GE: For The 'Things Are So Bad They Can Only Get Better' Investor

Summary

The sale of the BioPharma unit deprives the company of one of its best businesses.

Heavy debt loads and an underfunded pension program continue to weigh on the company.

COVID-19 provides a number of formidable headwinds.

In 2017, I wrote 3 articles on General Electric (GE) to warn readers of the coming implosion of the company. I haven’t penned a piece on General Electric since. Why? Because watching the company has been akin to viewing a truck, stuck axle-deep in mud, spinning its tires.

One could argue the stock serves as a decent trading vehicle, but for over two years, describing GE as an investment is an insult to the English language.

Nonetheless, I’m in constant search for bargains, so I conducted an in-depth investigation of the firm. A great deal of money can be made when a troubled company turns around.

I don’t believe a turnaround is a near-case scenario for GE. For years, the company has struggled with debt and pension burdens. Now COVID-19 provides a new wave of headwinds.

I fear bad news has arrived, and despite management’s best efforts, the sins of the past still weigh on the company.

New Headwinds Abound

Management cut the dividend (twice), divested a number of the company’s businesses and slashed jobs by the thousands in an effort to revive GE. One of those divestitures was the recent deal to sell GE’s BioPharma business to Danaher (DHR) for $21.4 billion.

I believe the sale of the BioPharma unit illustrates the obstacles on GE’s road to recovery. It is understandable when companies sell businesses that do not mesh with the larger enterprise. It makes sense to divest a business when a corporation is moving to a business model that a segment does not match.

Neither of those scenarios describe the deal with Danaher.

The Biopharma unit racked up $1.3 billion in FCF the year before it was sold. The proceeds from the sale were earmarked to reduce GE’s ponderous debt. Unfortunately, those funds may be needed to buttress the company against headwinds brewing from COVID-19.

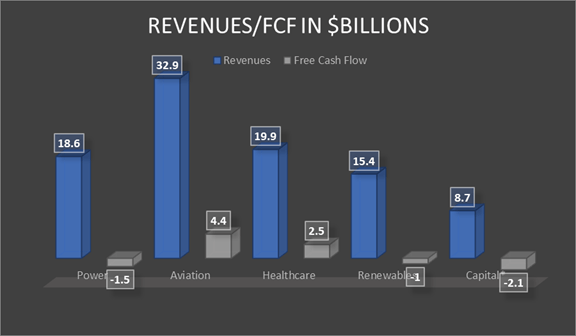

The chart below details the revenues and FCF generated by GE’s five segments. The numbers provided are prior to the loss of revenues from BioPharma.

Source: GE Presentations/Chart by Author

(* FCF of Capital Segment includes Corporate and Eliminations)

Following that deal, we are left with three segments that are FCF negative, plus the healthcare segment, with FCF that has been cut by more than half, and Aviation.

Aviation generated nearly 80% of FCF in 2019 (excluding BioPharma’s contribution). But last year’s results weren’t impacted by COVID-19.

GE is the sole supplier for 737 Max engines, and the grounding of Boeing’s (BA) 737 Max resulted in losses of roughly $1.4 billion in 2019. Management projects additional losses of $400 million per quarter until the 737 Max is back in production.

The coronavirus’ effect on the airline industry will likely last longer and have a more profound effect. You can get some idea of the severity of the problem by reviewing the slowing demand at Boeing and Airbus (OTCPK:EADSY).

Through the first three months of 2020, Boeing delivered 50 commercial aircraft. That compares to 149 during the same period in 2019 and represents the lowest number since 1984.

Meanwhile, Airbus reduced its commercial aircraft production markedly.

GE is the number one supplier of new jet engines. In normal times, that’s a strength. However, when less than 40% of the global airline fleet remains in service, that becomes an acute liability.

"The deep contraction of commercial aviation is unprecedented, affecting every customer worldwide."GE Aviation CEO David Joyce

There is a silver lining for GE, but not in the immediate future. Airlines will restrain capex, and fewer new aircraft means more maintenance.

GE uses new engines as a loss leader to fuel revenues in the segment’s service offerings. GE engines power roughly two thirds of every commercial aircraft. In turn, the servicing of aircraft drives nearly two thirds of the Aviation’s revenues, so fleets with older aircraft serve as a tailwind.

Unfortunately, the Aviation segment isn’t the only arm of the company adversely hamstrung by troubles plaguing the airline industry. GE Capital is affected through GECAS. GECAS is the globe's number one lessor and lender for commercial aircraft and engines.

