Alphabet: Here's What Every Investor Should Be Monitoring

Alphabet's YouTube property has become my primary investment thesis for purchasing shares of the company. I expect the property to continue to drive the share price higher.

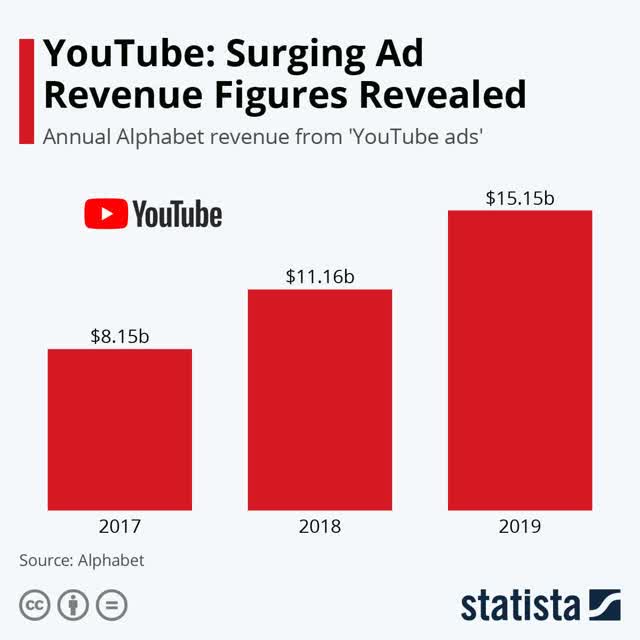

In Q1 2020, Alphabet reported that YouTube increased its ad-revenue by 36% in 2019 to ~$15 billion. Further, management has stated that there is a significant runway for growth.

My conservative math projects that YouTube will be worth approximately $700 billion by 2030, which will fuel the growth of Alphabet's share price ever higher.

I rate Alphabet a Buy at today's share price of $1420.

Looking for a helping hand in the market? Members of Beating the Market get exclusive ideas and guidance to navigate any climate. Get started today »

Investment Thesis

YouTube launched in 2005 and was acquired by Alphabet (GOOG, GOOGL) a year later for $1.65 billion. Until its last annual report, Alphabet did not release YouTube’s ad revenue, so investors were left to speculate what YouTube has been generating in the way of revenues and cash flows.

This changed in early 2020, when the company released YouTube’s ad revenue from the past three years in its annual report. 15 years on from the original purchase of YouTube, it's safe to say Alphabet's initial investment has paid off, as YouTube is worth at least about $200 billion today, which I will demonstrate later.

Today, I am going in-depth to explore YouTube’s revenue growth, its user base, and the value of its potential market. I am going to analyze how YouTube plans to continue to increase its ad revenue and how this will contribute to Alphabet's free cash flow, which will ultimately drive the value of the stock higher.

Method to the Madness: Democratizing Content

YouTube features user-generated videos, which means it doesn't have to pay for content in the same way that other video-based services, such as Netflix (NFLX), ESPN, or Hulu (DIS), do. This gives the company costs advantages that produce incredibly strong margins, which we cannot say with respect to Netflix.

I refer to this dynamic as the democratization of content generation - a strategy that has proven to be extremely powerful, as evidenced by the rise of platforms, such as YouTube, Seeking Alpha, and SoundCloud.

YouTube also benefits from user-generated content because people can create an image or brand to generate a follower base, as well as an ancillary business outside of YouTube. This has drawn tens of millions of content creators, hoping to make it big on the platform while developing their own brands and businesses.

Furthermore, YouTube's democratized nature affords it the ability to cast an extraordinarily wide net in terms of capturing consumers' attention, as there is always someone out there who is creating content for even the most niche interests (ASMR, anyone?). Whether it's listening to music, learning how to do something, or finding a review on something for which you're shopping, it's probably on YouTube.

