technology sector, a focus on low valuations could greatly reduce sell-off risk in a bust or crash scenario. Often, buying a “tortoise” in the stock market race can save your portfolio (and net worth) when the “hare” runs out of gas. Additionally, if the bull run continues in the U.S. equity market during 2021, Alphabet could morph into an outperformance winner soon. After the antitrust news hits and is digested by investors, relative upside vs. peers and general market indices could be uniquely positive for investment capital.

My plan is to purchase shares on material price weakness. Either an antitrust suit and/or the resumption of the technology-led market sell-off from September could open an excellent buy window in coming weeks.

Consulting with a registered and experienced investment advisor is recommended before making any trade.

Want to read more? Click the "Follow" button at the top of this article to receive future author posts.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short QQQ, as a hedge position. This security includes a weighting in GOOG shares.

This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.

This professional hacker is absolutely reliable and I strongly recommend him for any type of hack you require. I know this because I have hired him severally for various hacks and he has never disappointed me nor any of my friends who have hired him too, he can help you with any of the following hacks:

ReplyDelete-Phone hacks (remotely)

-Credit repair

-Bitcoin recovery (any cryptocurrency)

-Make money from home (USA only)

-Social media hacks

-Website hacks

-Erase criminal records (USA & Canada only)

-Grade change

-funds recovery

Email: onlineghosthacker247@ gmail .com