Technically, lease rates should remain the same due to the contract terms between GECAS and the airlines. However, the reality is that GECAS will be forced to adjust the lease terms to support their customers. After all, a client paying a reduced lease provides more revenue than one driven to bankruptcy.

The crisis will drive lease rates down, and that will result in depressed revenues for an extended period.

The following chart illustrates the differing lending branches within GE Capital.

Source: Metrics from GE Presentations/ Chart by Author

As previously noted, GE Capital had negative FCF prior to the COVID-19 crisis. The segment has tallied losses for five consecutive years. With this blow to GECAS, the pain can only worsen.

Perhaps a hint at the potential losses can be found in management's decision to cut 13,000 jobs, 25% of the Aviation segment’s workforce. Ominously, management stated the workforce reduction will be permanent.

The Baker Hughes Conundrum

For years, GE planned the divestiture of its stake in Baker Hughes (BKR). A stockholder’s agreement prohibited GE from selling the position in Baker Hughes in a wholesale fashion, and the enormous stake GE held in BKR presented difficulties in terms of selling the shares on the open market.

The steep decline in oil prices means shares of Baker Hughes trade for roughly one fourth of what the stock sold for three years ago. Management’s goal was to sell the position in Baker Hughes and use the funds to pay down debt.

The company previously stated plans to divest its remaining position in BKR would result in a loss of $8.4 billion, but that was when the shares stood at $23.57. Today the stock trades below $16.

“The only man who sticks closer to you in adversity than a friend is a creditor.”Anonymous

Despite the many steps management has made to reduce GE’s debt, the company’s debt-to-equity ratio stands four to five times higher than many of its peers. The debt burden prompted S&P to join Fitch in providing a negative credit outlook for the firm.

GE’s credit ratings now stand at Baa1 stable (Moody’s) and BBB+ negative, for S&P and Fitch.

This means GE’s debt is three notches above junk and is in danger of being downgraded.

The Elephants In The Room

Fitch also considers GE to be one of the long-term care insurance providers at greatest risk. In a recent report, Fitch stated GE has high exposure to claims and slender cash reserves devoted to their insurance offerings. The report also noted GE’s “very high” risk related to 250,000 retirees that depend on the company’s policies.

Harry Markopolos, a financial investigator, contends GE long-term care policies are underfunded by $29 billion.

There are reputable sources that seek to refute those claims. Goldman Sachs and Reuters see GE’s reserves as in line with peers.

This following, however, is not in dispute: General Electric’s pension deficit is the worst in corporate America. As I’m writing this article, GE’s market cap is a hair over $56 billion. At the end of 2018, the company had a total pension liability of $92 billion and plans were underfunded by $22 billion.

It is important to note that Danaher will assume the pension obligations related to the BioPharma deal.

Dividend And Valuation

GE has a current yield of .62%. The payout ratio is approximately 15%. Despite the low payout ratio, I think it is possible we will see a dividend cut to preserve cash.

As I type these words, GE trades for $6.41 a share. The average 12-month price target of 15 analysts is $9.68. The average target of the 5 analysts rating the company in the last 30 days is $7.70.

The current PE is 10.45 and the forward PE is 15.99.

My Perspective

I could spend another 1500 words writing on additional headwinds as well as the few positives surrounding an investment in GE. However, I hope I’ve provided a balanced view regarding the tremendous obstacles facing GE management.

I rate GE as a SELL.

This is the first time in 112 SA articles that I have recommended investors sell a stock. I readily admit that a turnaround in GE is possible. If that occurs, shareholders could be richly rewarded. However, the headwinds are formidable and may be long-lasting. Furthermore, the current market offers a proverbial target-rich environment of companies worthy of investment.

One Last Word

I hope to continue providing articles to SA readers. If you found this piece of value, I would greatly appreciate your following me (above near the title) and/or pressing “Like this article” just below. This will aid me greatly in continuing to write for SA. Best of luck in your investing endeavors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

CONTACT: onlineghosthacker247 @gmail. com

ReplyDelete-Find Out If Your Husband/Wife or Boyfriend/Girlfriend Is Cheating On You

-Let them Help You Hack Any Website Or Database

-Hack Into Any University Portal; To Change Your Grades Or Upgrade Any Personal Information/Examination Questions

-Hack Email; Mobile Phones; Whatsapp; Text Messages; Call Logs; Facebook And Other Social Media Accounts

-And All Related Services

- let them help you in recovery any lost fund scam from you

onlineghosthacker Will Get The Job Done For You

onlineghosthacker247 @gmail. com

TESTED AND TRUSTED!!!