An Ideal Place to Advertise

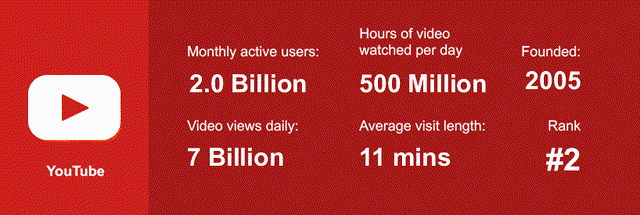

(Source: Smart Insights)

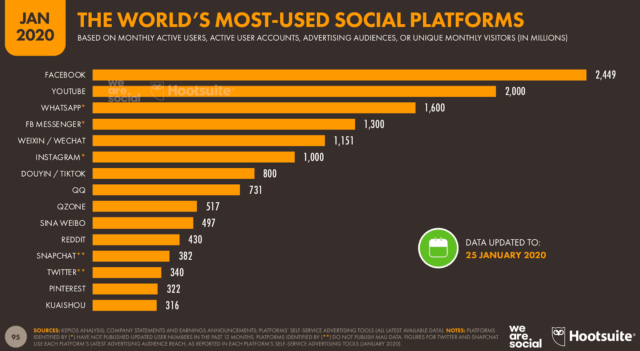

With 2 billion monthly users, YouTube is the world's number two most popular social media platform behind Facebook (FB) and the second-largest search engine behind only, you guessed it, its sister property, Google. According to a 2019 survey, about 60% of businesses use YouTube to share video content, while 90% of its users say they discover new products or brands while on YouTube.

In the Morgan Stanley Technology, Media & Telecom Conference in March 2020, Alphabet CFO Ruth Porat said:

“[For YouTube], the biggest part of ad revenue is Brand and we're really excited about that and the upside there... One of the things we’re extremely focused on is ensuring that we're providing advertisers with the tools they need to really present their brand the way they want, how they want and really to protect and measure that.”

YouTube has excelled in this area, as evidenced by 79% of marketers considering it as the most effective video marketing platform. This could be attributed to YouTube's users paying more attention to advertisements, which I will illustrate next.

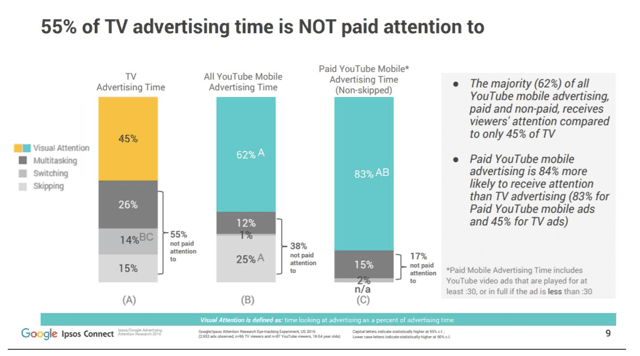

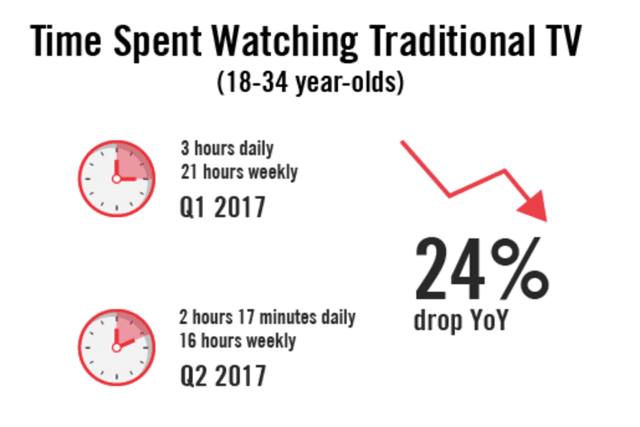

People pay more attention to YouTube ads as compared to television ads, as can be seen below. YouTube reaches more people through mobile devices (the fasting-growing content delivery channel as of late) than any television network.

(Source: Business of Apps)

As seen above, people are paying a lot more attention to the advertisements they see on YouTube, which is because users are significantly more engaged. This is an obvious byproduct, as when one uses YouTube, they actively search out the content they desire, then watch it.

Moreover, this bodes extremely well for the future increasing monetization of the platform, as historically, it has been seen as a sub-optimal place to advertise, being comprised of a younger, less wealthy audience.

Regardless of whether people are more interested in what they're watching or YouTube is tailoring its digital ads to the appropriate audiences, it's proving that it is a highly formidable ad giant that has a large runway for future monetization growth.

And YouTube doesn't require all of your personal information either, making it somewhat immune from any potential business-damaging privacy regulation that might materialize. Since YouTube's creators are focused on a specific image and creating a specific brand, it gives companies an ideal channel to reach a specific community, making advertising even easier.

YouTube's Userbase

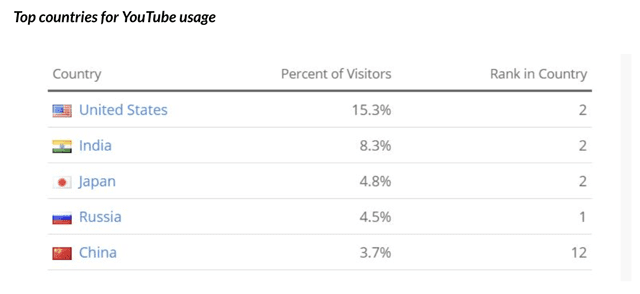

(Source: Business of Apps)

YouTube has an international user base, which benefits both its creators and viewers, since videos can be shared in over 100 countries. This expands the opportunity for YouTube to generate ad-revenue from international businesses.

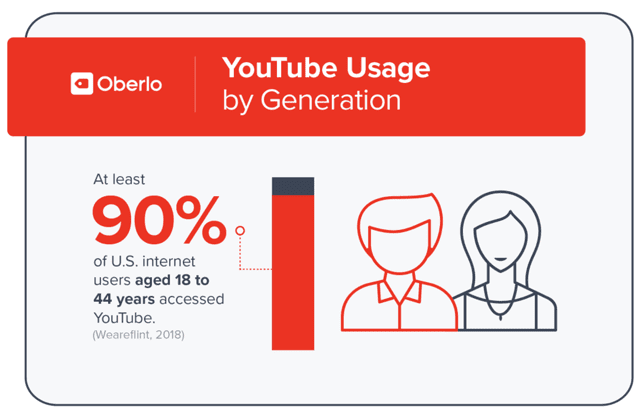

The platform is extremely popular among the younger generations (who continue to age and generate more money). I anticipate this trend to continue as more kids and young adults are growing up accustomed to YouTube.

While younger generations are decreasing their television time, they are turning towards YouTube. This is a strong (indoctrinated, if you will) customer base whose loyalty will likely persist well into adulthood, and YouTube will look to continue to foster this relationship with kids from a young age as it's done for people between 18 and 34. I anticipate this trend to continue in light of the fact that about 80% of parents let their children under 11 watch YouTube.

Percentage of U.S. internet users who use YouTube as of Q3 2019 by age group

(Source: Statista)

While the younger generation may be the focus, YouTube also has been gaining traction from its older populations, as can be seen above.

Revenue

(Source: Statista)

YouTube's ad revenue grew by 36% in 2019 and 37% in 2018. I expect this trend to continue as YouTube continues to develop pricing power on its ads and as businesses shift away from traditional advertising channels.

Now, let's see what YouTube is worth.

L.A. Stevens Valuation Model

To determine a fair value for YouTube, we will employ our proprietary valuation model. Here's what it entails:

- Traditional discounted cash flow model using free cash flow-to-equity discounted by our (as shareholders) cost of capital.

- Discounted cash flow model including the effects of buybacks.

- Normalizing valuation for future growth prospects at the end of the 10 years. Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Now, let's check out the results!

Assumptions:

Assumption

|

Value

|

Free cash flow per share

|

$5.15

|

Free cash flow per share growth rate

|

17.5%

|

Terminal growth rate

|

2%

|

Years of elevated growth

|

10

|

Total years to stimulate

|

100

|

Discount Rate (Our "Next Best Alternative")

|

9.8%

|

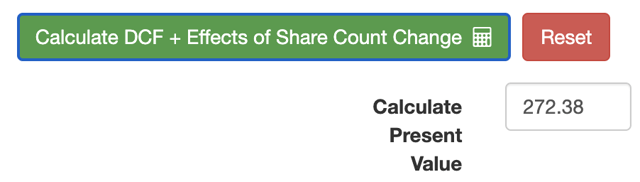

(Source: L.A. Stevens Valuation Model)

Using the L.A. Stevens Valuation Model, YouTube has a present value of ~$272 per share, meaning its current market cap is ~$200 billion.

But this is only step 1 of the LASV Model. To further illustrate the value of any asset, we must leverage steps 2 and 3.

Before we do steps 2 and 3, let's discuss a little about what's known as "margin of safety".

Margin of Safety

As always, we need to be conservative when estimating free cash flow growth and in determining our expected return, so as to implement a margin of safety, whereby we can be very, very wrong (i.e., our growth assumptions do not come to fruition) and still be right (i.e., our investment produces the returns we projected).

YouTube's revenue has been growing about 35% over the last two years, and I expect this trend to continue, but it will inevitably slow down at some point in the 2020s. 18.5% growth is conservative and gives YouTube large room for executional error, so we can be wrong and still be confident we'd achieve our expected return.

Now, let's check out the expected return, which is predicated on the growth of free cash flow per share. For more information on step 3, refer to the steps 1-3 above!

Expected Return

In order to arrive at a total expected return from YouTube, I took its current estimated value of approximately $200 billion and identified that such a value is 1/5th of Alphabet's current market cap and, therefore, YouTube's share price could be seen as 1/5th of Alphabet's current share price (of course, these are somewhat rough approximations, but they are highly conservative, so with the conservative assumptions, we eliminate the risk of miscalculations causing poor investment decisions).

With this in mind, we could state that YouTube's present share price is about $285, and therefore, our total expected returns from YouTube are about 16%.

That is, in 10 years, YouTube's value per share is estimated at $1230, hence, $285 -> $1230 equates to about 16% in annualized returns.

Risks

YouTube (and correspondingly, Alphabet) faces two primary risks:

- Management may fail to execute optimally, which could result in growth rates below what we've anticipated.

- Privacy regulation could damage the company's ability to generate ad dollars from digital ads.

- The present recession could extend for many months, leading to large immediate setbacks.

Conclusion

Now, we used extremely conservative assumptions to value YouTube. It's my strong belief (though I don't allow beliefs to guide my investing... I leave that up to the math) that YouTube will be worth well over $1 trillion by 2030. With that in mind, Alphabet will be at least double what it's worth today by 2030, and with its growing Cloud segment and massive share repurchase program, we can expect it to likely be worth even more.

Final takeaway: I rate Alphabet a Buy at $1500 and below.

As always, thanks for reading, remember to follow for more, and happy investing!

CONTACT: onlineghosthacker247 @gmail. com

ReplyDelete-Find Out If Your Husband/Wife or Boyfriend/Girlfriend Is Cheating On You

-Let them Help You Hack Any Website Or Database

-Hack Into Any University Portal; To Change Your Grades Or Upgrade Any Personal Information/Examination Questions

-Hack Email; Mobile Phones; Whatsapp; Text Messages; Call Logs; Facebook And Other Social Media Accounts

-And All Related Services

- let them help you in recovery any lost fund scam from you

onlineghosthacker Will Get The Job Done For You

onlineghosthacker247 @gmail. com

TESTED AND TRUSTED!!!